PWC's annual review of the Global Mining Industry through analysis of the Top 40 Global miners.

Summary Full PDF 54pp

Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Sunday, 7 June 2015

OT - UK Marginal Tax Rates

UK headline tax rates are not all they seem at certain earnings threshold levels, with various traps reviewed at the FT this weekend

John Kaiser & Others - Vancouver Canvest 2015

A roundup of all Coverage by Resource Investing News, including two interviews with John Kaiser discussing several of his regular picks.

Gold miners increasingly making bite-sized developments that carry less risk

Article at Business Insider

The cautious approach will likely persist even if conditions improve, with miners increasingly teaming up on big, complex projects to share costs, expertise and risk, senior mining executives and industry watchers said.......To be sure, not all mines can be built in phases and bigger projects will find fresh appeal when gold rebounds from the current $1,175 an ounce. "The market is short-term focused," said Jeannes at Goldcorp. "If the gold price were $1,800 an ounce and the equity markets were wide open . . . our investors would be questioning us if we weren't going for the full, large, build-out." But miners have learned from the past five years, said Joseph Foster, portfolio manager at Van Eck, Barrick's biggest shareholder. "I don't think we'll see the capital cost blowouts and the margin squeezes going forward that we have in the past," Foster said. "They've learned a very hard lesson and I don't think they'll forget it."

Saturday, 6 June 2015

Brent Cook at Vancouver Canvest 2015

Reporting HERE

Another who likes Dalradian and Kaminak.

Ross Beaty invested significantly in both.

Also Brent Cook Interview on Al Korelin Show - segment 6

Discusses, and owns

Another who likes Dalradian and Kaminak.

Ross Beaty invested significantly in both.

Also Brent Cook Interview on Al Korelin Show - segment 6

- "Getting a bit more positive on the sector"

- Lack of discoveries, looking blind, under cover, more drilling, more complex metallurgy at depth, more strip, therefore own the few economic deposits that work or those capable of finding them

- Accumulating over summer

- Industry wastes too much money on projects that never stand a chance.

Discusses, and owns

- Premier Gold, cash and 2 big projects in Nevada and JV with Centerra in Ontario.

- Focus ventures - high margin potential phosphate project in Peru

- B2 Gold following buyout of Papillon. Namibia and Mali high margin developments

- Companies with cash to last over 1.5 years, and high margin legitimate projects with good people..

Avoiding 100's of juniors with market caps under $15m with no project, no cash, can go to zero. So little money out there to finance high capex low margin deposits, leads to continual dilution.

Another Interview HERE

Another Interview HERE

Really, if you own 10 solid companies that are doing solid work and have the money to stay alive and have a deposit or discovery that looks like it’s going to work, that’s all you need. You don’t need 50 companies.Discusses and Owns

- Pilot Gold

- Mirasol (JV with Yamana)

- Mariana Resources "I was just there looking at it. It’s pretty darn interesting. It’s certainly a discovery. It’s got high-grade potential" (See Interview at PDAC)

- Likes / Owns - Fission Uranium, Denison Mines, Energy Fuels. "because they’ve got a lot of resources drilled out, permitted, ready to go. I would not spend a dime looking for uranium. There is so much uranium out there. It’s just waiting on higher prices."

Thursday, 4 June 2015

Sunday, 31 May 2015

Eric Coffin Interview - Vancouver Show & Metals Investor Forum

As reported at IKN the traditionally large scale Cambridge House Vancouver Show looks to be poorly attended this year as junior metals exploration falls further out of favour and the companies involved run shorter of cash.

A more select "forum" has been put together with some well known letter writers.

Highlighted companies include - Eric Coffin's Liongold, Goldquest - John Kaiser on Sabina - Brien Lundin on Balmoral & Fission 3 - Gwen Preston's Kaminak & Pilot Gold. - Nevsun and First Mining Finance also announced attendance.

Post Show Review of 12 presenting companies

Eric Coffin in discussion with Gwen Preston

A more select "forum" has been put together with some well known letter writers.

Highlighted companies include - Eric Coffin's Liongold, Goldquest - John Kaiser on Sabina - Brien Lundin on Balmoral & Fission 3 - Gwen Preston's Kaminak & Pilot Gold. - Nevsun and First Mining Finance also announced attendance.

Post Show Review of 12 presenting companies

Eric Coffin in discussion with Gwen Preston

The Real Value of Gold in the Ground - Mickey Fulp / Cipher Research

Mercenary Geologist Mickey Fulp continues to publish an interesting series of deeper studies with Cipher Research.

Previously looking at the real long term costs and profitability of gold mining and "adequacy ratios".

The recent publication looks at the more junior "gold in the ground" explorers and developers, identifying points of over and under-valuation.

A case study of Rainy River, (with it's perfect bull ending at the start of 2011), subsequently bought out by New Gold makes clear the cycles of value creation and destruction for investors buying at different points in the discovery and development process and in particular during the bull and bear phases when capital floods in and out of the relatively small gold mining market. Valuations are leveraged to peak and increasing gold prices rather than more conservative and eventually pessimistic assumptions.

Whilst Fulp dismisses Rainy River as never being on his radar due to over-valuation it is clear that in bull markets for gold miners go-to stories emerge which can move well over "fair value". Value is far easier to find in bear markets but cheap can get cheaper until the turn.

Fulp leaves with some checklists to consider

Previously looking at the real long term costs and profitability of gold mining and "adequacy ratios".

The recent publication looks at the more junior "gold in the ground" explorers and developers, identifying points of over and under-valuation.

A case study of Rainy River, (with it's perfect bull ending at the start of 2011), subsequently bought out by New Gold makes clear the cycles of value creation and destruction for investors buying at different points in the discovery and development process and in particular during the bull and bear phases when capital floods in and out of the relatively small gold mining market. Valuations are leveraged to peak and increasing gold prices rather than more conservative and eventually pessimistic assumptions.

