Youtube - below

Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Wednesday, 30 July 2014

Brent Cook Interviewed by Daniella Cambone

Interview on Kitco

On the junior side, he thinks that it is an interesting area to look at but at the same time it is getting ‘tough.’ “There are very few [junior] companies out there now with the technical competence and cash to really advance exploration plays.” However, Cook says well-standing junior companies are the place to be because over the next two years, the majors are going to have to buy something and this is where they will be looking

Tuesday, 29 July 2014

Productivity in Mining - Ernst & Young

Report from Ernst & Young putting the case for "broad transformation" by the miners to increase productivity.

A long term re-focus is required

Monday, 28 July 2014

Eric Coffin & Rick Rule Discussion at Sprott Vancouver Resource Symposium

Discussions from Sprott Conference on Korelin.

Sprott Symposium - Includes list of Sponsor Companies

Reports on Symposium discussions

Sprott Symposium - Includes list of Sponsor Companies

Reports on Symposium discussions

- Northern Miner (free subscriptions offer)

- Sprott

Liam Halligan - UK Telegraph Questioning the Dollar

Goldbug narrative in the mainstream / establishment UK Telegraph newspaper questioning the Dollar's role as reserve currency, the rise of the Brics at purchasing power parity and non-dollar trade settlement.

Martin Armstrong also discusses the politicisation of the dollar in trade and reserves.

Martin Armstrong also discusses the politicisation of the dollar in trade and reserves.

Sunday, 27 July 2014

Silver Deposits in Mexico - Size & Grade

Comparative graphic from Plata Latina

Also Silver Institute - Global Silver Production for perspective

And Companies with Mining Projects in Mexico according to the Mexican Geological Service - large searchable database.

Production Development Exploration

Also Silver Institute - Global Silver Production for perspective

And Companies with Mining Projects in Mexico according to the Mexican Geological Service - large searchable database.

Production Development Exploration

Top 20 Silver Producing Countries in 2013

(millions of ounces)

| |||

|---|---|---|---|

| 1. | Mexico | 169.7 | |

| 2. | Peru | 118.1 | |

| 3. | China | 118.0 | |

| 4. | Australia | 59.2 | |

| 5. | Russia | 45.4 | |

| 6. | Bolivia | 41.2 | |

| 7. | Chile | 39.2 | |

| 8. | Poland | 37.6 | |

| 9. | United States | 35.0 | |

| 10. | Argentina | 24.7 | |

| 11. | Canada | 20.8 | |

Friday, 18 July 2014

New Sprott Gold Miners ETF

New Gold Miners ETF from Sprott - SGDM

Sprott discuss weighting for growth and balance sheet strength - HERE

Company components - at launch sees a very strong concentration in top 3 holdings. Franco Nevada, Randgold and Goldcorp.

Sprott discuss weighting for growth and balance sheet strength - HERE

Company components - at launch sees a very strong concentration in top 3 holdings. Franco Nevada, Randgold and Goldcorp.

Wednesday, 16 July 2014

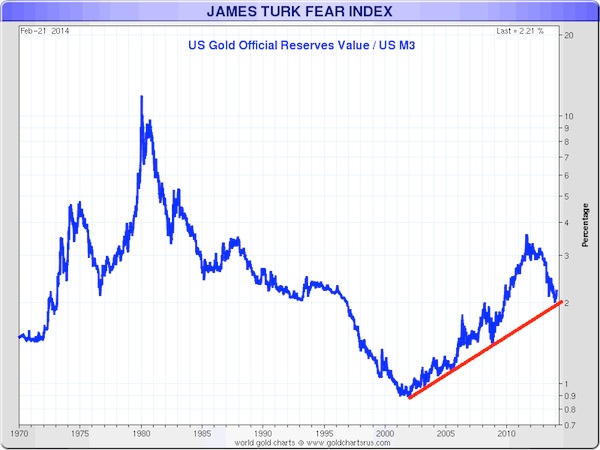

Rising Rates Good for Gold - Myrmikan Capital - Daniel Oliver

Myrmikan Capital Research Report

If less printing and higher rates were bad for gold, as the bank analysts tell us, gold should have sold off vigorously. It surged instead.

Tuesday, 15 July 2014

Wednesday, 9 July 2014

Marginal Oil Production Costs vs Rise of Alternatives

Ambrose Evans Pritchard reviews the marginal cost of oil production and the increasing competitiveness of alternatives, which may leave trillions of dollars of malinvestment - the "subprime danger of this cycle".

