Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Wednesday, 31 December 2014

Gold Juniors that Gained Traction in 2014

Northern Miner article discuss

Detour Gold, Guyana Gold, Lakeshore Gold, Rio Alto, Probe Mines

Detour Gold, Guyana Gold, Lakeshore Gold, Rio Alto, Probe Mines

Tuesday, 30 December 2014

Consolidated Gold Fund & ETF Holdings

Consolidated precious metal fund and ETF holdings (top 25 holdings).

Reviewing

Also company names need cleaning so there are some duplicates

- see tables below - 184 companies across 24 Funds & ETFs

Reviewing

- Total Market Cap of holdings - Total holdings approx $15bn

- Maximum % weighting in portfolios

- Greatest % increase / decrease in holdings. (= fund size + weighting)

Also company names need cleaning so there are some duplicates

- see tables below - 184 companies across 24 Funds & ETFs

Sunday, 28 December 2014

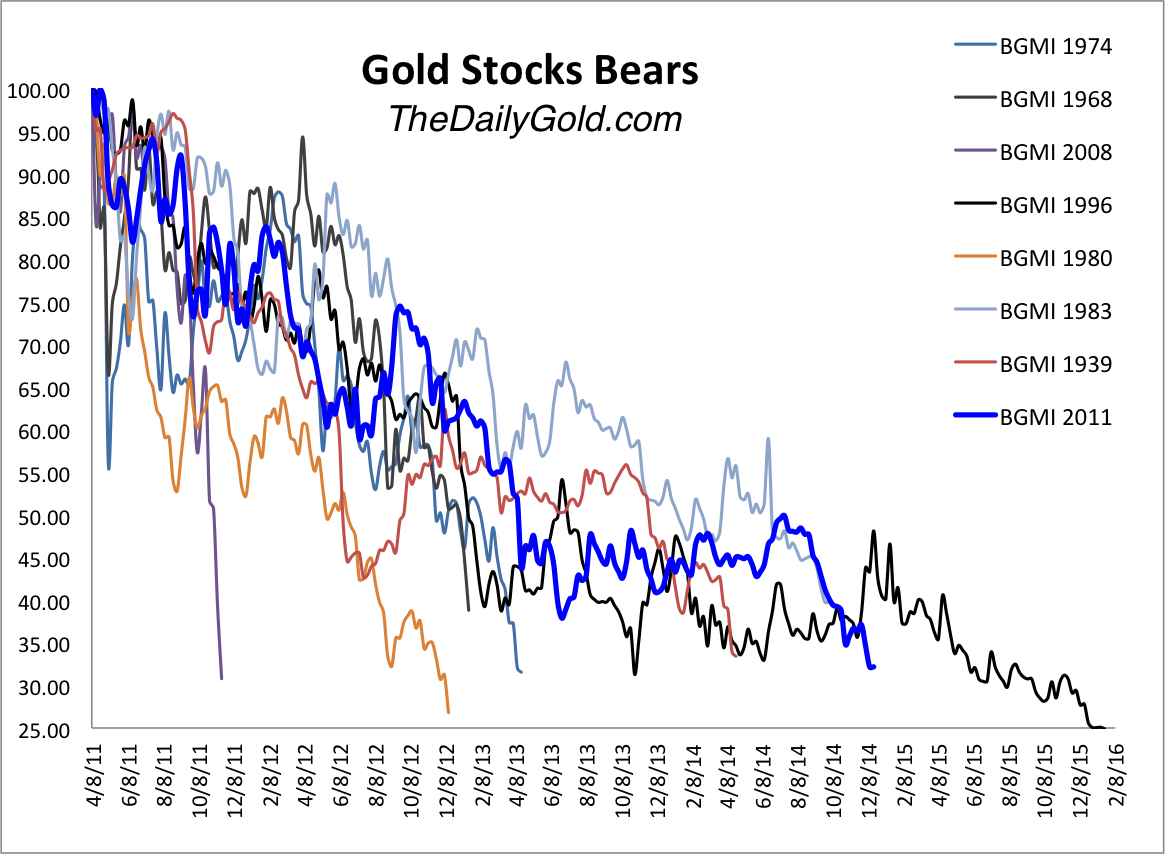

Gold Mining Stock Bear Market Comparisons

Update from Jordan Roy-Byrne comparing Barron's Gold Mining Index Bear Markets. Only the 1996 bear was longer in duration. The 1996 timing analogue might point to a bounce but that came after a base not the recent plunge we have seen.