Whilst Fulp dismisses Rainy River as never being on his radar due to over-valuation it is clear that in bull markets for gold miners go-to stories emerge which can move well over "fair value". Value is far easier to find in bear markets but cheap can get cheaper until the turn.

Fulp leaves with some checklists to consider

- Because the consulting engineering firms operate in a highly competitive business environment, they are hired with the expectation of tailoring technical reports to the client’s needs and desires.....For this reason, investors must scrutinize engineering reports carefully. It is often necessary to make adjustments to the assumptions and key variables to arrive at a more realistic project value at any point in time........As an aside, have you ever come across a negative feasibility study? Remember folks, for every failed mine, there was a positive feasibility study

- Too often we find the so-called “experts” that lay investors choose to rely upon are not experts at all. Instead they are brokers, investment bankers, or in-house promoters whose primary interest is in collecting commissions or fees for selling stock, deals, and private placements, or earning consulting fees from the company....Folks, please make sure that you understand the motivations of any expert, analyst, broker, promoter, writer, or talking head whose advice you choose to follow. Here are a few questions you can ask that will afford valuable insight into this matter:

- Does he own shares in the company and at what price?

- Is he participating in the deal or placement with his own personal funds?

- Will he collect a commission or fees for selling you the stock or deal?

- Does he get paid to promote the company via fees, stock, and/or options?

- Is he or his firm underwriting the deal for a fee, commission, and/or warrants?

- Will he give you a full disclosure statement regarding his financial relationship with the company and/or project?

John Kaiser Interview

Interview At Korelin

Kaiser believes the better juniors have bottomed while sentiment is 1/10.

Discussion of Eastmain Resources as a destination for investors bought out of Probe by Goldcorp. Believes adding value through increasing understanding of the structural controls, spent too long in the past drilling and exploring, PEA due for current deposit plus future exploration potential.

Kaiser "Tracker" report on Eastmain (much of Kaiser's work can be followed free after a short period)

Deposit comparables from Eastmain's presentation

Kaiser believes the better juniors have bottomed while sentiment is 1/10.

Discussion of Eastmain Resources as a destination for investors bought out of Probe by Goldcorp. Believes adding value through increasing understanding of the structural controls, spent too long in the past drilling and exploring, PEA due for current deposit plus future exploration potential.

Kaiser "Tracker" report on Eastmain (much of Kaiser's work can be followed free after a short period)

Deposit comparables from Eastmain's presentation

Sunday, 17 May 2015

Peter Brandt - Turns Bullish on Silver

Peter Brandt called the bear in 2011 and is now bullishly inclined

I am moving into a state of high alert in Silver. While I still am inclined to trade a breakout in either direction (given a measured-risk entry), my preference is now slanted toward the buy side. Silver could become rather exciting during the weeks ahead.

Eric Coffin Gold Stock Picks

A number of Coffin's recent write ups have seen significant moves. Interview at The Gold Report with picks.

Sunday, 10 May 2015

6 Juniors that have soared in 2015

Smallcap-Power

Canadian high grade / turnaround - Claude, Eastmain, Kirkland Lake

Nevada high grade - Klondex

Senegal backed by Franco Nevada - Teranga

Toll Processor - Dynacor

Canadian high grade / turnaround - Claude, Eastmain, Kirkland Lake

Nevada high grade - Klondex

Senegal backed by Franco Nevada - Teranga

Toll Processor - Dynacor

Saturday, 9 May 2015

Wednesday, 6 May 2015

Calling Bond Bear Markets

Quite a few big names pointing to a potential bottom in interest rates and peak in bonds.

Calafia Beach pundit commentary and analysis.

Gary Tanashian points out that the bond bull "continuum" is still very much in place

Calafia Beach pundit commentary and analysis.

What prompted me to make this call? It was the recent 47 bps bounce in 10-year German bund yields, off of an incredible low of 0.05% a few weeks ago.Whereas Armstrong suggests a final blow off top in bonds, as stock markets dip, and divergent strength in the US against European before the true rush from government debt & bonds floods into the US stock market.

Gary Tanashian points out that the bond bull "continuum" is still very much in place

UK Election - Austerity

Looking like a very tight result and another coalition to come.

Acting-Man discusses the reality of the UK economy.

Sunday, 3 May 2015

Martin Armstrong on the end of cash - negative interest rates - bond bubbles and Gold

Armstrong's recent focus on controls of cash holdings, negative interest rates and debt/bond bubbles coming into the September 2015 period. Some would see a role for gold, Armstrong suggests not yet.....more.....

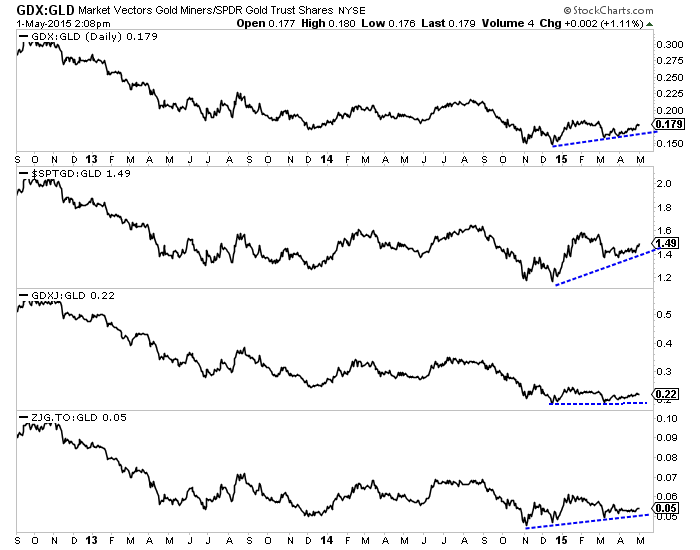

Jordan Roy Byrne - Relative Strength in the Miners - Plus Stock Picks

Interview at Kitco

Stock Picks.

Stock Picks.

- Likes Bear Creek Mining, very cheap, believes silver market will turn, Corani world class asset.

