PWC's annual survey of Canadian Junior Mining, including Top 100 companies.

Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Saturday, 15 October 2016

Sunday, 25 September 2016

More State and Fiscal Policy action using free money - Turning points for Bonds?

Ambrose Evans Pritchard highlighting enormous global debt levels, issues with free market capitalism and encouragement by global institutions to government spending and investment, fiscal policy to take the baton from monetary policy, or be supported by monetary policy.

Acting Man reviews moves by the Japanese Central Bank targeting 10 year bonds to 0% giving governments free long term money to enact plans. Do the Central Banks have such control or can the bond vigilantes influence?

Sunday, 11 September 2016

Steve Saville - Explaining Moves in the Gold Price

Gold price drivers / correlations

These are traditional flight to safety associations.

The question will be if bonds turn as interest rates rise, if the Yen weakens due to central bank actions will gold automatically fall?

Jeff Gundlach at DoubleLine

Jeff Gundlach at DoubleLine

“This idea that fiscal stimulus may be coming seems to be getting sniffed out by the bond market,” Gundlach said. More debt spending may increase the cost of government borrowing by adding supply and making investors demand higher yields...........Gundlach told Reuters this summer that his firm went “maximum negative” on Treasuries on July 6 when the yield on the benchmark 10-year Treasury note hit 1.32 percent. The 10-year now yields around 1.60 percent. All told, Gundlach said he turned short-term negative on gold and gold miners but has not sold any of his firm’s positions.

Monday, 5 September 2016

Sunday, 4 September 2016

Gold and Silver Miner Fundamentals - 2016-Q2

Reviews from Adam Hamilton at Zeal

GDX GDXJ SIL

A point of particualar note; acquisition activities over the past few years have seen the "Silver Miners" become increasingly gold weighted.

A company like Silver Standard which was an ounces in the ground silver play has acquired gold mines.

Plenty more to the analysis of these companies in particular reserves and resources.

An ETF 'fundamentally' weighted by sales or production would be an interesting comparison in a bull market.

GDX GDXJ SIL

A point of particualar note; acquisition activities over the past few years have seen the "Silver Miners" become increasingly gold weighted.

A company like Silver Standard which was an ounces in the ground silver play has acquired gold mines.

Plenty more to the analysis of these companies in particular reserves and resources.

An ETF 'fundamentally' weighted by sales or production would be an interesting comparison in a bull market.

Canadian Venture Holds the 50 Day?

Worth keeping a close eye on this as we move into what are usually the best seasonals for gold and miners, but following an extremely big run this year.

A lot of the bigger indices and ETFs haven't done this.

Will the Venture lead or fold?

A lot of the bigger indices and ETFs haven't done this.

Will the Venture lead or fold?

Saturday, 20 August 2016

Exploration Leaders - Quality is Important

Discussion with Brent Cook, Joe Mazumber, John-Mark Staude and Morgan Poliquin from Sprott's Natural Resources Conference

Linked HERE

Linked HERE

- Finance flooding into the sector

- Questions of how long will your treasury last has become can you get more drills? How much money do you need, how quickly can you do something.

- Many stocks have moved only justified at $1500+ gold

- Majors have taken big write downs, slower to move aggressively, many established deposits are low quality and much higher prices, majors may move down the food chain for higher quality at lower price. Majors have a lot of marginal ounces they have written down, acquisition only makes sense for higher quality.

- Up cycle people want to drill. Many companies just marketing, don't want to drill just finance. Better companies want to drill and find the fatal flaw quickly, not romance the project, move on.

- Further along in the cycle, there will always be new projects and discoveries as more exploration underway.

- investors making money in the big stocks only just beginning to trickle down, the general public isn't in yet despite big moves up from extreme bear bottom.