Friday, 26 December 2014

Gold, Silver and Mining Stock Picks for 2015

Following on from 2014 Picks and 2013 Picks

Published stock picks for 2015 - Harder to find mining rec's this year. I shall update with more identified

Published stock picks for 2015 - Harder to find mining rec's this year. I shall update with more identified

- Raymond James - Denison Mines, Lundin Mining, Detour Gold

- Morgan Stanley International Mining Tips - New Boliden, Alrosa, Fresnillo, RioTinto, BHP Billiton, Nori'lskiy

- Zack's via Barchart - Allied Nevada, Banro

- The Australian - Tim Blue - (&write ups) - Berkeley Resources ( Uranium), Paringa Resources (Coal), Gold Road, Independence Group, Doray Minerals, Rox Resources, Crusader Rescurces, Duketon Mining, Western Areas, Cassini Resources, Sirius Resources, BHP

- Hard Asset Investments - (plus part 2 top 5) on Seeking Alpha - True Gold Mining, Alacer, B2 Gold, Klondex, Dynacor Gold, Callinan Royalties, Iamgold, Sandstorm, Rubicon, Richmont Silvers - Fortuna Silver, Silver Wheaton, Avino Silver, Silvercrest, First Majestic,

- Nick Hodge - Outsider Club - Fission Uranium

- Outsider Club - Part 1 - Bear Creek, Atac, Pilot Gold, Columbus Gold - Part 2 Lydian, B2 Gold, Elorado, Agnico Eagle

- Radomski - Top5 short / long term

- Ledbed - Wildcat Silver, Calibre, Pershing Gold

Stock Picking Contests

- Silicon Investor - Discussion - Spreadsheet 2015 - Spreadsheet 2014

Value Investing Links

Value Walk's "Timeless Reading" long list of reading

The Gold Miners' question is timing to find value - by value money managers - or value traps

The Gold Miners' question is timing to find value - by value money managers - or value traps

London Mines & Money Presentations

Various Presentations - HERE Including

Evy Hambro (Blakrock) and Mark Bristow of Randgold (embedded below)

Wednesday, 24 December 2014

Wednesday, 17 December 2014

Commodities Outlook 2015 - Deutsche Bank

HT IKN - Deutsche Bank's 140pp report across commodity sectors. Including many cost curves

Friday, 12 December 2014

Scotiabank Mining Conference 2014 - Webcasts

Scotiabank's mining conference was held on 2/3rd December.

Various discussions of gold price direction Mineweb ( what's in store for gold webcast below)

Webcasts Here - (change index numbers)

Various discussions of gold price direction Mineweb ( what's in store for gold webcast below)

Webcasts Here - (change index numbers)

- Precious Metal Miners - at an Inflection Point - Golden Star, Kirkland Lake, Teranga, Timmins Gold

- Thrill of the Hunt active in M&A - Primero, Goldfields, US Silver & Gold, B2 Gold

- Finding Hidden Value in Canadian Gold - Iamgold, Aurico, New Gold

- Mine builders - done it before doing it again - Rio Alto, Argonaut , Ivanhoe, TMac

- Leveraging Flagship Assets into Growth - Mandalay, Centerra, Dundee PM

- What's in Store for Gold in 2015 - Rob McEwen, WGC

- First Gold in 2015 - Emerging Gold Producers in 2015 - Rubicon, Guyana Gold, Asanko, True Gold, Mark O'Dea, Torex Gold

- Promising Metals Projects in a Capital Constrained Environment - Premier Gold, MAG Silver, Lydian, Pretium, Reservoir Minerals

- Gold Projects in the Pipeline - Alacer, Dalradian, plus

- Advancing New Discoveries - Orca, Pilot Gold, Probe Mines, Newstrike, Roxgold

- Star Projects - The next Royalty Generators - Virginia, Osisko, Altius

- Growing off a Silver Base - Endeavour Silver, Silver Standard, Tahoe, Silvercrest

- Comeback of the Diamond Miners

- Uranium

- Zincs Time to Shine

- What's next for Nickel

- The next generation of BC Copper Mines

- Singing Peru's Praises - BVN, Bear Creek, Pan American Silver

- Manageable Mega Projects in the Americas - Novagold, Nevada Copper, Alderon

- Franco Nevada

- Silver Wheaton - Randy Smallwood

- Agnico Eagle

- Eldorado

- New Gold - Randall Oliphant

- Yamana

- Detour Gold

Notes from London Mines & Money Conference

At CEOca

The mood was much more upbeat than I expected. However, the prevailing sentiment in the conference was that there’s more pain to come. The good news is that the cream should start to rise to the top allowing for the best management teams to get funded.

