Area to consider:

- Influential Writings - Fundamentals of a Gold Bull market.

- Recognising asset bubbles, the mania we have waited for, how to ride the bull and invest profitably

- Begin to to explore, "what's next?" - where are the undervalued situations which saw the smartest investors seek out gold in 2000.

Influential Writings - Fundamentals of a Gold Bull Market.

- A wide ranging overview, "In Gold We Trust" by Ronald-Peter Stoferle at Erste Group - this is updated annually - follow on the blog.

- GMO Indicate the importance of Emerging Markets buyers in the past 10 years, in particular Indian and Chinese buyers. They associate this with "financial repression", the lack of other available options aswell as the "traditional / cultural affinity" aspects.

- Many writers indicate the importance of low and negative "real" interest rates in firmer gold prices. Part of the reasoning is that it then "costs" little to hold metal, there is little interest income forgone from conventional deposits. Steve Saville here writes about 3 dimensions of interest rates' influence on gold; real interest rates, the forward rate curve and credit spreads. Here Mark Motive assesses negative real interest rates and gold bull markets.

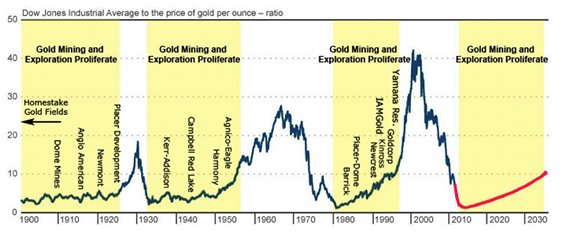

- A number of analysts point to "big cycles" relating the price of the dow in gold, preferences for "paper" against "hard assets". Here Quinton Hennigh discusses the time for mining and exploration in the cycle.

- With both Obama and Mitt Romney publicly supporting Ben Bernanke it is essential to read the playbook of Ben Bernanke's take on the 30's depression and his view of the Fed's toolkit to fight deflation. See his 2002 speech "Deflation - Making sure it doesn't happen here". The escape from the 30's was devaluation of debt against gold.

- The Bernanke speech is often quoted since in review of what is happening now, Ambrose Evans Pritchard at the UK Daily Telegraph foresees and encourages enormous printing as the remaining solution.

- Janet Yellen's speech on the Phillips Curve, Implications of Behavioural Economics for Monetary Policy, relating inflation and unemployment, but also addressing the relationship between inflation and inflationary expectations, has been identified by Stewart Thomson as an indicator that she will favour a higher inflation rate. Some have suggested that a rising gold price is an effective policy tool to indicate inflation when the fed fears deflation.

- A wide ranging article here assessing the Many Values of Gold by "Victor the Cleaner".

- Jim Sinclair - Legendary because he rode the 1970's gold bull and exited at the top. A financial insider who writes daily at JSMineset. Can sometimes sound a bit extreme and will no longer say sell to trade dips until he gets out but I think there is deep understanding here and many years of genuine efforts to inform small investors.

- A simple overview "Five Pillars of the Gold Bullmarket.

- Have we seen the clear top in Government Bonds which he sees as the last pillar to drive gold? The past year few years and Japan's long deflation have made a short bonds view a "widow-maker" trade. Government paper is a huge market and a reflex postion of safety for vast flows of capital. Calling a bond top is a tough call, even Bill Gross was embarrassed by a bearish position in 2011.

- However clearly interest rates are very low and as Gavyn Davies writes in the FT there are big risks to the downside and limited upside in government bonds.

- Even Bill Gross the "Bond King" is starting to see changes to come at the Zero Bound and gold as a store of value when there is little value left in paper.

- Michael Pento a regular bond bear sees the coming of negative bond yields as ringing a bell at the top of a 30 year bond bull. I believe that given enough fear this could become a clear reality. For how long is the hardest question.

- Sinclair sees that Gold will balance the external debt of the US

- And here with the supporting data. This was Sinclair's basis for riding the 70's bull. Now gets to >$10,000 gold.

- Believes that Gold will rise and remain high because it will become a part of the monetary system. Not a gold standard but a "Modernised Gold Certificate Ratio". It may be loss of trust in money, after enormous printing, which brings gold back into the system. Suggests that Bernanke seeks higher gold prices to allow for devaluation of debt against gold as in the 30's depression.

