“If you’re looking for producing assets, they’ve never been cheaper,” said Brad Gordon, head of African Barrick Gold Plc, just renamed Acacia Mining Plc. “Now is the time to be contrarian and pick up some of the best ground in Africa.”.........Acacia’s chief executive officer isn’t the only one on the prowl. Randgold CEO Mark Bristow said last week his company had a war chest of more than $500 million to spend on deals, a figure Gordon said Acacia could match for the right asset.

Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Sunday 30 November 2014

Randgold & Acacia (African Barrick) Look to African Gold Aquisitions

Article at Bloomberg

Diamond Miners & Exploration

The diamond market is notoriously opaque with very specialised skills and knowledge to provide valuations of non-standard stones and the DeBeers cartel controlling pricing until 2000.....more

Gold: a 6000 year old bubble revisited - Willem Buiter of Citigroup in full

Citigroup economist, former Bank of England, Willem Buiter's provocative Gold article just ahead of the Swiss Gold referendum.

Discussed here by Ambrose Evans Pritchard with link to Buiter's Full Paper

Further discussion by Izabella Kaminska at the FT

Discussed here by Ambrose Evans Pritchard with link to Buiter's Full Paper

Further discussion by Izabella Kaminska at the FT

Tuesday 25 November 2014

Sunday 23 November 2014

Gold Mining Hedge Book

Dominic Frisby considers gold miners' production hedging at Moneyweek.

If the global hedge-book is rebuilt that hedging will see sales into the futures market.

If producers are un-hedged collapsing prices would see very large losses in the industry which could reduce mine supply, though with such large above ground stock many would suggest that mine supply is not significant for gold pricing.

If the global hedge-book is rebuilt that hedging will see sales into the futures market.

If producers are un-hedged collapsing prices would see very large losses in the industry which could reduce mine supply, though with such large above ground stock many would suggest that mine supply is not significant for gold pricing.

Saturday 22 November 2014

Comparing Canadian Venture Market Corrections - Canaccord

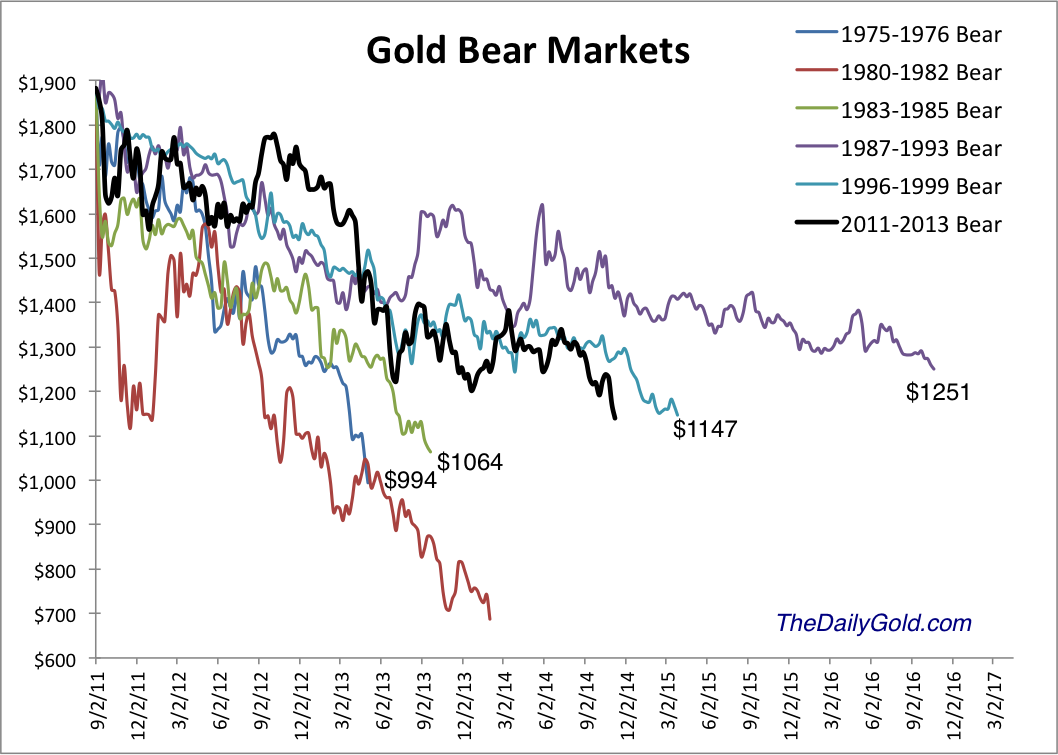

US Global Investors Weekly Report notes Canaccord's comparisons of Canadian Venture crashes over the years. The current bear is near the longest in time, though actually down less than many in %. This compares with Jordan Roy Byrne's tracking of the gold and silver bears.

