Referenced by Jordan at

The Daily Gold in his review of "Gold Stocks Climbing Epic Wall of Worry".......more

Despite returns of more than 65 percent in a year when the S&P 500 is up 4 percent, gold miner ETFs have seen half a billion in outflows. That is practically unheard of as inflows and performance are usually highly correlated when it comes to ETFs.......This oddity is no doubt connected to the billions that were poured into GDX over the past several years as investors bloodied their hands trying to catch a falling knife. GDX had lost 75 percent in the three years leading up to 2016......JNUG is returning four times the returns of its underlying index due to the compounding effect of resetting leverage daily into a upward-moving market. No ETF has ever returned more than 300 percent in a year. Yet JNUG has still seen $83 million in outflows.

As Jordan comments

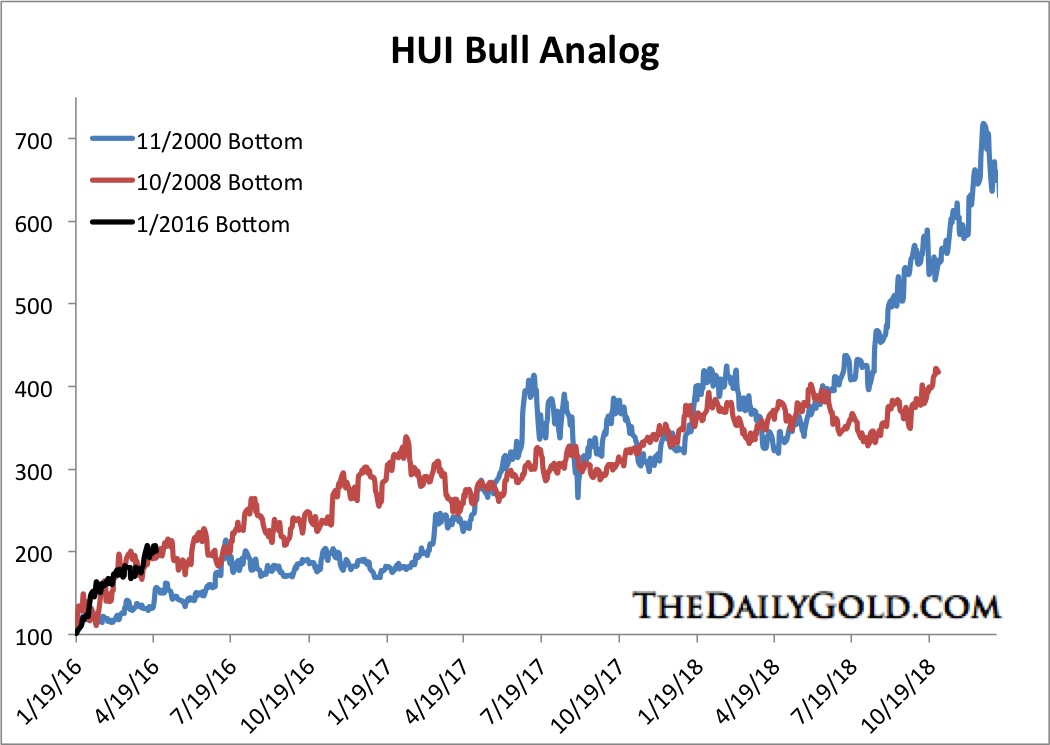

The fact is when a devastating bear market finally gives way to a new bull most investors and even those with a bullish bias are either outright incredulous or simply decide to wait for the inevitable correction. The problem is the correction never comes or when it does come, it is smaller than expected and the buying opportunity evaporates quickly and instantly.

The chart might give hope that a correction is due....

In the case of the Silver ETF, the paper trading of silver will be exposed due to a lawsuit where Germany will provide evidence about the corruption.

ReplyDeleteJust like LIBOR, the price of silver was fixed.

Geologist such as Brent Cook recently interviewed on Kitco can't look past a chart. The shortage in physical silver, the vastly reduced inventories, the surge in physical demand, and the exposure of the price suppression scheme are beyond a geologist expertise.

Yet, strangely enough, Kitco used this guy as a "market expert".

Meanwhile, several people who actually called silver's low plus or minus three weeks are providing the information for the case of triple digits in silver within two years.

My prediction is that "time will be the judge".

It would not surprise me to see $19.20 by the end of May 2016. However, $17.36 by end of May will be just fine.

hi

ReplyDeleteThe shortage in physical silver, the vastly reduced inventories so much.

ReplyDeleteบาคาร่า

gclub จีคลับ

gclub casino