Reference to Investec's Mining Clock

Wednesday, 10 August 2016

Saturday, 6 August 2016

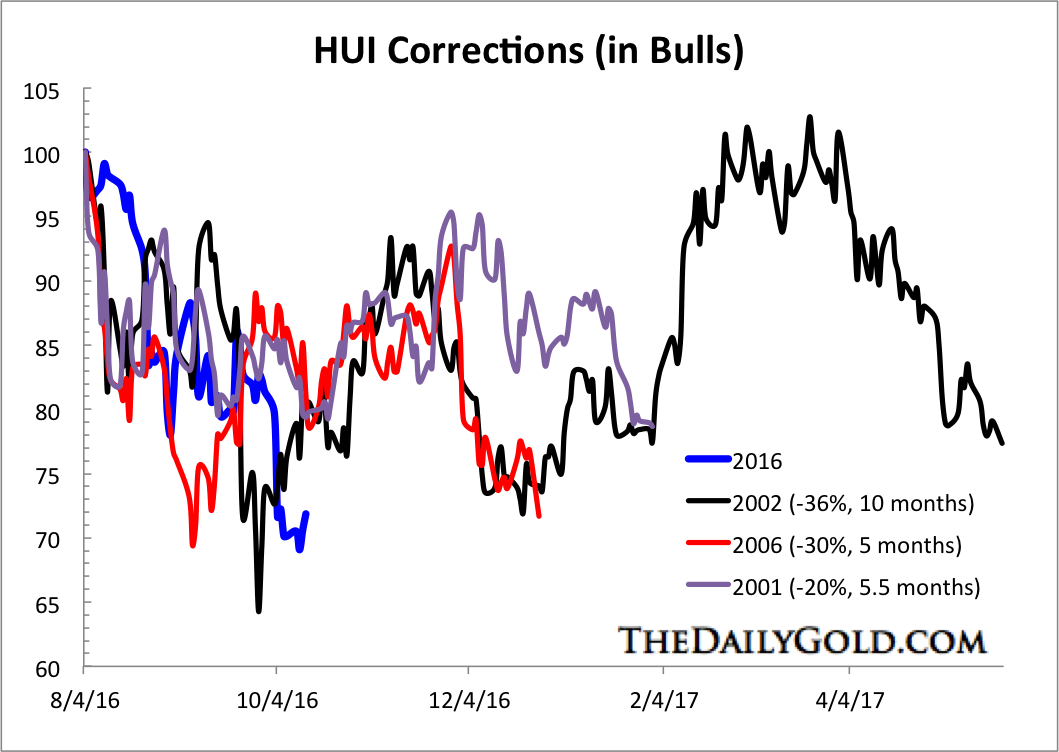

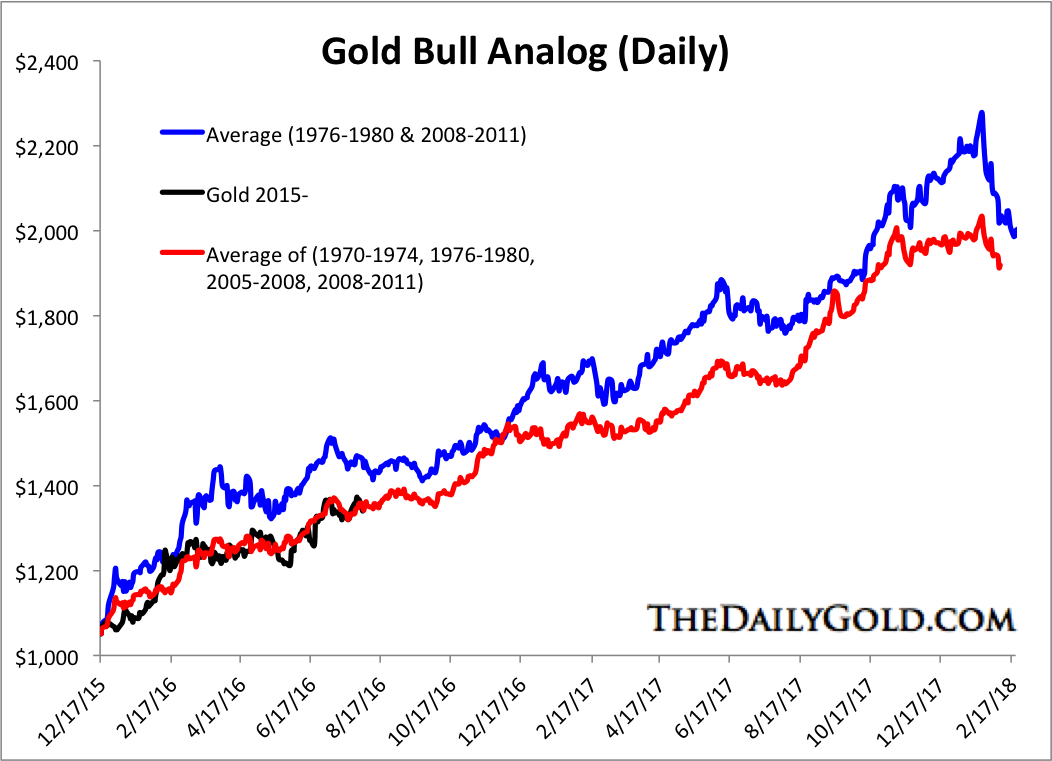

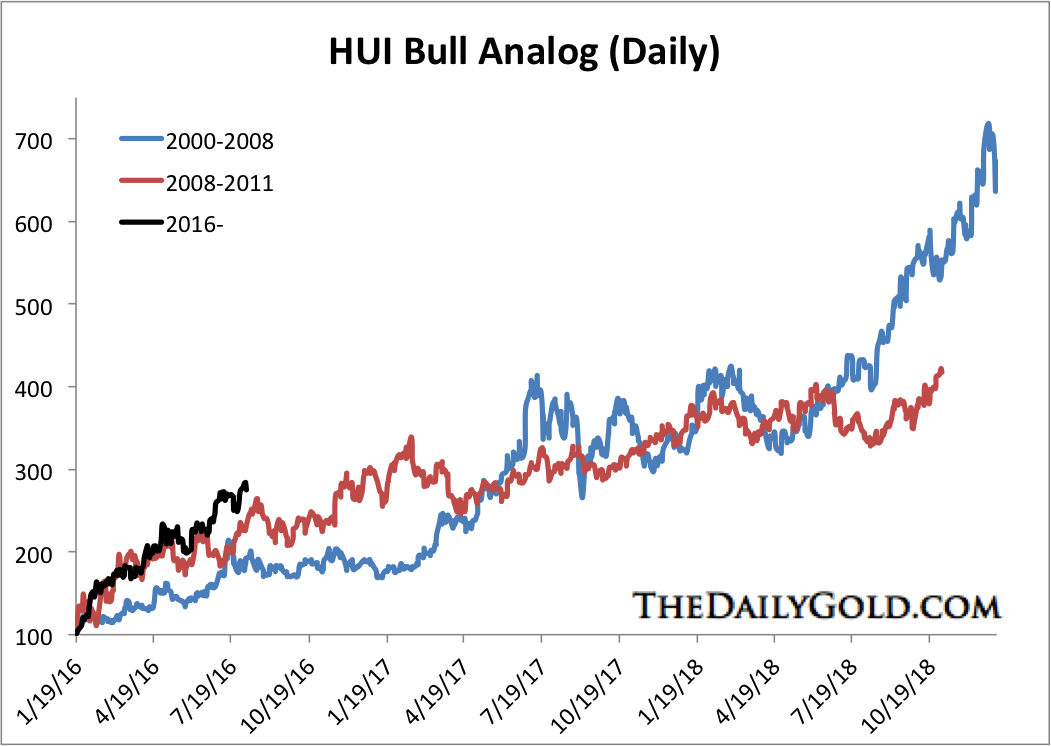

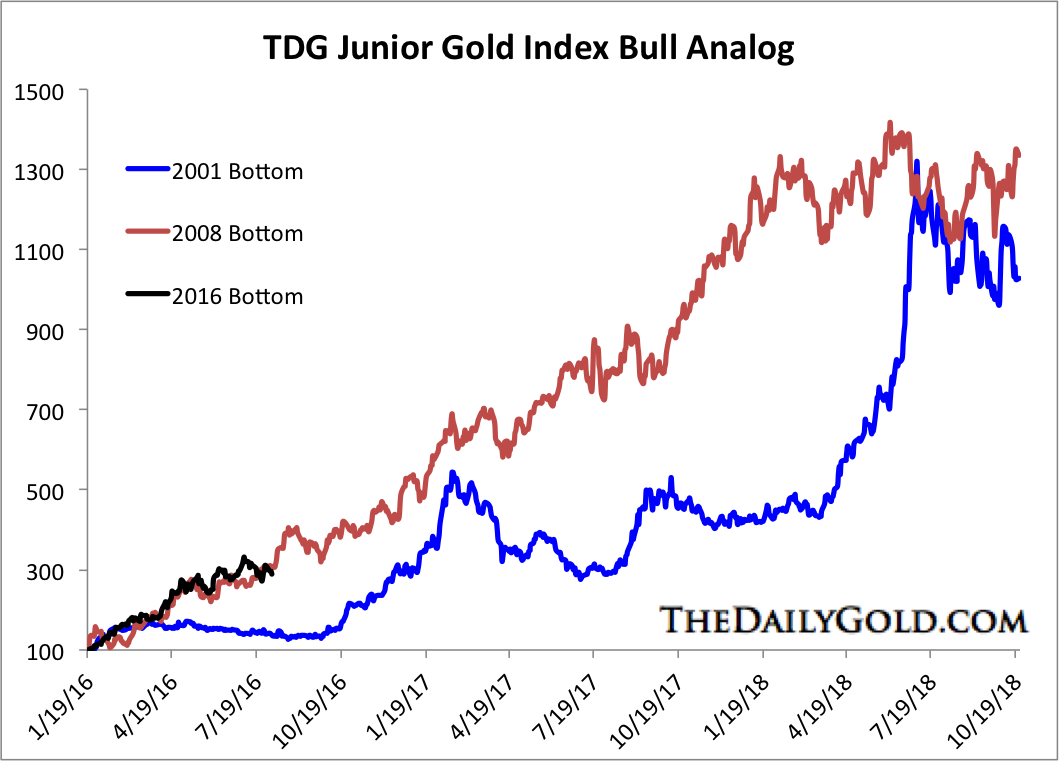

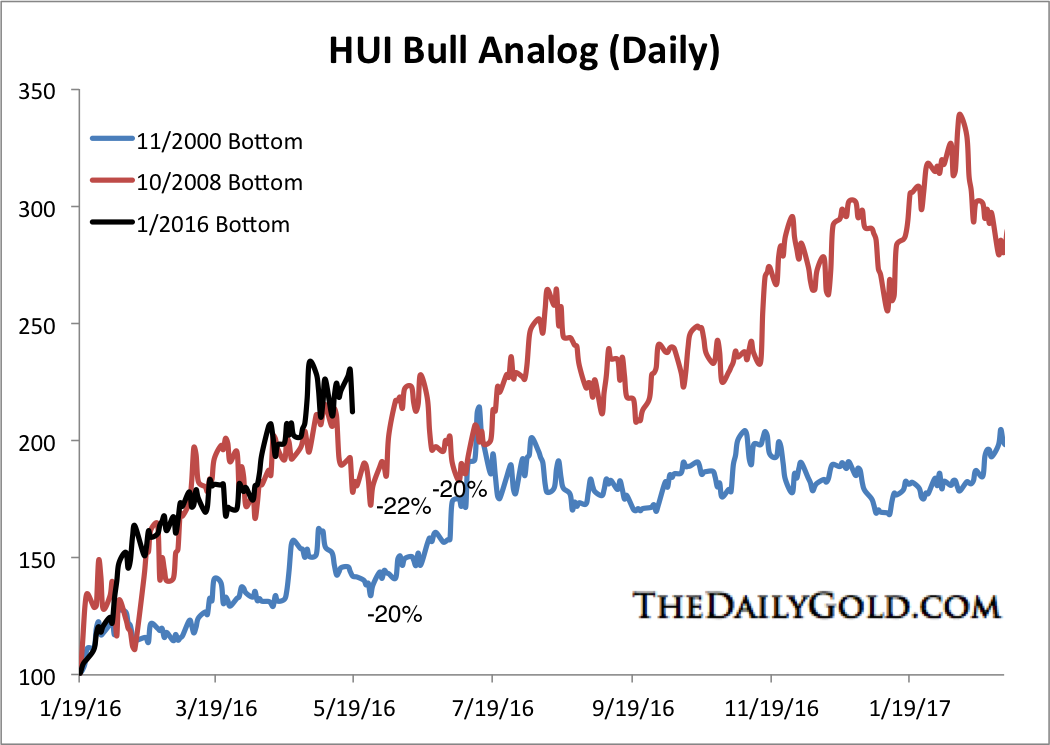

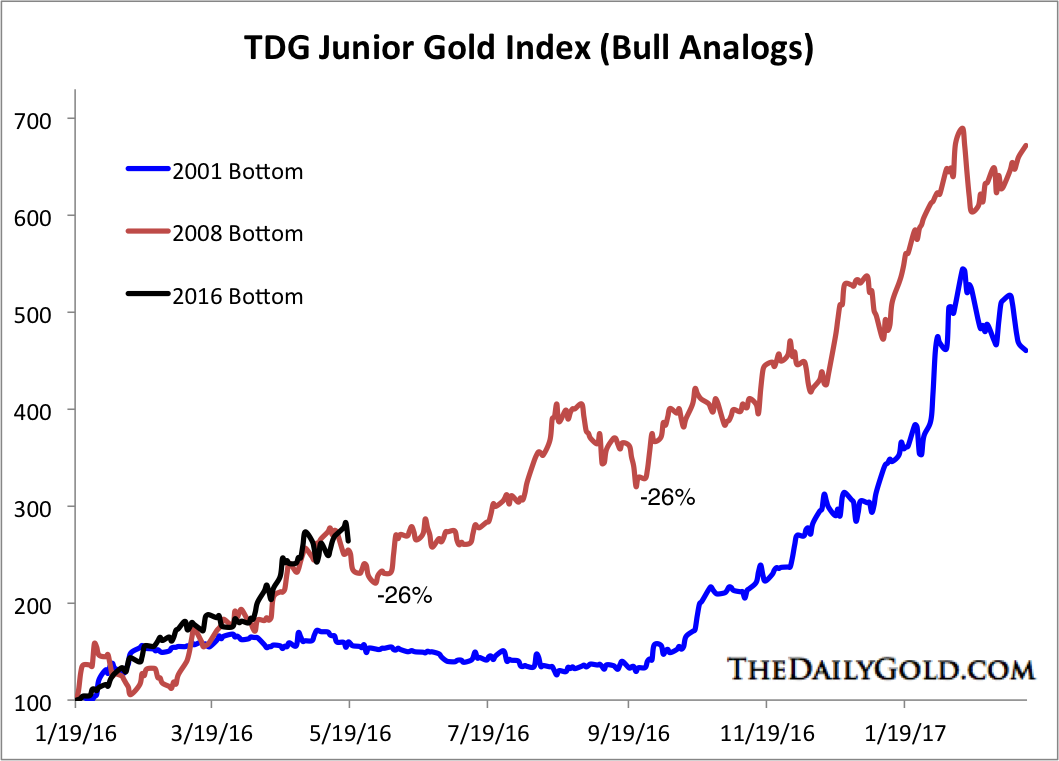

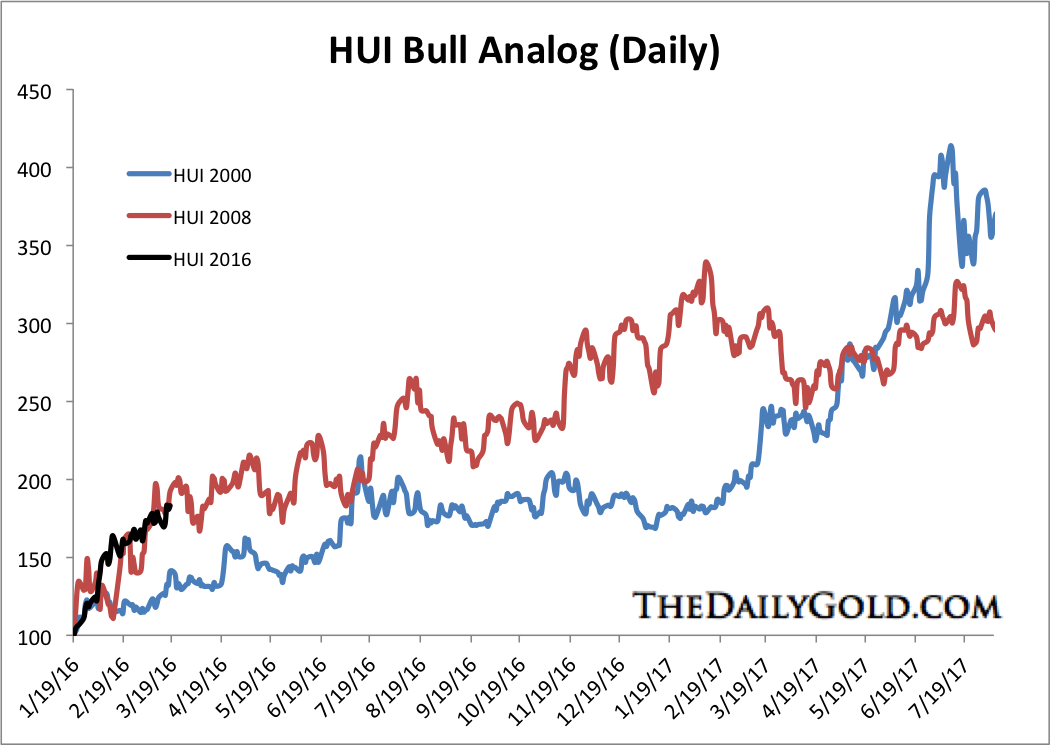

Gold Bull Analogues and Seasonals

Updates from Jordan Roy-Byrne - Pointing to a rest for Gold and the majors, but juniors favoured? Seasonals are good....

Adam Hamilton on Seasonals

We have had an unusually strong summer. Will the rest of the year be stronger or level out?

Adam Hamilton on Seasonals

