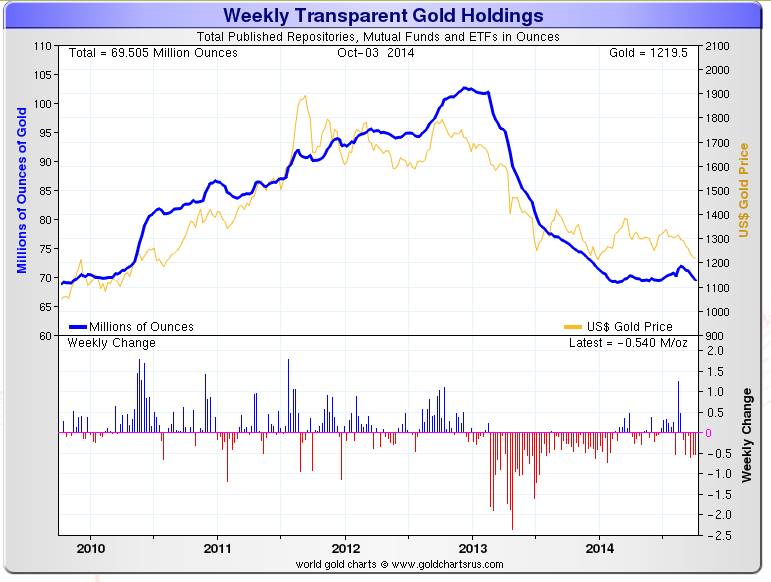

Trader Dan Norcini has often pointed to the holdings of the Gold ETF being a clear indicator for Western investor sentiment towards the metal as holdings rose and fell with price.

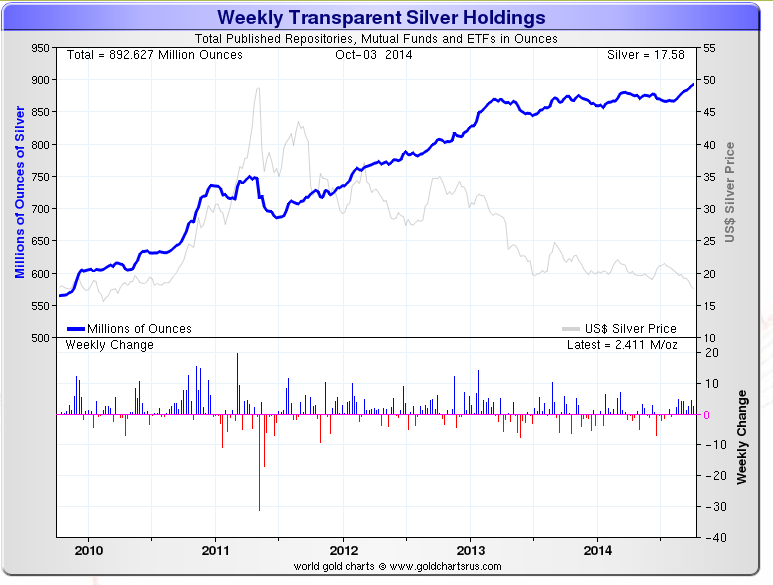

Yet we see the opposite in silver, which is either yet to see an enormous unwinding or remains a relatively low value market holding, perhaps seen as an effective "leveraged" hedge?

892m oz of silver is worth approx $14bn - over 1 year mine supply ~ 800m oz

69m oz of gold is worth approx $80bn - below 1 year mine supply ~ 90m oz

Silver is seen as the more speculative metal and yet has seen increased holdings during this bear phase in the precious metals.

No comments:

Post a Comment