- Suggests that gold miners will become utilities, 1m oz deposits will be mined.

- Jim Rickards appears to have credible government contacts and credentials suggesting he may be more than a delusional goldbug and yet he has many views in line with Sinclair. He points out that currency collapses are not unusual, having happened in 1914, 1939 and 1971 - clearly two directly relate to the world wars. He foresees a currency crisis where gold will be re-introduced to the monetary system. His price to avoid a deflationary impact is $7-9,000 dependent on whether M1 or M2 is backed and at what percentage. The argument that there is not enough gold is solved by price. He sees the physical / paper market as key to driving prices like Sinclair.

- Robert Zoellick of the World Bank, writing in the FT suggests that gold could re-enter the monetary system.

- USA Gold introduced the writings of "Another", followed by "Friend of Another", now followed by a blog called friend of friend, FOFOA. These writings seem to show deep knowledge of monetary flows and events, however they are deeply "gold buggy". Ultimately the argument is that there will be very dramatic revaluation higher of gold and a movement to "freegold". Only physical gold will be valuable, not paper derivatives. I struggle to see such a shift in "power" "allowing" millions of investors and Indian peasants owning jewellery to become so powerful.

- I like to follow the blog at "Jesse's Crossroads Cafe". The writer seems to have a deep understanding of the financial and monetary system. A good example here reviewing Gold's Power to reveal the true value of financial assets. And also here on modern monetary theory the antithesis of which is gold. The author also views the silver market as extremely distorted, on this point I am less confident, the silver market has a history of powerful manipulation in both directions.

- Always interesting to listen to Marc Faber's interviews.

- Eric Sprott has been a leading proponent of Gold & Silver though stayed too bullish since the 2011 bear - Here the Sprott Goldbook 1999-2014

- Jim Rogers Interviews - general hard assets focus.

- A number of writers have made projections of Gold's ultimate peak. Equally important are the stepping stones along the way, especially the major intermediate tops and bottoms as the miners and juniors are dumped wholesale at these points. Some of the more respected price commentators;

- Alf Field projects $4,500 on the next wave 3 of 3 up but miscalled this in 2011/12. Alf is well respected by Jim Sinclair and has called the "waves" of gold well during this bull market, though he called the bottom early in 2008.

- Lorimer Wilson at Munknee tracks 150 analysts and their high gold price projections.

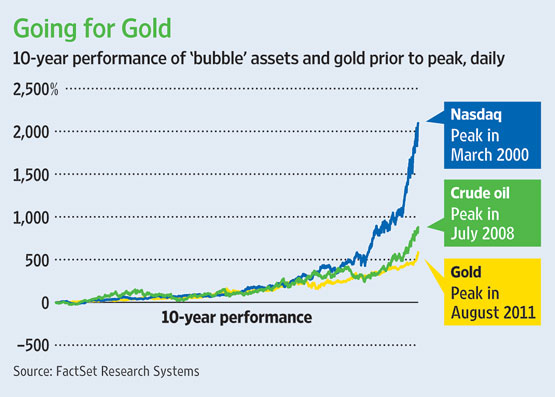

Recognising Asset Bubbles - Where is Gold?

- Asset prices and classes move in long waves and cycles.In the short term any asset can become over-bought and over-sold but being on the right side of the secular trend is key.

- The report above by Erste Bank lays out details of gold's relative valuations not being excessive.

- Pater Tenebrarum's site is excellent. From there a review of Gold's bull market, not yet a bubble.

- A recent discussion of the bubble cycle - Willem Weytjens

- James Turk - Remember he does sell gold at Goldmoney, but he does have a clear view on why gold. Here discusses bubbles - suggests gold is not widely owned enough to be a bubble and people justifying why not to own it. Suggests Bonds and government "safe" debt is the bubble.