- Kirkland Lake Gold - turnaround stock, reserves. Price near 2 year high, room to move higher. (JGMS - Eric Sprott recently on board here)

- Doesn't like prospect generators, unlike many others. Sees sense of the model, the promotion is that they are safer. Charts and performance are mostly poor. Gambling stocks on exploration drillholes.

- Real interest rates driving gold. Expects 2015 bottom.

Recent article sees relative strength in the gold stocks even during gold's recent price decline as significant and evidence that gold miners may have bottomed relative to gold.

The reasons for the gold miners’ relative strength are unlikely to be temporary. Sure Oil has rebounded but its price remains well below the $100/barrel it averaged throughout 2011 to 2014. That is helping miners. In addition, local currency weakness has been a boon

Jim Rogers - Waiting for US Dollar Bubble Top to Buy More Gold

Interview with Jim Rogers. Still likes stocks in China, Russia, Japan.

Waiting for US$ bubble top to buy more gold, maybe....(on gold from start of interview)

Sees US rate hike, market dip, easing, blow off top.

Waiting for US$ bubble top to buy more gold, maybe....(on gold from start of interview)

Sees US rate hike, market dip, easing, blow off top.

Saturday, 2 May 2015

Why the Rush into Canadian Gold Mines May Continue - Sprott's Todoruk

The weak Canadian dollar is making Canada's relatively safe jurisdiction more appealing for acquisitions. The same argument might be put for Australian deposits yet the majors have made a number of divestments, is their need to strengthen balance sheets forcing sales?

Todoruk's short list of appealing Canadians includes

Todoruk's short list of appealing Canadians includes

a short list of well-followed companies would include Detour Gold for its Detour Lake mine, Pretivm Resources for its large, high-grade Valley of the Kings deposit, Rubicon Minerals for its very near-production Phoenix gold mine, Richmont Mines with its Island Gold mine, Lakeshore Gold with its producing gold mines in the Timmins mining camp, Kirkland Lake with its producing mine in eastern Canada, and Kaminak Gold which owns the Coffee gold deposit in the Yukon.

Friday, 1 May 2015

Tuesday, 28 April 2015

Sunday, 26 April 2015

Junior Gold M&A - Novacopper buy Sunward.

Some big names, Thomas Kaplan's Electrum, John Paulson, and Seth Klarman's Baupost have been significant holders of Sunward, trading below their high $20m cash (no debt).

Sunward hold a very large scale (global top 3%) low grade (0.53g au) Gold-copper deposit, Titiribi, in Colombia which has yet to see an economic study, but would presumably be a project requiring a much higher real gold price and then be highly leveraged to the 10m oz + gold (mostly inferred) & 800m lb copper.

NovaCopper have many of the same holders. The acquistion appears to look to apply Sunward's cash to advance NovaCopper's Alaskan copper deposits.

Sunward hold a very large scale (global top 3%) low grade (0.53g au) Gold-copper deposit, Titiribi, in Colombia which has yet to see an economic study, but would presumably be a project requiring a much higher real gold price and then be highly leveraged to the 10m oz + gold (mostly inferred) & 800m lb copper.

NovaCopper have many of the same holders. The acquistion appears to look to apply Sunward's cash to advance NovaCopper's Alaskan copper deposits.

Eric Coffin can still draw the crowds

The junior market can still come alive to a good promo by a respected letter writer. The 5 year chart puts the 40%+ increase in perspective. This one went out to Coffin's email list and also via CEOca which appears to be getting in with Brent Cook, Coffin, Roulston and Sprott.

Perhaps it helped that juniors with deposits have been seeing M&A bids.

Perhaps it helped that juniors with deposits have been seeing M&A bids.

Thursday, 23 April 2015

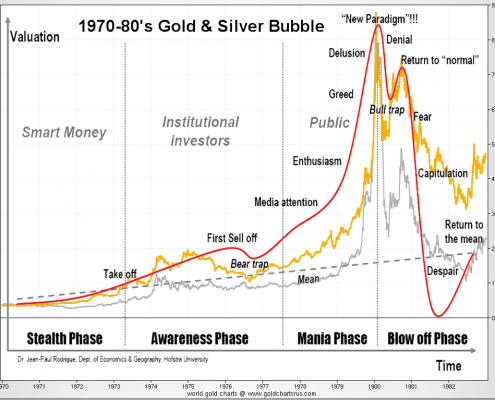

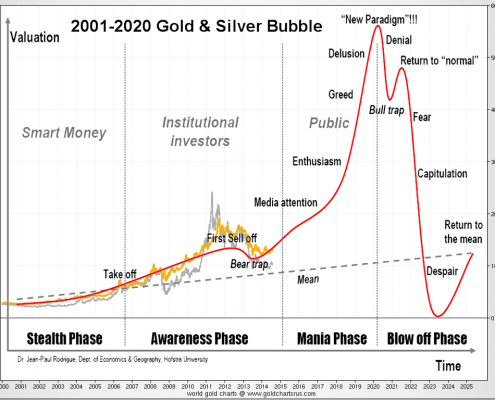

Gold Bubbles

Chris Vermeulen has cooled on gold for the past few years but is suggesting the bull resumes later this year. Clearly if both the charts below spanned the same period, the 2011 peak was it.

Taking Steve Saville's analysis of the "1970s" gold bull however he would show the real move in the miners starting in the 1960s even while the metal price was fixed.

Taking Steve Saville's analysis of the "1970s" gold bull however he would show the real move in the miners starting in the 1960s even while the metal price was fixed.

Wednesday, 22 April 2015

Drill Baby Drill

You thought 2ft concrete walls would protect your valuables?

Details of Easter Robbery of safety deposit boxes in Hatton Garden, London

Details of Easter Robbery of safety deposit boxes in Hatton Garden, London

Tuesday, 21 April 2015

Aussie Gold Mines for Sale - Newcrest's Telfer and Barrick's Cowal

More Aussie Gold assets look to be hitting the market with Newcrest named as both potential buyer and seller.