And the long term charts from stockwatch

And the long term charts from stockwatch

Thursday 20 November 2014

Hugh Hendry - Learning to Love the Central Banks

Well known bear turns believer in the power of Central Banks Interview at Moneyweek

... and part 2 and part 3

... and part 2 and part 3

Today, I question the relevancy of that disaster insurance. In a world where the central banks seem to have your back, seem to be underwriting risks and global asset prices, do you require that intense scrutiny of risk?........I was at a conference with some of the great and the good global macro managers in September in New York and I asked them all the question, “If the S&P is down 12% what do you do? Are you selling more or are you buying?” Guess what? They’re all buying. So the central banks have created a behavioural tic which is becoming self-reinforcing and I believe we saw another manifestation of that behaviour in October.

Wednesday 19 November 2014

Monday 17 November 2014

Junior Gold M&A - Carlisle Goldfields - Interest from Aurico and Nordgold

The last I read of Carlisle Goldfields was in this report from Paradigm Capital and the stock proceeded to halve shortly afterwards. Last week Carlisle rebounded on two corporate moves with Aurico looking to take a near 20% stake and a subsequent offer for the company from Russian backed Nordgold.

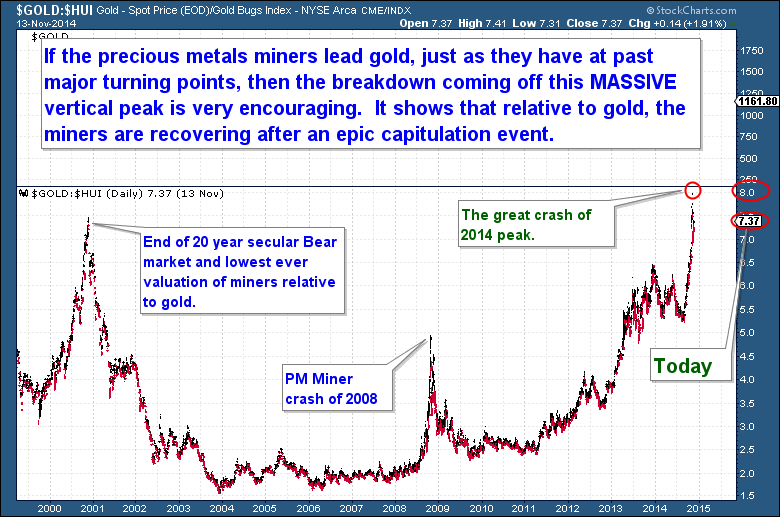

Extreme Gold:Hui Ratio

Bob Loukas at the Financial Tap discusses the current position of the miners and includes a long term chart of the gold price:gold miners ratio, reminding us of the extremes reached during the recent sell off. Of course the ratio may mean revert two ways, with a recovery in the miners or as the gold price breaks lower whilst the miners fall less or stabilise. Indeed a recovery for the precious metals sector "should" expect the miners to lead the metal.

