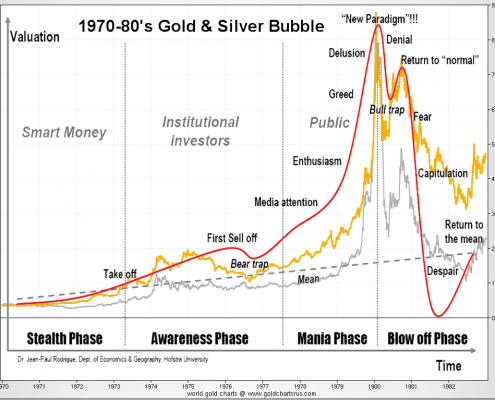

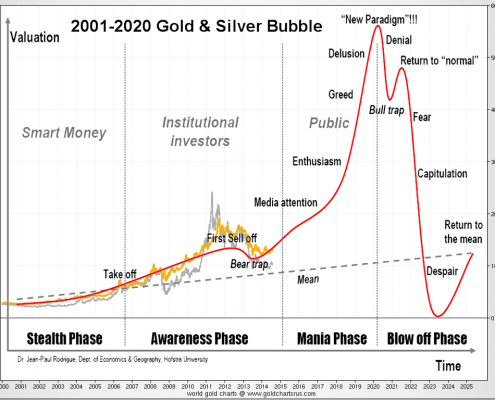

Chris Vermeulen has cooled on gold for the past few years but is suggesting the bull resumes later this year. Clearly if both the charts below spanned the same period, the 2011 peak was it.

Taking Steve Saville's analysis of the "1970s" gold bull however he would show the real move in the miners starting in the 1960s even while the metal price was fixed.

Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Hello.

ReplyDeleteI agree, the real bull is yet to get going.

But I also disagree, in that it will take us into a new world (or rather back towards an older world), as plans are now in place to allow the US dollar-based non-system we have been stuck with since the 40s to finally fail.

This will mean a huge debt deflation, a huge depression, and a much much higher gold price than most can imagine. Whilst the gold price will peak then fall a little, it'll be much like $35 to $850, maybe plus a nought.

Watch Europe and the BIS, they are behind the move.

Good luck.

Https://webster.lt

ReplyDelete