- Newcrest and Hecla amongst bidders for Barrick's Cowal, 1.5m oz P&P, 270k oz production @ $740-$775 AISC

- Bank of America Merrill Lynch seeking bids for Newcrest's Telfer mine, >500k oz gold production 2014

Monday, 20 April 2015

Gold Miner M&A - Evolution Mining bid for La Mancha Australia Assets

Evolution will grow to 530-600k oz pa -

La Mancha will own ~30% and provide $100m cash for more growth.

Presentation

La Mancha will own ~30% and provide $100m cash for more growth.

Presentation

Saturday, 18 April 2015

Sprott launch Junior Gold Mining ETF - SGDJ

Sprott have followed the launch if their Gold Miners ETF - SGDM with a Junior Gold Miners version - SGDJ.

There are a couple of conflicting messages

What are the SGDJ holdings? Are they different from GDXJ Holdings or BMO's ZJG Holdings?

Sprott have less royalty here, B2 and Centerra are much more significant and the x3 silver miners stand out, though I recall GDXJ started out with a high % of silver miners.

So how has Sprott's senior Gold Miner ETF - SGDM fared since launch against GDX Holdings?

Not so good.

Here they have a policy of high exposure to "stronger balance sheets" in particular Randgold and Franco Nevada, which did not suffer to the degree Barrick, Goldcorp and Newmont did and have not seen the same rebounds.

There are a couple of conflicting messages

Very junior discovery activity seems out of bounds (similarly even "GLDX explorers ETF holdings" are mainly developers of well explored and defined deposits, so really just taking the producing aspect out of GDXJ).

- "Why invest in junior miners? -"High-value discoveries and mine development can create enormous upside potential" ..........But......."The Index methodology tends to favor junior and intermediate producers versus early stage exploration companies whose historical success rate is low."

What are the SGDJ holdings? Are they different from GDXJ Holdings or BMO's ZJG Holdings?

Sprott have less royalty here, B2 and Centerra are much more significant and the x3 silver miners stand out, though I recall GDXJ started out with a high % of silver miners.

| COMPANY | TICKER | Weight % |

| B2Gold Corp | BTO CN | 7.71% |

| Centerra Gold Inc | CG CN | 6.46% |

| First Majestic Silver Corp | AG US | 6.08% |

| Hecla Mining Co | HL US | 5.63% |

| Pan American Silver Corp | PAAS US | 5.60% |

| Alamos Gold Inc | AGI CN | 5.23% |

| Harmony Gold Mng-Spon ADR | HMY US | 4.23% |

| IAMGOLD Corp | IAG US | 4.16% |

| Primero Mining Corp | PPP US | 3.72% |

| OceanaGold Corp | OGC CN | 3.47% |

| Sandstorm Gold Ltd | SAND US | 3.41% |

| Aurico Gold Inc | AUQ US | 3.17% |

| Detour Gold Corp | DGC CN | 3.00% |

| Rio Alto Mining Ltd | RIO CN | 2.74% |

| China Gold International Res | CGG CN | 2.69% |

| Nevsun Resources Ltd | NSU CN | 2.65% |

| Alacer Gold Corp | ASR CN | 2.59% |

| Kirkland Lake Gold Inc | KGI CN | 2.57% |

| Lake Shore Gold Corp | LSG CN | 2.47% |

| Novagold Resources Inc | NG US | 2.26% |

| Argonaut Gold Inc | AR CN | 2.22% |

| Semafo Inc | SMF CN | 2.05% |

| Fortuna Silver Mines Inc | FSM US | 1.87% |

| Silver Standard Resources | SSRI US | 1.67% |

| Endeavour Silver Corp | EXK US | 1.55% |

| Dundee Precious Metals Inc | DPM CN | 1.47% |

| Torex Gold Resources Inc | TXG CN | 1.46% |

| Gold Resource Corp | GORO US | 1.37% |

| Pretium Resources Inc | PVG US | 1.22% |

| Rubicon Minerals Corp | RBY US | 1.04% |

| Premier Gold Mines Ltd | PG CN | 0.97% |

| Mag Silver Corp | MAG CN | 0.78% |

| Seabridge Gold Inc | SA US | 0.71% |

| Guyana Goldfields Inc | GUY CN | 0.66% |

| Asanko Gold Inc | AKG CN | 0.59% |

| Continental Gold Ltd | CNL CN | 0.53% |

So how has Sprott's senior Gold Miner ETF - SGDM fared since launch against GDX Holdings?

Not so good.

Here they have a policy of high exposure to "stronger balance sheets" in particular Randgold and Franco Nevada, which did not suffer to the degree Barrick, Goldcorp and Newmont did and have not seen the same rebounds.

Canada's Discovery Performance - Richard Schodde - MinEx Consulting

Another interesting presentation from Richard Schodde at MinEx (many more presntations here including Pacific region)

Covering the volatility of exploration spending, the importance of juniors in discoveries and the rarity and importance to valuation of tier 1 and 2 discoveries.

Covering the volatility of exploration spending, the importance of juniors in discoveries and the rarity and importance to valuation of tier 1 and 2 discoveries.

$1Bn Quebec Mining Fund

Reported at Pierce Points and Bloomberg

While Finance Minister Carlos Leitao announced plans for the fund in June, Quebec’s legislature has yet to authorize its creation. Capital Mines Hydrocarbures should be able to support as many as 10 mining projects once it begins operating, Daoust said. “The raison d’etre of that fund is to make sure that at the end of the day, if the funding is complicated for the last 10 or 20 percent of a project, we will be there,” the minister said. “We can go to C$200 million, but normally we should not invest more than 10 or 15 percent of a project.”

Friday, 17 April 2015

Wednesday, 15 April 2015

Adrian Day Interview with Sprott's Tekoa Da Silva

Another recent interview from Sprott, this time with Adrian Day, a long standing investor in the natural resources space. Transcript and youtube at the link.

