Linked at IKN

Brent discusses failures at Allied Nevada, Rubicon, Midway. Lack of quality, poor supply of good projects against investment demand. Complex Industry. On drill plans, continuity, dilution, strip ratios, impacts for Dalradian, Moneta. Grade smearing - drill interval calculator.

Presentation of all data, e.g. Mirasol & Alamaden vs Otis.

Joe discusses quality vs leverage. Lower quartile long lived assets, return vs scale. Heap leach study and Kaminak gold, recoverable gold. Reservoir minerals.District scale exploration upside. Bought quality in poor market. Opposite strategy buy optionality, leverage to price, duration to cash, jurisdiction key to liquidity. Need to understand the majors gain ozs in their current portfolios as prices rise, impairments due to write downs of current assets. Low liquidity can't exit positions. Optionality has worked but needs trading focus - in a bear quality goes down too though.

Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Saturday, 28 May 2016

Wednesday, 25 May 2016

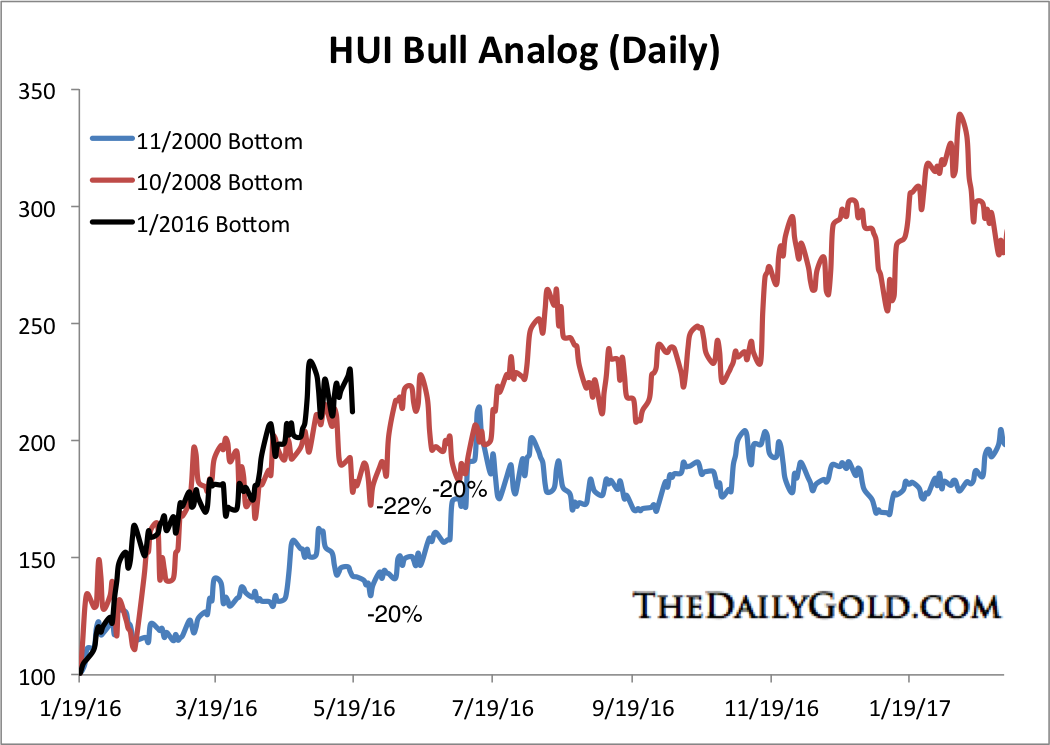

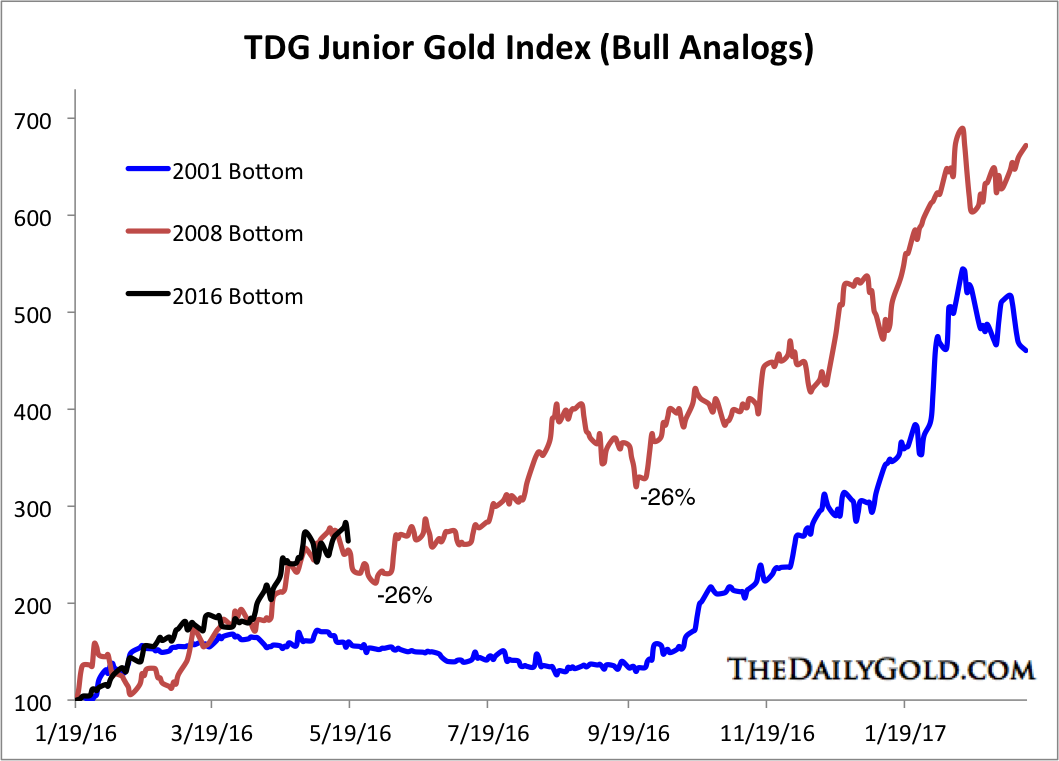

Gold Bull Analogues

Jordan Roy Byrne updating the current bull against previous markets, due the correction we are seeing

And Longer Term Gold Price Bulls in Perspective !! From Jordan's presentation - HERE

And Longer Term Gold Price Bulls in Perspective !! From Jordan's presentation - HERE

Rick Rule Interviews

Interview at KWN - Here

Interview at Palisade

Interview at Palisade

- Sees likely pause of momentum trade.

- Big discovery would drive the whole market.

- High quality deposits are rare, when discovered go for good prices, Reservoir, Kaminak.

- Urgent need for exploration and discovery. Last cycle $ were spent re-treading old properties, mining markets not deposits.

- Sticking to tried and true terrain, real large world scale discoveries taking place in politically risky locations.

- Discipline and rationality set apart successful long term speculator. Stupidity vs reality

- Cobalt mostly in Russia / Congo but likely for

- We are in a bull market, bull markets consolidate, early stage, don't get shaken out.

- Most of the gain concentrated in the best stocks.

- Most fortunes will be made and given back.

- Avoids greater fool theory on 10c stocks, big positions with high quality teams.

- Limit stocks held to those you will spend an hour a month analysing.

- All the big winners fell 50% at least twice on way to huge gains, if know well will add to positions.

- Moved down into high quality early exploration, prospect generators and specific names with high grade drill holes, been selling some high profile companies. Buying new names unknown, unloved with undiscovered unappreciated values, $10m caps.

Subscribe to:

Comments (Atom)