Canaccord Junior Mining - Joe Mazumder

Interview at CEO .ca

There are companies that provide leverage as an ‘out-of-the-money’ option on the gold price because they have the liquidity to deliver a high beta. Those without the liquidity do not offer the beta despite having projects with high gold leverage......The asymmetry is derived by selecting

Tuesday, 8 July 2014

Rick Rule - Do the Work - 3 investors with $3bn on the sidelines for juniors

Do Rule and the "bigmoney on the sidelines" get what they want?

"Market clearing prices like summer 2000"

Choose your strategy - "Do the work" or "Have a hunch, bet a bunch"

Also see more recent comments HERE

Also see more recent comments HERE

“I don’t know about the short term,” said Rick, “but ‘leveraged’ plays are looking pretty attractive to me because they are so hated.”‘Leveraged’ plays on precious metals usually refer to mines or deposits that depend on higher metals prices in order to generate returns. Today, many investors prefer to focus on projects that may prove to be money-making at current metals prices. But Rick says the aversion to leverage makes these types of opportunities more attractive:“In my view, precious resources and precious metals markets have an up-cycle that lasts around five years. To me this means we could see much higher metals prices within the next couple of years. Right now, nobody wants to own the leveraged juniors; everybody wants to own the smaller, high-grade deposits, which are less dependent on higher metals prices. What that means is that leveraged deposits are probably cheap. I’d warn that you may not get much pleasure from owning them in the next 12 months. In the 3 or 4-year timeframe though, you could be handsomely rewarded.

OT - Le Tour Yorkshire - Grand Départ 2014

Massive crowds for Tour de France Grand Depart in Yorkshire - England...pics

Sunday, 6 July 2014

John Hathaway - Tocqueville Gold Investor Letter - 2014-Q2

Latest Letter

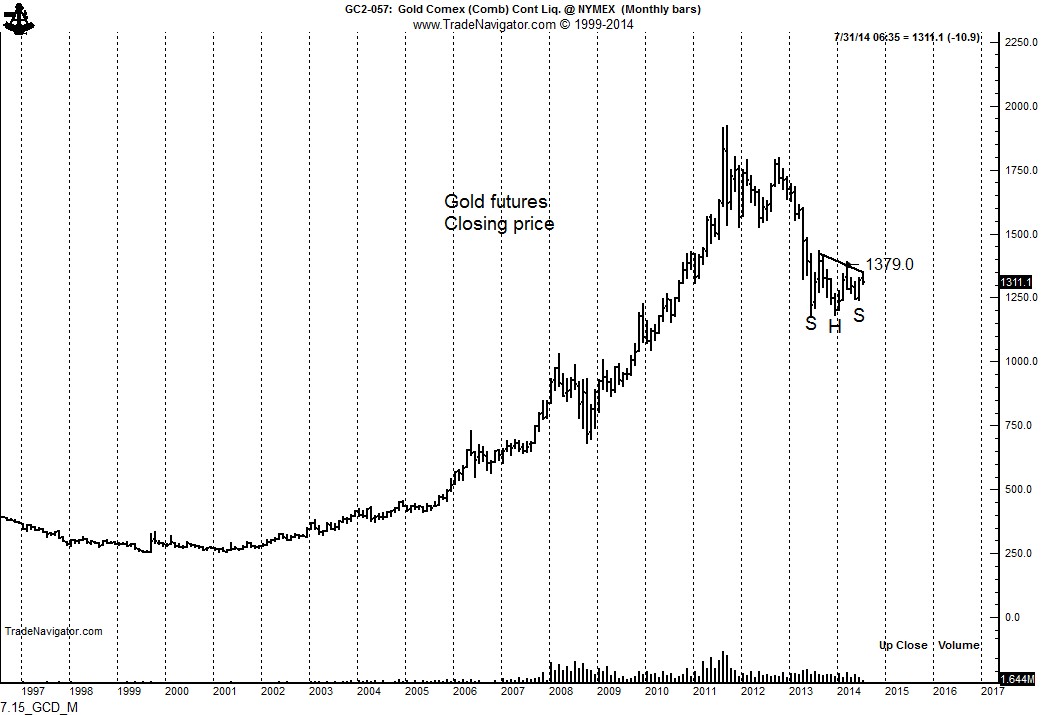

The precious metals complex, both mining shares and bullion, appears to be in the process of completing a major bottom extending back to mid-2013.

Subscribe to:

Comments (Atom)