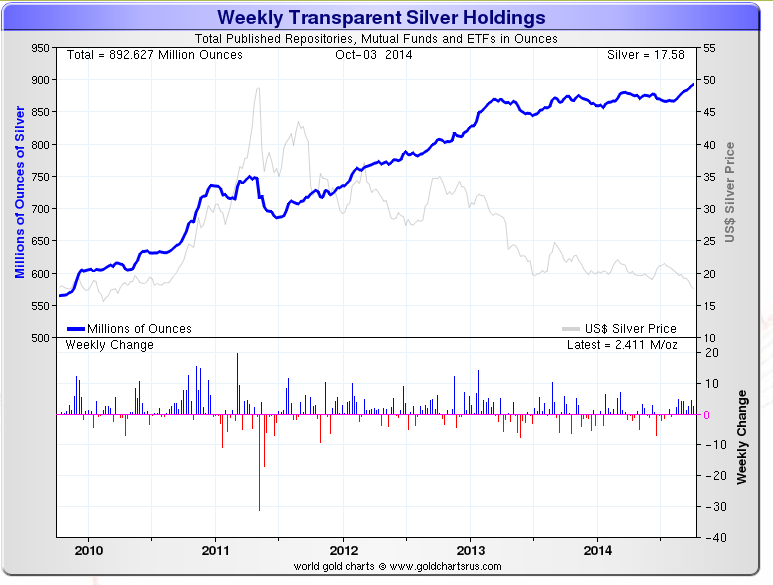

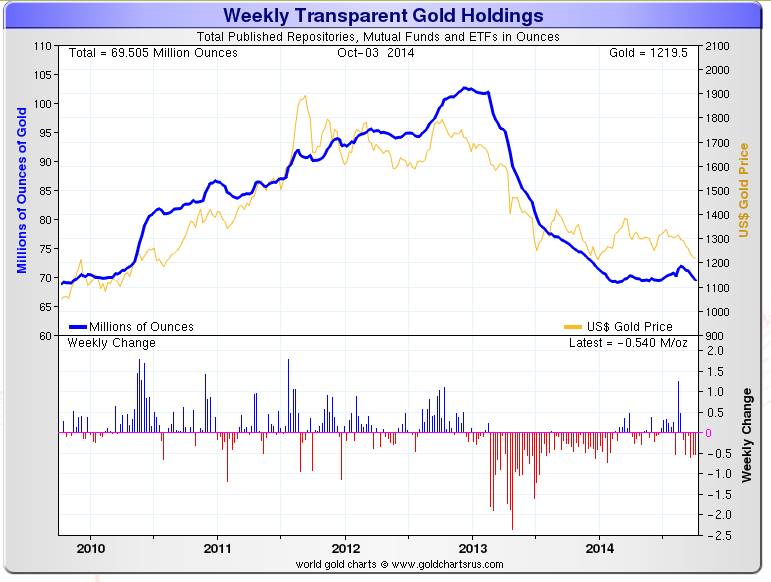

Gold & Silver ETF Holdings vs Price

Trader Dan Norcini has often pointed to the holdings of the Gold ETF being a clear indicator for Western investor sentiment towards the metal as holdings rose and fell with price.

Yet we see the opposite in silver, which is either yet to see an enormous unwinding or remains a relatively low value market holding, perhaps seen as an effective "leveraged" hedge?

892m oz of silver is worth approx $14bn - over 1 year mine supply ~ 800m oz

69m oz of gold is worth approx $80bn - below 1 year mine supply ~ 90m oz

Silver is seen as the more speculative metal and yet has seen increased holdings during this bear phase in the precious metals.

Saturday 15 November 2014

Peter Brandt - Gold Blow off Bottom ?

Brandt suggesting possible end to the 3 year bear market in precious metals with a blow off bottom...........more

Wednesday 12 November 2014

Gold Stock Rankings

Early September saw the Denver Gold Show and Precious Metals Summit, and the beginning of a sustained period of weakness in the mining stocks.

At the time I published a watchlist of all the stocks presenting (this and a number of other watchlists and stocklists are under the "companies" heading on the left sidebar of the blog)

There were just over 200 companies making it to one or both shows.

The far right of the listing tracked long term performance against a 10th September base date.

Here is a ranking of performances since then also showing daily performance last Friday 7th November on the day the GDX reported the highest ever volume.

Also showing relative positioning to 52 week highs and lows.

Click the arrow to expand or right click to open a new tab and zoom in.

Please note that Market Caps are in quote currencies, so it is not quite right to add up as I have done and as ever always double check the data as sometimes google finance returns some odd data.

At the time I published a watchlist of all the stocks presenting (this and a number of other watchlists and stocklists are under the "companies" heading on the left sidebar of the blog)

There were just over 200 companies making it to one or both shows.

