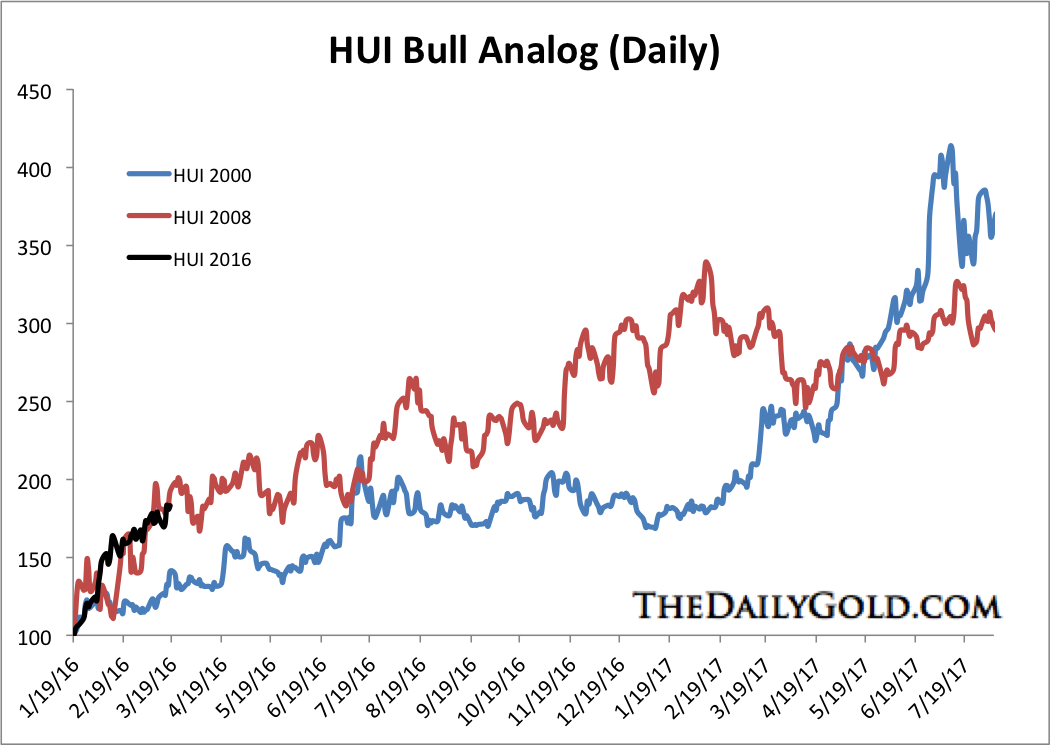

The fierce and persistent rally in Gold Stocks during 2016 has many awaiting a pullback. Jordan Roy-Byrne cautions against applying bear market analysis to a new bull.

Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Sunday, 20 March 2016

Rick Rule Interview

Lessons of the last down cycle should last for 2-3 years and see gold miners earn increasing cashflow per share with a rise in gold prices, benefiting shareholders.

Identify senior and intermediate producers with growing revenues.

Real move in speculative stocks in 9 months, will be a spectacular market, understand depth and severity. Long long way to run with the correct stocks.

Precious metal streams very valuable to struggling base metals miners, streamers offer lowest cost of capital, increase quality and visibility of revenue stream, plus optionality on the streamed mine.

Loves 'optionality' companies, large deposits drilled off with nil NPV at the bottom of the cycle, must preserve the optionality, management must do almost nothing to dilute shareholders, merge and lower SG&A, number of projects then focus on the best. Spend money when the move has progressed and share prices have advanced. Easiest and most dramatic upside except for occasional discovery will be optionality plays. Preference with developement studied and permitted, but less likely. Power of private placements and warrants in micro-caps. Sellers and buyers are exhausted driving outsize moves with some bids.

Risk of appearance of being profitable during low commodity prices through high-grading.

Identify senior and intermediate producers with growing revenues.

Real move in speculative stocks in 9 months, will be a spectacular market, understand depth and severity. Long long way to run with the correct stocks.

Precious metal streams very valuable to struggling base metals miners, streamers offer lowest cost of capital, increase quality and visibility of revenue stream, plus optionality on the streamed mine.

Loves 'optionality' companies, large deposits drilled off with nil NPV at the bottom of the cycle, must preserve the optionality, management must do almost nothing to dilute shareholders, merge and lower SG&A, number of projects then focus on the best. Spend money when the move has progressed and share prices have advanced. Easiest and most dramatic upside except for occasional discovery will be optionality plays. Preference with developement studied and permitted, but less likely. Power of private placements and warrants in micro-caps. Sellers and buyers are exhausted driving outsize moves with some bids.

Risk of appearance of being profitable during low commodity prices through high-grading.

Brent Cook & Joe Mazumder at PDAC

Seeing fundamental drivers for this upturn in previous metals.

Companies with debt had higher levels of due diligence.

Streamed assets showed poorer quality.

Change in the industry and investors looking for returns, but how long will that last if gold heads back over $1,500

Companies with debt had higher levels of due diligence.

Streamed assets showed poorer quality.

Change in the industry and investors looking for returns, but how long will that last if gold heads back over $1,500

Wednesday, 16 March 2016

Druckenmiller 30% in Gold

At the end of 2015 Stanley Druckenmiller held 30% of the $1bn Duquesne family office fund in GLD. Druckenmiller accumulated around $1,200 during early/mid 2015.

Druckenmiller tipped his hand when he gave a speech during Q2 2015 where he said the following: “Our monetary policy is so much more reckless and so much more aggressively pushing the people in this room and everybody else out the risk curve that we're doubling down on the same policy that really put us there (in the 2008 financial crisis) and enabled those bad actors to do what they do. Now, no matter what you want to say about them, if we had had five or six percent interest rates, it (the housing bubble) would have never happened because they couldn't have gotten the money to do it.......This is crazy stuff we're doing. So, I would say you have to be on alert to that ending badly. Is it for sure going to end badly? Not necessarily. I don't quite know how we get out of this, but it's possible.”

Institutions - Gold & Negative Rates

Munich Re including gold investments

The world's largest reinsurer is far from alone in seeking alternative investment strategies to counter the near-zero or negative interest rates that reduce the income insurers require to pay out on policies. Munich Re has held gold in its coffers for some time and recently added a cash sum in in the two-digit million euros, Chief ExecutiveNikolaus von Bomhard told a news conference. "We are just trying it out, but you can see how serious the situation is," von Bomhard said. The ECB last week cut its main interest rate to zero and dropped the rate on its deposit facility to -0.4 percent from -0.3 percent, increasing the amount banks are charged to deposit funds with the central bank.

Subscribe to:

Comments (Atom)