Gold M&A - Alamos - Aurico Gold $1.5bn merger

Two equally sized mid-tier gold miners, Alamos and Aurico, are set to merge.

John McCluskey of Alamos would be CEO of the combined company with operations in Ontario and Mexico and development in Turkey. Rival bids seem likely. TD suggest the deal is dilutive for Alamos.

Alamos stock held up very well during the earlier part of the bear market but has since slipped.

Aurico struggled as Gammon gold, disposed of key Mexican assets to Carlos Slim companies and focused on the new, and potentially very large, Young Davidson mine in Canada which was a buyout of Northgate minerals for $1.46bn in 2011.

John McCluskey of Alamos would be CEO of the combined company with operations in Ontario and Mexico and development in Turkey. Rival bids seem likely. TD suggest the deal is dilutive for Alamos.

Alamos stock held up very well during the earlier part of the bear market but has since slipped.

Aurico struggled as Gammon gold, disposed of key Mexican assets to Carlos Slim companies and focused on the new, and potentially very large, Young Davidson mine in Canada which was a buyout of Northgate minerals for $1.46bn in 2011.

Barron's - Newmont shares could rise 55%

Mainstream Barron's on Newmont

But Newmont, the world’s No. 2 gold producer after Barrick, is likely to emerge a winner even if gold falls further. The Greenwood Village, Colo.–based company has sold assets and cut costs, reducing its break-even production price by about $200 in the past two years, to $1,002 an ounce.

Ross Beaty Interview with Sprott's Tekoa Da Silva

Transcript - HERE

Ross Beaty has been making significant junior investments recently - see HERE

Ross Beaty has been making significant junior investments recently - see HERE

Put all that together and it’s all happening now. You know what? There are a lot of weird things that I can’t really figure how it’s going to end. But quite frankly, my salvation here, my refuge, is in precious metals. It’s in gold and silver. So I’m very bullish on gold right now. I’m particularly bullish watching what’s happening to the gold price relative to the US dollar. I’m bullish on silver because silver will follow gold. Silver has always traded with gold...........This is the end of four years of really weak markets, in the metal space and in the resources space. So a lot of investors are bruised and bloodied. We’re starting the fifth year. If the tide is going out and there is a huge macro wave -- a wave for metal prices declining, you’re probably better off to own the metal than the companies, because the companies tend to underperform the metals in a bear market. Bear markets feed on themselves. So if an investor is losing money, he’s not going to want to buy another speculative gold company or copper company. So it’s true that even in bad, bad markets, you will have some great investment successes where a company has had good exploration results or has done a really, really smart acquisition. You will have those. But typically the whole sector is going to be losing out and the best strategy then is to do what nobody does which is sell at the top. Buy at the bottom, sell at the top. That’s what you’re supposed to do. But of course nobody ever does that. It’s times like this where we’ve had four years of bear markets and I don’t know whether the bear is going to turn into a bull market in a year or two years or two days. I really don’t know when the bottom is. But I know this is not the top. We’ve had four years of terrible markets. I would say today is just a really good time to be building a portfolio of well-run junior companies. My bias is in gold because I think that gold and silver are going to outperform the other metals. But buy a portfolio of companies and really focus on a couple of things. One is the asset has to be good. You can have a genius with a crappy asset and he’s not going to make money. You can have an idiot with a phenomenal world class asset and he’s actually going to make money. The stock is going to go up. The second thing is: people are really, really important. But my first priority is to look at the asset, to look at the quality of the project that the company has............there are a lot of similarities today to what typically happens in the bottom of the bear market. There is a lot of sadness, a lot of difficulty raising money, a lot of very stressed junior companies, and very unhappy investors. That’s the nature of the beast. When things turn, the tide will come in and everybody will be happy again.

Brent Cook Interview with Sprott's Tekoa Da Silva

Interview from a couple of weeks ago - HERE with Transcript

The major mining companies are decreasing their costs, but what they’re really doing is increasing their future costs. They’re pushing costs out into the future. That has to be resolved but my sense is that we are in a bottoming process. I don’t think it’s going to get a lot worse and I think that two or three years out, these major mining companies are going to wake up to the fact that they’ve shut down exploration. They’ve shut down their development. They’ve got nothing in the pipeline and all of a sudden when they’re announcing their costs the analysts will start saying, “Yeah, but you don’t have any more ore.”So you want to identify the properties and the people that can last through this bottoming period, as well as those companies that will come out the other end in possession of the very few quality discoveries that are out there. That’s all you’ve got to do—simple, right? Haha......There are probably six gold projects in the world right now that are being developed that I think will probably work, held by junior companies. I’m not talking about majors.In terms of companies that are competent, we’ve got something like 1500 listed on the Vancouver exchange. I would say probably – 20% percent of them are companies that I would consider putting money into [in the right circumstance]......Maybe 25%. But I don’t buy everything. My portfolio, I try and keep it to 20 companies or less and I think that’s something investors should do as well. If you own too many stocks, you forget why you bought them. They go up, they go down…and then you start hoping they go back up for no reason at all. That’s my philosophy anyway.

Sunday, 12 April 2015

Why is Gold Mining such a Crappy Business - Saville

Steve Saville has a follow up article to an earlier one discussing why Gold Mining has seen such poor returns.

Both owe a great deal to Doug Pollitt's Denver Gold 2014 presentation which deserves a full read.

There are suggestions that some companies are becoming better allocators of capital.

It also supports Brent Cook's repeated thesis that a more rational industry will be even hungrier for quality junior projects and discoveries when the market does turn.

Both owe a great deal to Doug Pollitt's Denver Gold 2014 presentation which deserves a full read.