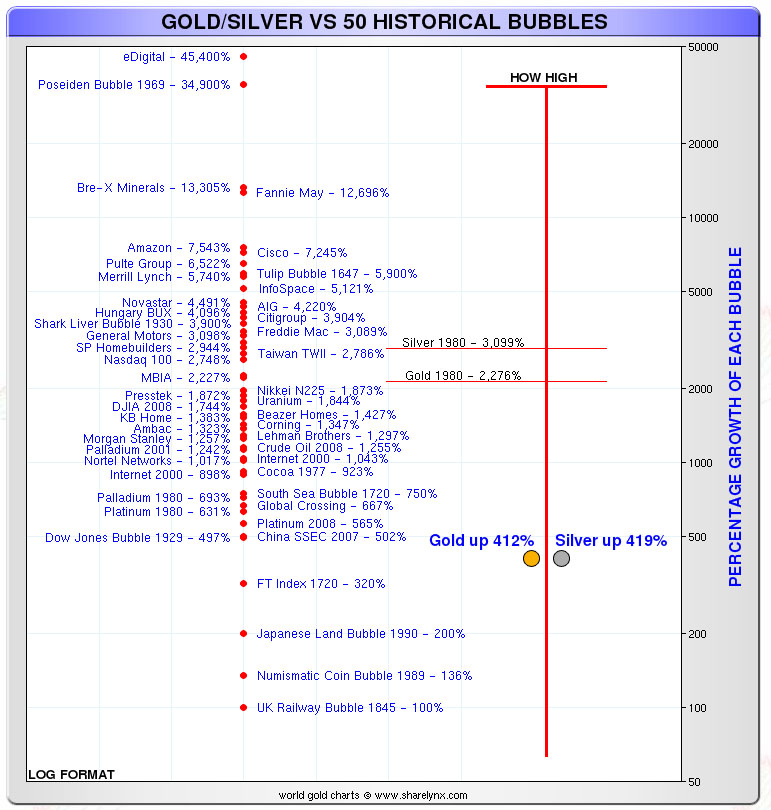

- A comparison chart below by Nick Laird of Sharelynx compares gold and silver in to previous bubble markets. Obviously by its recent peak in August 2011 @ $1900 gold was up approximately 800% from a $250 low. Interesting commentaries featuring the chart by Jordan Roy Byrne at the Daily Gold and Dominic Frisby at Moneyweek.

- Jordan Roy Byrne quotes Jesse Livermore the legendary trader on how to trade a bull market. It is important to remember this through all the volatility of the gold bull. A longer extract is presented here by Tischendorf. The key learnings:

- After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money.

- If I sold that stock now I’d lose my position; and then where would I be?

What's Next?

- Popular ownership and mania in gold miners indicating the peak of a bubble. But if Sinclair is correct long term value would remain with prices at a much higher plateau if gold is re-introduced to the monetary system - the gold mine "utilities".

- Graphene Technology could be involved across multiple applications including energy/batteries.

- New Energy sources. Peak oil and global warming. How real? Priorities in recessionary period?

- Natural Gas out of a very low US price as export infrastructure and domestic conversion is built out.

- Agriculture, per Jim Rogers. Global population growth, increasing global wealth and protein in diets.

- Water - long abuse of ground-water sources.

- Nano-tech

- Bio-tech - aging populations, utilising progress in genome mapping. Long term liabilities in healthcare promises require more efficient solutions.

- Infrastructure, old infrastructure to replace in the west, new infrastucture in the developing world.

- Emerging Markets - Africa, Burma

- Property; old bulls seldom return quickly but there are some clear suggestions of value in the housing market. My concern is that whenever interest rates increase the market will be very unstable.

Yesterday I was reading a news about a billionaire who converted half of his wealth in gold, people do value this commodity. However, if we look at technology that is also a great field to invest in, if that billionaire had invested this much money in starting a big tech company like Kayako or an ecommerce empire like Alibaba or Ebay, just imagine how many jobs he would have created.

ReplyDeleteبرامج PetraNewacc برامج تخدم كل الانشطة والاعمال التجارية والصناعية والخدمية بالاضافة الى ادارة شؤون الموظفين الخاصة بهذه المؤسسات هذا يقدم لك قيادة حكيمة لاعمالك المحاسبية والادارية

ReplyDeletehttps://www.petranewacc.com

برنامج الصيدليات

برنامج مستلزمات الاسنان

برنامج حسابات

تحميل برنامج مخازن

برنامج حسابات محلات الملابس

برنامج محاسبة شركات

برنامج كاشير