We have had an unusually strong summer. Will the rest of the year be stronger or level out?

Saturday, 28 May 2016

Brent Cook & Joe Mazumder - Quality vs Leverage / Evaluating Stocks - at MI.Forum

Linked at IKN

Brent discusses failures at Allied Nevada, Rubicon, Midway. Lack of quality, poor supply of good projects against investment demand. Complex Industry. On drill plans, continuity, dilution, strip ratios, impacts for Dalradian, Moneta. Grade smearing - drill interval calculator.

Presentation of all data, e.g. Mirasol & Alamaden vs Otis.

Joe discusses quality vs leverage. Lower quartile long lived assets, return vs scale. Heap leach study and Kaminak gold, recoverable gold. Reservoir minerals.District scale exploration upside. Bought quality in poor market. Opposite strategy buy optionality, leverage to price, duration to cash, jurisdiction key to liquidity. Need to understand the majors gain ozs in their current portfolios as prices rise, impairments due to write downs of current assets. Low liquidity can't exit positions. Optionality has worked but needs trading focus - in a bear quality goes down too though.

Brent discusses failures at Allied Nevada, Rubicon, Midway. Lack of quality, poor supply of good projects against investment demand. Complex Industry. On drill plans, continuity, dilution, strip ratios, impacts for Dalradian, Moneta. Grade smearing - drill interval calculator.

Presentation of all data, e.g. Mirasol & Alamaden vs Otis.