The far right of the listing tracked long term performance against a 10th September base date.

Here is a ranking of performances since then also showing daily performance last Friday 7th November on the day the GDX reported the highest ever volume.

Also showing relative positioning to 52 week highs and lows.

Click the arrow to expand or right click to open a new tab and zoom in.

Please note that Market Caps are in quote currencies, so it is not quite right to add up as I have done and as ever always double check the data as sometimes google finance returns some odd data.

Junior Gold M&A : Central Rand Gold $150m offer from Hiria Group / Marsa

Central Rand shares soared over 400% as a bid came from an unlikely buyer, financial leasing and iron/nickel mining group Marsa.

Central Rand moved back into production, and continued losses in 2013 (FT)

The company would claim over 36 million oz of JORC inferred / indicated gold in old South African mining leases.

I can only imagine that this is not expected to be economic near term, but perhaps a bet on optionality over long term gold prices and mining technology / robotics moving deeper underground?

Central Rand moved back into production, and continued losses in 2013 (FT)

The company would claim over 36 million oz of JORC inferred / indicated gold in old South African mining leases.

I can only imagine that this is not expected to be economic near term, but perhaps a bet on optionality over long term gold prices and mining technology / robotics moving deeper underground?

Tuesday 11 November 2014

Martin Armstrong on Gold Suppression - Bond Bear Market - Stock Bull

Discussion of Metal price suppression -

I remain bullish long-term BECAUSE there is no such suppression. If there was, it cannot be a free market so write it off. (JGMS - Armstrong has been bearish on gold - until time/price ?anyone?)Discussing potential for very high US Stocks in a private wave moving away from Bonds

This is a question of TIME more so than price. Keep in mind that the amount of capital contained in the bond markets is at least 3 times that in equities. If we see the Bond Bubble in 2015.75, then the capital pouring out of bonds will be like the 1929 Stock Market Crash. That money will then flow outward. This is when we will see the greatest potential for a rise in equity and YES we should see the turn in all tangibles including gold..............The worst for the Sovereign Debt Crisis seems to be first shaping up in Europe. Here we have new highs but with declining energy. The divergence warns that we are in a MAJOR topping pattern.......Everything is correlating so far on time. We have the metals crashing shaking the tree to get rid of all the perpetual bulls. They just have to be devastated before you can move in the opposite direction. This is just how markets move. The stock market advance has been with historic lows in retail participation. This sets the stage for the skeptics to rush back and buy the highs. The average person

Peter Brandt on Gold - Dollar - Copper and Silver

Brandt Updates his masterly overview of gold from the 1970's to present - HERE

And discusses gold breaking down - HERE (JGMS-Miners 'should' be ahead of the metal ?)

Patterns indicating Copper collapse to $2.22 - HERE

And discusses gold breaking down - HERE (JGMS-Miners 'should' be ahead of the metal ?)

Also discussing potentially extremely bearish patterns for the Euro, and hence extremely bullish US Dollar - HEREThis pattern has a target near $970. I believe that the last of the Gold-bugs will finally throw in the towel if the market has a wash out of $1,000. While as a trader I am interested in the short side of Gold futures, as an investor I want to accumulate physical Gold on this final leg of the bear trend that started at the September 2011 high. A decisive close above 1210 on the daily chart would place the descending triangle interpretation into doubt. A decisive close above 1260 would indicate that Gold has bottomed.

Yet, history tells a far different story than a range-bound Euro. The chart below shows the Euro dating back to the early 1970s (note – the chart is adjusted to use the D-Mark as a proxy for the Euro prior to 1999.) As this chart shows, the Euro is far from oversold. The decline from 1.4000 since May is not particularly spectacular from historic measures. However, a decline to 90 cents would be something special........ Remember, charts represent possibilities, not probabilities and definitely not predictions

Patterns indicating Copper collapse to $2.22 - HERE

Support has been uncovered at and just below the $3.00 level repeatedly since 2011. However, each successive price recovery has been weaker and weaker. A decisive close below 2.92 and then 2.87 would complete this chart pattern and establish a price target of 2.22. Only well funded traders should engage this market. The Copper market is known for high volatility.

