Picks noted

HERE, a number of these are long standing picks.

- Gold: Midas, Temex, Highway 50,

- Peregrine Diamond,

- Copper: Amarc, Tsodilo, InZinc, Nickel: First Point Minerals

- Scandium International - (new materials theory, see also investments by Robert Friedland)

Kaiser's detailed company analyses can be found

HERE , with those over a month old being free to read. Clearly the latest notes are restricted to paid members but price reaction may indicate bullish or bearish to the original views you can follow.

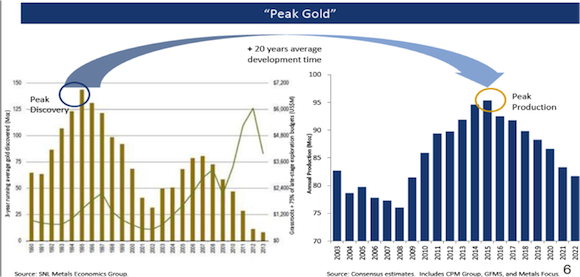

Interview discusses changes in the oil market and the bullish case for gold, changing from the 'apocalyptic goldbug narrative' to one focussed on the improving 'real price' of gold for the miners. (As

discussed on the blog here, miners operating outside the US should see substantial cost reductions)

China infrastructure build out over, focus on consumption.

India future powerhouse, hardline on regulations, take 5-7 years then a supercycle for massive expansion.