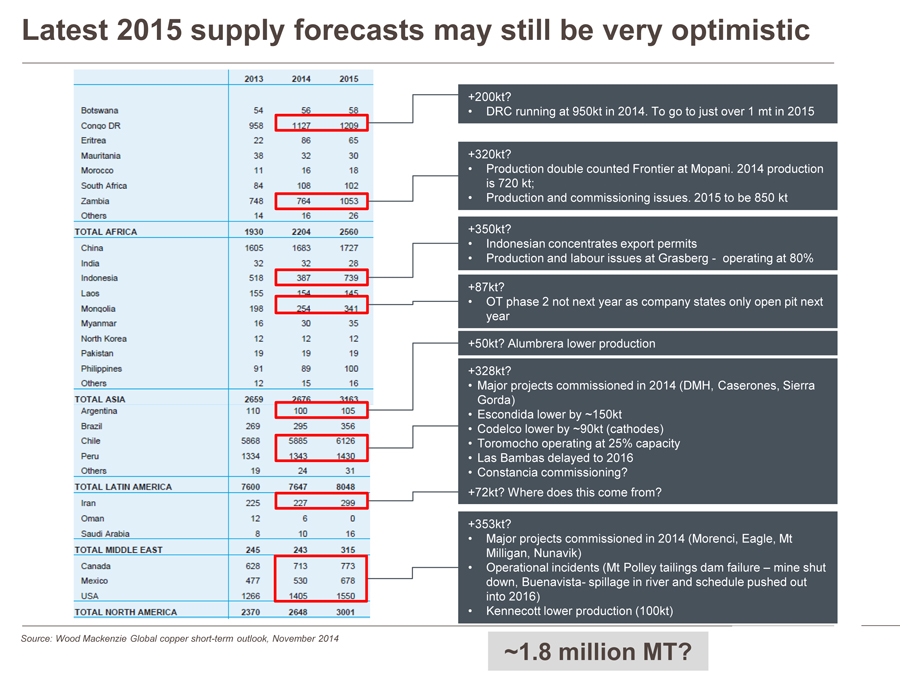

Copper Surplus or Deficit

Glencore depend on copper for almost 40% of earnings.

Ivan Glasenberg has been extremely critical of miners raising production levels - although bidding for Rio.

Here Glencore challenge coper supply growth assumptions.

Ivan Glasenberg has been extremely critical of miners raising production levels - although bidding for Rio.

Here Glencore challenge coper supply growth assumptions.

Thursday, 11 December 2014

Mining Investment Risk - Trust of NI 43-101

Another HT IKN

Discussion of reporting standards and mining management behaviour HERE

Discussion of reporting standards and mining management behaviour HERE

Wednesday, 10 December 2014

Peter Brandt - Six Chart Reasons Silver has probably bottomed - Technical Target $26

Peter Brandt discusses

Imagine, good miners operating with silver heading to $26 and hope for more instead of $15 expecting less. With energy costs heading to half 2011 levels, local currencies and labour costs 20% down. Capital costs in a market where most metals and energy markets are giving consultants cause to worry about their next paycheck. And everyone has their stink bids in for tax loss selling.

Imagine, good miners operating with silver heading to $26 and hope for more instead of $15 expecting less. With energy costs heading to half 2011 levels, local currencies and labour costs 20% down. Capital costs in a market where most metals and energy markets are giving consultants cause to worry about their next paycheck. And everyone has their stink bids in for tax loss selling.

Larger Players account for 40% of Exploration Expenditure - SNL

Report from SNL

IKN's take on the positive implications for selected juniorsThe top three explorers in 2014 include one copper producer (Antofagasta), a diversified major (Vale), and a major preciousmetal producer (Fresnillo)

Long story short what I'm pointing to is nothing more nor less than the revaluation of mineral assets. Now we're at near-zero, up has more chances than down, right? Well, I don't know if I'm right, but a big fat clue would be if some major or even Tier 2 goldie started running with that plan (AEM, perhaps?). If so, it'd be the time to position again into what you believed to be great rocks at low prices before the real money gets there.

Mining M&A to Double as Market Elements Align - Grant Thornton

Summary Full PDF

Gathering Momentum, the new report, attributes the resurgence of M&A to the confluence of four main factors, identified through feedback from over 250 senior mining executives globally. The first is that with one-in-ten junior miners likely to enter administration and a quarter of major mining companies anticipating challenges with financial covenants, the market can expect significant quantities of distressed assets and low valuations. There is also a ripe environment for matchmaking, with a third of executives at mining companies stating that they are likely to make an acquisition (35% junior and 32% major) and approximately the same amount showing an appetite for selling - believing that their company will either be sold or undergo a partial sale (36% junior and 27% major/other). Furthermore, lower commodity prices are identified by the report as a driver for M&A; pushing companies to band together to generate scale and lower productions costs in order to remain competitive.