Joe discusses quality vs leverage. Lower quartile long lived assets, return vs scale. Heap leach study and Kaminak gold, recoverable gold. Reservoir minerals.District scale exploration upside. Bought quality in poor market. Opposite strategy buy optionality, leverage to price, duration to cash, jurisdiction key to liquidity. Need to understand the majors gain ozs in their current portfolios as prices rise, impairments due to write downs of current assets. Low liquidity can't exit positions. Optionality has worked but needs trading focus - in a bear quality goes down too though.

Wednesday, 25 May 2016

Gold Bull Analogues

Jordan Roy Byrne updating the current bull against previous markets, due the correction we are seeing

And Longer Term Gold Price Bulls in Perspective !! From Jordan's presentation - HERE

And Longer Term Gold Price Bulls in Perspective !! From Jordan's presentation - HERE

Rick Rule Interviews

Interview at KWN - Here

Interview at Palisade

Interview at Palisade

- Sees likely pause of momentum trade.

- Big discovery would drive the whole market.

- High quality deposits are rare, when discovered go for good prices, Reservoir, Kaminak.

- Urgent need for exploration and discovery. Last cycle $ were spent re-treading old properties, mining markets not deposits.

- Sticking to tried and true terrain, real large world scale discoveries taking place in politically risky locations.