It is really quite amazing that we chucked billions and billions and got no supply response at all. What this tells us is that there is simply not a lot of gold out there. How many genuine finds were there in the last cycle? Half a dozen? A dozen? In fifteen years we might have discovered enough new material to keep the mills turning for two or three years. The raw material was just not there, even in the face of the avalanche of money to tease it out.......... To step back and re-cap: being an asset class unto itself which from time to time comes into favour generates substantial investment demand. Gold is a small sector to begin with – lots of money into a small sector drives down the cost of capital and encourages issuance. Against this there are fewer still opportunities within the small sector to invest the incoming capitalThis leads to gross misallocation of capital as the financial sector chases scale, growth and leveraged returns in marginal projects. As Saville discusses elsewhere buying low value ounces in the ground was once a successful strategy, but not now. As Rick Rule has discussed this leaves a marginal industry as prices fall.

There are suggestions that some companies are becoming better allocators of capital.

It also supports Brent Cook's repeated thesis that a more rational industry will be even hungrier for quality junior projects and discoveries when the market does turn.

Larry Edelson remains Bearish on Gold and Miners

After calling for a resumption of the bull last June (with the launch of an expensive advisory service - any refunds?) Edelson quickly reverted to a bearish position and now sees a big sell off coming 14th April and likely long term lows in May, June or October - so a few options there.

Edelson suggests he is close to Martin Armstrong who sees major "big bang" in bond markets in September 2015. Will gold be a refuge or initially sell off too? As miners topped at the end of 2010 well ahead of peak gold prices some better issues may see strength ahead of gold lows, some significant investors are putting capital to work, Beaty, Lundin and others.

But perhaps many more, Rick Rule for example, are looking for a final vicious capitulation bottom.

Edelson suggests he is close to Martin Armstrong who sees major "big bang" in bond markets in September 2015. Will gold be a refuge or initially sell off too? As miners topped at the end of 2010 well ahead of peak gold prices some better issues may see strength ahead of gold lows, some significant investors are putting capital to work, Beaty, Lundin and others.

But perhaps many more, Rick Rule for example, are looking for a final vicious capitulation bottom.

Whitman Howard - Roger Bade - Mining stocks April-2014

Roger Bade was early calling the mining bear market. An out-dated report from April-14 reviews some UK listed miners. (click on link at bottom of page)

Comparisons with 1970s Gold Bull - Saville

Steve Saville highlights problems in comparing the recent gold bull against the 1970s where gold prices started out fixed. The mining stocks reflected the early 60's start of the bull.

Dollar movements before and after Fed interest rate increases

Market Anthropology shows past movements in the dollar index after interest rate rises. Of course they haven't risen yet.

Thursday, 9 April 2015

Biggest Indian Jewellery Maker Looks to Spend $700m on Aussie Goldminers

A story reported by Dave Pierce, initially published at the Australian Financial Review.

Rajesh Metha of Rajesh Exports is India's largest jewellery manufacturer with a $1.2bn market cap in Bombay, vertically integrated through mining, refining, manufacturing and retailing.

The company consumes 140T of gold pa, around 15% of Indian imports, and has apparently decided gold miners are cheap enough, now looking to spend $700m in Australia where annual gold production is around 280T pa. The timing seems a little odd following a number of disposals by the majors whereby Northern Star has emerged as a significant force.

Linked are some of Australia's biggest gold miners

Rajesh Metha of Rajesh Exports is India's largest jewellery manufacturer with a $1.2bn market cap in Bombay, vertically integrated through mining, refining, manufacturing and retailing.

The company consumes 140T of gold pa, around 15% of Indian imports, and has apparently decided gold miners are cheap enough, now looking to spend $700m in Australia where annual gold production is around 280T pa. The timing seems a little odd following a number of disposals by the majors whereby Northern Star has emerged as a significant force.

Linked are some of Australia's biggest gold miners

Mr Mehta would not name the Australian mines nor companies that he was looking at, but said talks with advisers had begun. "We have met a lot of investment bankers here and we are evaluating the best way to get in, what is the best way to do it, as we are looking at not only taking interest in the gold mining sector but we are also looking at forging a relationship with the largest gold-producing mines to buy and ensure supply from them," he said. "We can be a good consuming partner for them." The comments follow recent momentum towards a free trade agreement between Australia and India, and last year's visit to Australia by Indian Prime Minister Narendra Modi. It also comes after two years of regular deal-making in the Australian gold industry, as several foreign gold miners have sold assets to try to reduce their exposure to Australia.

Junior Speculation - $20k to $15m to $4m

CEOca put up this discussion with Robert Hirschberg, a venture stock speculator who has made it and lost it over several decades. Hope & warning in equal measure.

Monday, 6 April 2015

Mining Costs and Innovation

Bearish metals markets should drive cost reduction and innovation.

Mish reports on Caterpillar's innovations with autonomous trucks.

An older report highlights potential energy innovation utilising solar power in remote mine sites like Sandfire's DeGrussa mine. The cost savings are perhaps less clear with low oil prices.

Mish reports on Caterpillar's innovations with autonomous trucks.

An older report highlights potential energy innovation utilising solar power in remote mine sites like Sandfire's DeGrussa mine. The cost savings are perhaps less clear with low oil prices.

Sunday, 5 April 2015

OT - Troubled Morrissey

TroubledMozza has some wonderful tweets to amuse those who find Smiths lyrics popping into their minds from time to time. Some classics were linked at The Poke which I have linked below a little music to accompany, but a full browse of Troubled Morrissey's Twitter is essential for the Smiths inclined.

Tuesday, 31 March 2015

OT - The Kaiser Chiefs on Lairy

My Own Market Narrative asks - What is Lairy?

The Kaiser chiefs are worth turning up loud on the matter - video below

The Kaiser chiefs are worth turning up loud on the matter - video below

Sunday, 29 March 2015

The Real Cost of Gold Mining - Adequacy Ratios

In February Mickey Fulp published analysis with Cipher Research detailing the financial failures of the gold industry and proposing a renewed focus on grade rather than growth which analysts chased companies to chase for the past decade.