Greenspan Opines on Gold - Council on Foreign Relations with FT's Gillian Tett

As central banks look to up the battle against deflation will gold be used to signal inflation?

Greenspan: Is gold currently a good investment - yes, in this case I didn't equivocate........"Gold is a Currency" it is still the premier currency, no currency including the dollar can match it.......it is half commodity, when an economy is weakening it goes down like copper, gold is an intrinsic currency.......Why do central banks put reserves into an asset with no rate of return and a cost of storage?

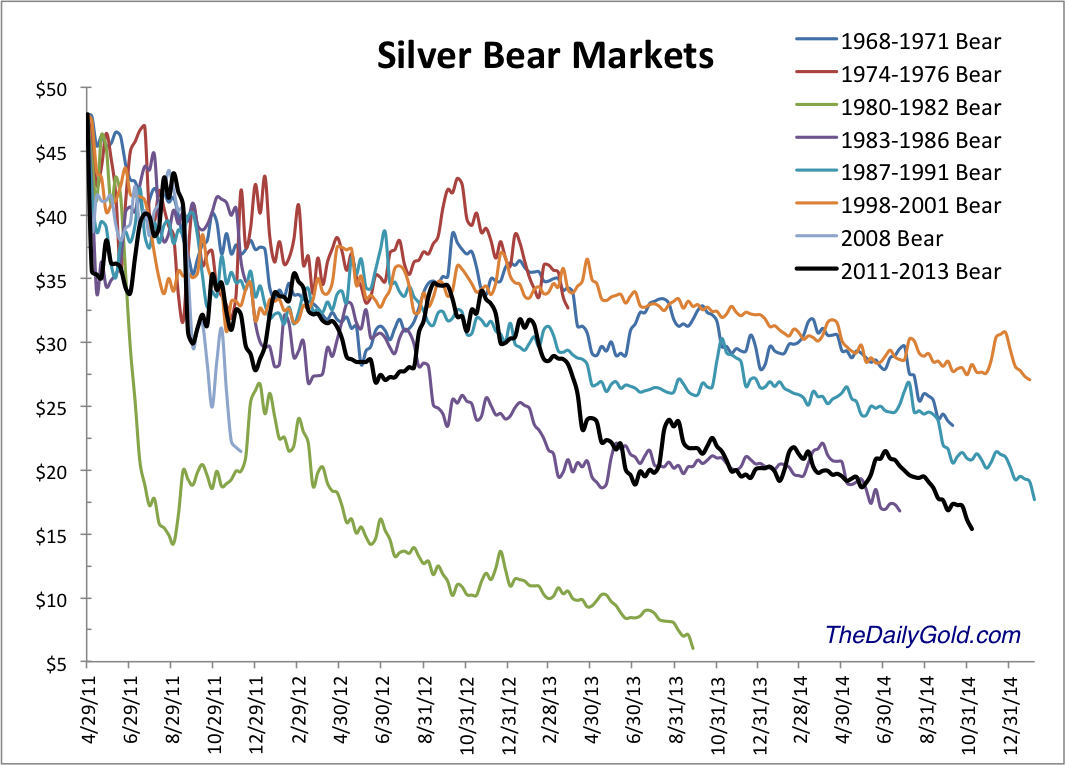

Comparing Gold & Silver Bear Markets

Jordan Roy Byrne continues to track comparable bears as a function of time and price.

Silver’s bear began five months before Gold’s and the bear analog below makes a strong case that the current bear will end very soon. Other than the epic collapse from 1980-1982, the current bear is the worst ever for Silver in terms of price and is the third worst in terms of time.

Sunday 2 November 2014

Saturday 1 November 2014

PWC - Junior Mine 2014

Junior Mining Report 2014 from PWC In Full

Analysis of the top 100 venture miners as of 30th June - Capitalisations have changed some since! Moreover the overall venture has collapsed with Oil and energy companies which had become a large part of the venture index.

Summary balance sheets and P&L for the Top 100 Companies.

Analysis of the top 100 venture miners as of 30th June - Capitalisations have changed some since! Moreover the overall venture has collapsed with Oil and energy companies which had become a large part of the venture index.

Summary balance sheets and P&L for the Top 100 Companies.

Subscribe to:

Posts (Atom)