- Discipline and rationality set apart successful long term speculator. Stupidity vs reality

- Cobalt mostly in Russia / Congo but likely for

- We are in a bull market, bull markets consolidate, early stage, don't get shaken out.

- Most of the gain concentrated in the best stocks.

- Most fortunes will be made and given back.

- Avoids greater fool theory on 10c stocks, big positions with high quality teams.

- Limit stocks held to those you will spend an hour a month analysing.

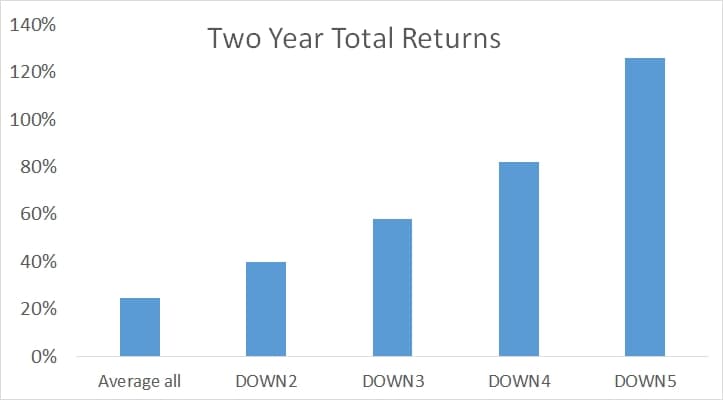

- All the big winners fell 50% at least twice on way to huge gains, if know well will add to positions.

- Moved down into high quality early exploration, prospect generators and specific names with high grade drill holes, been selling some high profile companies. Buying new names unknown, unloved with undiscovered unappreciated values, $10m caps.

Sunday, 24 April 2016

Gold Miner ETFs Are Having the Rally of a Lifetime and Burned Investors are Missing It

Referenced by Jordan at The Daily Gold in his review of "Gold Stocks Climbing Epic Wall of Worry".......more

Saturday, 23 April 2016

Uranium Supply-Demand

Nukem Presentation

This week Cameco announced suspension of operations at their Rabbit Lake uranium in Athabasca.

This week Cameco announced suspension of operations at their Rabbit Lake uranium in Athabasca.

Friday, 22 April 2016

Monday, 18 April 2016

Lithium Stock List

All sensible advice is that this is a bubble, like Uranium, Rare Earths & Graphite before.

The big low cost 'salar' producers will expand to fill requirements.

As the price rises any and all project costs appear to make a return.

In the meantime many of these are the best performing stocks on the Australian and Canadian exchanges.....until....

The big low cost 'salar' producers will expand to fill requirements.

As the price rises any and all project costs appear to make a return.

In the meantime many of these are the best performing stocks on the Australian and Canadian exchanges.....until....

Sunday, 17 April 2016

Tuesday, 12 April 2016

Rick Rule Interviews

While continuing to warn of pullbacks, volatility and poor issuers, Rule speaks with increased conviction of the bottom being in for precious metals and their stocks.

Interview at Korelin.

Interview at KWN

Interview at Palisade

Continuing to seek a management team and deposit for large scale optionality prepared to 'do nothing'.

Biggest returns from placements with warrants but large numbers of placements are low quality.

High returns from good optionality plays. Good returns from investing in discovery after first drillholes.

Limited number of companies involved in the silver space will create a wild market.

Admits inability to sell at the top. Backing superior managements, deposits and balance sheets but when the market rolls over everything goes down, good, bad and ugly.

Interview at Korelin.

Interview at KWN

Interview at Palisade

Continuing to seek a management team and deposit for large scale optionality prepared to 'do nothing'.

Biggest returns from placements with warrants but large numbers of placements are low quality.

High returns from good optionality plays. Good returns from investing in discovery after first drillholes.

Limited number of companies involved in the silver space will create a wild market.

Admits inability to sell at the top. Backing superior managements, deposits and balance sheets but when the market rolls over everything goes down, good, bad and ugly.

Gold Stocks Break Out

At Acting Man -

Gold stocks breaking out but early stage.

CEF still offering discounts and Rydex inflows still low.

Gold stocks breaking out but early stage.

CEF still offering discounts and Rydex inflows still low.