Most interesting is the "Adequacy Ratio" which simply compares operating cashflows against all outflows including "capex"

- Summary Report

- Interview

- Youtube Pt1 Pt2 Pt3

Most interesting is the "Adequacy Ratio" which simply compares operating cashflows against all outflows including "capex"

Cipher Research has developed a new, simple, and powerful tool to analyze profitability, the Adequacy Ratio (AR). It is cash inflows (revenues) divided by cash outflows (OP-EX + IMP + debt repayment + dividends paid). Note it does not include equity raises or cash spent on acquisitions. If the ratio is greater than 1.0 a company is healthy; if less than 1.0, unhealthy. Of the seven companies we looked at over 11 years, none had an average ratio greater than 1.0 over the period. Only for one year, in 2011 when gold hit its all-time high, did the average adequacy ratio for the companies as a whole exceed 1.0. To compare for example, Apple has a 1.3 adequacy ratio over the past 5 years.This industry-wide failure means the major gold miners have not generated enough cash flow to meet their obligations despite the amazing 11-year run for gold. We found that companies have been going into debt to pay dividends. For example, Newmont took on an additional $5.8 billion in debt and paid out $5.2 billion in dividends over the period. We know of small-tier junior miners that have paid out dividends with equity raises… that’s unholy and in my opinion, should be illegal.

Sunday, 15 March 2015

Saturday, 14 March 2015

Euro QE and Debt Restructuring

OMFIF on risks of European QE

.......It feels as if the markets are programmed to crash when the ECB's QE programme nears its end, if not before.Pettis on Debt restructuring

As soon as Draghi made the statement to do “whatever it takes”, markets recognized that the ECB was in effect guaranteeing the bonds of EU member states whose credibility was in question, and yields immediately dropped. It is important to understand why this was effectively a kind of debt restructuring. .......Draghi’s promised immediately reduced a larger part of the uncertainty associated with the resolution of the debt. The collapse in uncertainty reversed the reflexive process in which rising uncertainty caused declining economic expectations, which caused rising uncertainty.

Thursday, 12 March 2015

Sunday, 8 February 2015

Franco Nevada look to deploy $1bn

Reported at Bloomberg

Franco-Nevada Corp., a Canadian company that provides financing for energy and mining projects, sees sagging commodity prices as an opportunity to complete deals worth more than $1 billion this year.

“I’d like to deploy all my cash this year,” David Harquail, chief executive officer of the Toronto-based company, said in an interview in Vancouver Monday. “That would be my ideal.” Harquail, who put more than $900 million to work in 2014, said mining and energy companies need more financing for projects hurt by falling prices. Franco-Nevada and other buyers of royalties provide financing to developers in exchange for a discount on future output.

Greg Gibson moves to Barkerville Gold - Callaghan Out

In October 2013 we noted Greg Gibson's industry moves.

Things haven't worked out well at San Gold, Northern Gold, Temex or Kerr Mines (formerly Armistice) during this bear market.

We now see Gibson and Thomas Obradovich (formerly Aurelian) recruited, ousting promoter Frank Callaghan at Barkerville Gold.

Barkerville became notorious, and their stock was suspended, for putting out an extremely optimistic resource statement in 2012.

Things haven't worked out well at San Gold, Northern Gold, Temex or Kerr Mines (formerly Armistice) during this bear market.

We now see Gibson and Thomas Obradovich (formerly Aurelian) recruited, ousting promoter Frank Callaghan at Barkerville Gold.

Barkerville became notorious, and their stock was suspended, for putting out an extremely optimistic resource statement in 2012.

Premier Gold JV with Centerra Gold

Breaking the usual pattern of junior buyouts here we see Premier Gold, a significant junior with multiple projects, entering a 50:50 Joint Venture where Premier's contribution is the Trans-Canada Gold property and Centerra fund $300m of development. PEA was completed Jan-14 and Feasibility is underway. PEA indicated 19% IRR @ $1250 Gold, with Capex at $410m including an $83m contingency.

With falls in the $CAD vs $US and depressed general commodity markets mine-building costs in Canada should be favourable.

With falls in the $CAD vs $US and depressed general commodity markets mine-building costs in Canada should be favourable.

The Trans-Canada property is in Ontario's Geraldton Beardmore camp which saw a great deal of speculative investment after Kodiak Gold made spectacular drillholes in 2007 and raised substantial funds but never pulled together a successful deposit. Goldstream Minerals now hold the properties they call Hardrock East, with Kodiak's Brian Maher involved.

Kodiak merged with Golden Goose to form Prodigy Gold and developed the Magino deposit bought out by Argonaut, but needing higher gold prices for development.

Meanwhile Roxmark and Ontex developed old mines, Brookbank and Bankfield amongst others in the region and merged to form Goldstone Resources subsequently bought out by Premier Gold.

Saturday, 7 February 2015

Baker Steel & EMR Capital raising over $600m for Mining Investments

EMR Capital raising $450m for mining investment fund.

Top Holdings - currently including private company holdings include deeply out of favour iron and coal aswell as silver, gold, platinum and copper

Baker Steel (additional link HERE) looking to increase assets 6 fold by $180mEMR Chief Executive Jason Chang said the fund will focus on copper, gold, coking coal and the fertiliser potash, and had attracted a mix of institutions, endowments and private investors....."We think now is a good time to deploy capital into these markets," Chang told Reuters in an interview. "We're looking at the medium to long term and not worried about the day-to-day fluctuations."

The Baker Steel Resources Trust – which has lost nearly three quarters of investors’ money – is asking for clients to pile in millions more in an audacious call that the commodity slump will soon be over.The investment trust, managed by David Baker and Trevor Steel, has lost investors 72.3 per cent in the past three years, according to FE Analytics.Investors have been fleeing from anything related to commodities in the belief that the ‘super cycle’ sparked by China’s rapid growth had come to an end.The £31.4m trust is planning to increase its assets sixfold through a £79m share issuance and a further £100m capital raising to be outlined at an extraordinary general meeting later this month.