Sunday, 7 December 2014

The US Dollar - Reserve Currency Burden / Debt Risks

The rise of the US Dollar is clear to any commodity investor as prices fall. The "goldbug narrative" of a collapse in the Dollar looks increasingly unlikely..... more ......

Sprott's Rick Rule interview with Tekoa Da Silva - On Speculative Profits

Widely linked around the blogs already this is an excellent interview with Rick Rule picking up on many repeated themes and more. The transcript (on the link above) is pretty complete but listening to the interview is worthwhile and probably more worthwhile in a few years time in any improved market. Some more notes below......

Gold Miners' Production Costs - Dundee - Plus cost build ups and drivers.

Dundee research at CEO - comparing costs across their covered miners.

I have appended a chart from Goldcorp's presentations showing fuel/power and labour/contractor costs across their various operations.

These costs make up ~50% of operating costs and impact both operating costs and sustaining capex. If gold can stabilise in US$ terms then the "real price" of gold against operating costs can increase which should be a key driver for the miners .....more....

I have appended a chart from Goldcorp's presentations showing fuel/power and labour/contractor costs across their various operations.

These costs make up ~50% of operating costs and impact both operating costs and sustaining capex. If gold can stabilise in US$ terms then the "real price" of gold against operating costs can increase which should be a key driver for the miners .....more....

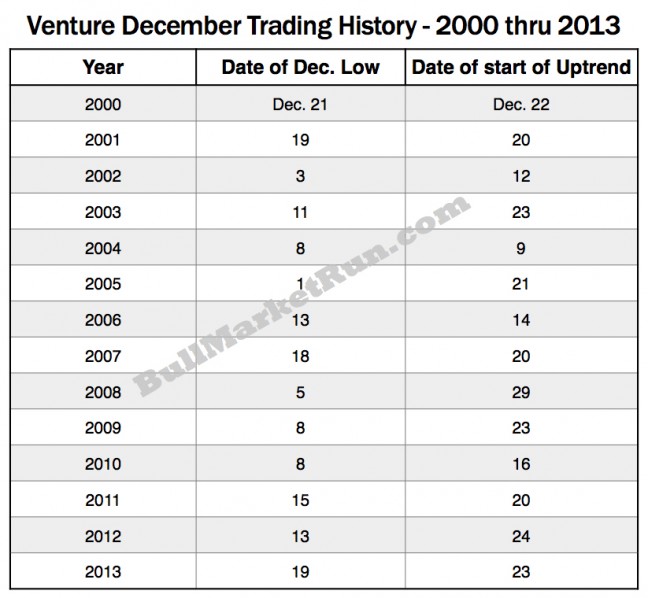

Canadian Venture Seasonality - December Lows and Uptrends

Bullmarketrun have a focus on the Canadian Venture market and speculative issues, here they review historical December lows and uptrends during the final throes of tax loss selling.

Friday, 5 December 2014

Why Central Banks buy Equities - Armstrong

Martin Armstrong continues to anticipate a Euro crisis driving funds towards the dollar, and the dollar assets of preference may be equities.

Wednesday, 3 December 2014

Tuesday, 2 December 2014

Junior Gold & Silver M&A - Coeur D'Alene in talks with Paramount Silver & Gold

(Update 17th Dec - Official Bid Confirmed at $146m )

Initial reporting from 'sources' at Reuters.

Initial reporting from 'sources' at Reuters.

Silver/gold producer Coeur with operations in Mexico, the US & Bolivia in talks with Paramount who have Silver projects in Mexico including San Miguel's 350,000 acres around Coeur's operations which may extend Palmajero's life by 7 years. Paramount's other assets including the Sleeper gold project in Nevada could be spun out.

Black Friday & Manic Monday in Gold & Commodities

Very unusual action between the OPEC meeting and Swiss gold vote.

From Mike Shedlock

Commentary at Acting Man

From Mike Shedlock

Commentary at Acting Man

we also mention last week’s capitulation in the crude oil market as an influencing factor. In fact, it is hard to tell what had more of an effect on the gold price, in spite of the fact that crude oil has very little to do with gold. These are after all two completely different markets, but there are a few ways in which they are linked. The first link is monetary inflation and its effects on prices and currency exchange rates. Rising US inflation expectations, which usually coincide with expectations of looser monetary policy........The second link between oil and gold prices is through investment funds that are focused on commodities. If they are forced to sell one major commodity (due to redemptions or margin calls), they often have to sell other commodities as well.......In fact, the sharp decline in crude oil prices mainly affects the profit margins of gold mining companies, since energy is one of their major input costs (crude oil has declined rather noticeably against gold in recent weeks). Gold mining margins should continue to improveShort Side of Long....on the Gold:Silver ratio

Subscribe to:

Comments (Atom)