Sunday, 20 March 2016

2016 Gold Stock Rally in Perspective

The fierce and persistent rally in Gold Stocks during 2016 has many awaiting a pullback. Jordan Roy-Byrne cautions against applying bear market analysis to a new bull.

Rick Rule Interview

Lessons of the last down cycle should last for 2-3 years and see gold miners earn increasing cashflow per share with a rise in gold prices, benefiting shareholders.

Identify senior and intermediate producers with growing revenues.

Real move in speculative stocks in 9 months, will be a spectacular market, understand depth and severity. Long long way to run with the correct stocks.

Precious metal streams very valuable to struggling base metals miners, streamers offer lowest cost of capital, increase quality and visibility of revenue stream, plus optionality on the streamed mine.

Loves 'optionality' companies, large deposits drilled off with nil NPV at the bottom of the cycle, must preserve the optionality, management must do almost nothing to dilute shareholders, merge and lower SG&A, number of projects then focus on the best. Spend money when the move has progressed and share prices have advanced. Easiest and most dramatic upside except for occasional discovery will be optionality plays. Preference with developement studied and permitted, but less likely. Power of private placements and warrants in micro-caps. Sellers and buyers are exhausted driving outsize moves with some bids.

Risk of appearance of being profitable during low commodity prices through high-grading.

Identify senior and intermediate producers with growing revenues.

Real move in speculative stocks in 9 months, will be a spectacular market, understand depth and severity. Long long way to run with the correct stocks.

Precious metal streams very valuable to struggling base metals miners, streamers offer lowest cost of capital, increase quality and visibility of revenue stream, plus optionality on the streamed mine.

Loves 'optionality' companies, large deposits drilled off with nil NPV at the bottom of the cycle, must preserve the optionality, management must do almost nothing to dilute shareholders, merge and lower SG&A, number of projects then focus on the best. Spend money when the move has progressed and share prices have advanced. Easiest and most dramatic upside except for occasional discovery will be optionality plays. Preference with developement studied and permitted, but less likely. Power of private placements and warrants in micro-caps. Sellers and buyers are exhausted driving outsize moves with some bids.

Risk of appearance of being profitable during low commodity prices through high-grading.

Brent Cook & Joe Mazumder at PDAC

Seeing fundamental drivers for this upturn in previous metals.

Companies with debt had higher levels of due diligence.

Streamed assets showed poorer quality.

Change in the industry and investors looking for returns, but how long will that last if gold heads back over $1,500

Companies with debt had higher levels of due diligence.

Streamed assets showed poorer quality.

Change in the industry and investors looking for returns, but how long will that last if gold heads back over $1,500

Wednesday, 16 March 2016

Druckenmiller 30% in Gold

At the end of 2015 Stanley Druckenmiller held 30% of the $1bn Duquesne family office fund in GLD. Druckenmiller accumulated around $1,200 during early/mid 2015.

Druckenmiller tipped his hand when he gave a speech during Q2 2015 where he said the following: “Our monetary policy is so much more reckless and so much more aggressively pushing the people in this room and everybody else out the risk curve that we're doubling down on the same policy that really put us there (in the 2008 financial crisis) and enabled those bad actors to do what they do. Now, no matter what you want to say about them, if we had had five or six percent interest rates, it (the housing bubble) would have never happened because they couldn't have gotten the money to do it.......This is crazy stuff we're doing. So, I would say you have to be on alert to that ending badly. Is it for sure going to end badly? Not necessarily. I don't quite know how we get out of this, but it's possible.”

Institutions - Gold & Negative Rates

Munich Re including gold investments

The world's largest reinsurer is far from alone in seeking alternative investment strategies to counter the near-zero or negative interest rates that reduce the income insurers require to pay out on policies. Munich Re has held gold in its coffers for some time and recently added a cash sum in in the two-digit million euros, Chief ExecutiveNikolaus von Bomhard told a news conference. "We are just trying it out, but you can see how serious the situation is," von Bomhard said. The ECB last week cut its main interest rate to zero and dropped the rate on its deposit facility to -0.4 percent from -0.3 percent, increasing the amount banks are charged to deposit funds with the central bank.

Wednesday, 3 February 2016

Life is What Happens

Life is what happens to you while you're busy making other plans.

Time to resume some blogging

Time to resume some blogging

Subscribe to:

Comments (Atom)