While he admitted it was impossible to call the exact bottom, he said with valuations as low as had been seen in many years, much of the “smart money” in the private equity space was also poised. “We are at or somewhere near the bottom,” he said. “Whether we have actually seen it or whether we will in another six or 12 months, I don’t know. But the risk-reward of the potential upside looks positive.” He thought the current conditions would not “last forever”. “The sector is on its knees and we would like more capital to take advantage of that. Mr Steel said with the new money he would be interested in adding a handful of development-oriented stocks, of which he had already identified a pipeline of potential names.

“There is very little competition in our space and it gives us an opportunity to do attractive deals,” he said. “It might be companies that need the last bit of capital to get their projects into production, or if they have a lot of debt. We can get involved in refinancing that debt – effectively exploiting that weakness – and getting in at a good entry point for our investors.” He said that while the sector could continue to fall, he wanted to raise the money now because the risk of waiting to get the deals done at a better price was too great.

Top Holdings - currently including private company holdings include deeply out of favour iron and coal aswell as silver, gold, platinum and copper

Martin Armstrong's Writings & Presentations

Martin Armstrong's forecasts and cycles work foresees a key turn point in September 2015, "Big Bang", and currently points to a problem in the bond markets, a strong dollar and US stock market.

He currently sees gold weak but later gains as the bond markets weaken.

Most recent interview HERE (part 3 discusses the September-15 turn)

Armstrong Papers and you-tube links below.....

He currently sees gold weak but later gains as the bond markets weaken.

Most recent interview HERE (part 3 discusses the September-15 turn)

- Seeing beginnings at the periphery now in Greece, China.

- Only US strong, pushing up US$. If US stockmarket chops then initial sell off then take off to upside in 2017. Phase transition as capital flees bonds to stock markets.

- Current concentration of capital in bond markets. Sitting on money because don't know what to do.

- If Stock market increases then Fed will raise interest rates, then higher dollar.

Armstrong Papers and you-tube links below.....

Mickey Fulp on Buying the Best Junior Miners

Interview from VRIC at Small Cap Power. Stock picks are sponsors.

Wednesday, 4 February 2015

Gold Long Term Turning Point - Second Time Lucky ?

Chart from Jeff Clark's monthly chart showing long term turning points at MACD crosses.

We narrowly missed a crossover last year, but have now.

We narrowly missed a crossover last year, but have now.

Sunday, 1 February 2015

World Economic Forum - Davos 2015 - On Mining

Mining Papers from Davos

Also summaries of many other presentations from other industries and regions.

Also summaries of many other presentations from other industries and regions.

Tuesday, 27 January 2015

Pinetree falls to Creditors - Sheldon Inwentash out

Symbolic of the rise and fall of the canadian juniors; today news that Sheldon Inwentash has left Pinetree having failed to maintain covenants on large debentures.

Pinetree's big peak was in the uranium bubble but rose into 2011 invested across many mining stocks.

Inwentash ensured a last hurrah in 2011 taking pay of 10% of fund growth.

Pinetree's big peak was in the uranium bubble but rose into 2011 invested across many mining stocks.

Inwentash ensured a last hurrah in 2011 taking pay of 10% of fund growth.

Pinetree Capital, an investment fund with a portfolio worth $794 million, paid its CEO Sheldon Inwentash $34.6 million in 2010.Market Cap today C$ 17m

Sunday, 25 January 2015

Ross Beaty Interview - Vancouver 2015

- Outlook has changed quite "profoundly" since last year.

- Bearish on most metals, very bullish on gold, more bullish as the months have gone on. Nervous on copper.

- Metals move in cyles, make money on the way in, this is the kind of time to be buying.

- Mostly investing in gold and silver stocks. Great couple of years ahead for silver.

- Ecuador, mining industry as catalyst for country growth as oil turns down, Beaty and Lundin view.

- Still likes renewable energy, thinks dirty coal is dead, dustbin of history. Oil little to do with renewable energy - competes with coal and gas, low gas prices an issue.

- Strong pricing has encouraged over-supply for most metals. Zinc well balanced, copper energy metal not so over-supplied.

- Successful juniors de-risked large assets good management.

- Been buying gold and silver junior stocks. Good discoveries rare but always a winner.

- Watching and buying a number of junior mining stocks undisclosed below 10% insider holdings.

John Kaiser Stock Picks from Vancouver Resource 2015

Picks noted HERE, a number of these are long standing picks.

Kaiser's detailed company analyses can be found HERE , with those over a month old being free to read. Clearly the latest notes are restricted to paid members but price reaction may indicate bullish or bearish to the original views you can follow.

Interview discusses changes in the oil market and the bullish case for gold, changing from the 'apocalyptic goldbug narrative' to one focussed on the improving 'real price' of gold for the miners. (As discussed on the blog here, miners operating outside the US should see substantial cost reductions)

China infrastructure build out over, focus on consumption.

India future powerhouse, hardline on regulations, take 5-7 years then a supercycle for massive expansion.

- Gold: Midas, Temex, Highway 50,

- Peregrine Diamond,

- Copper: Amarc, Tsodilo, InZinc, Nickel: First Point Minerals

- Scandium International - (new materials theory, see also investments by Robert Friedland)

Kaiser's detailed company analyses can be found HERE , with those over a month old being free to read. Clearly the latest notes are restricted to paid members but price reaction may indicate bullish or bearish to the original views you can follow.

Interview discusses changes in the oil market and the bullish case for gold, changing from the 'apocalyptic goldbug narrative' to one focussed on the improving 'real price' of gold for the miners. (As discussed on the blog here, miners operating outside the US should see substantial cost reductions)

China infrastructure build out over, focus on consumption.

India future powerhouse, hardline on regulations, take 5-7 years then a supercycle for massive expansion.

Brent Cook Interviews - VRIC-15

Don't buy crap zombie juniors. Copper may have lower supply. Gold higher by year end.

Interview at CEOca

Additional interview discussing the usual subjects of lack of discoveries and the majors needing to buy good deposits, of which there are few, plus more discussion of selling discipline.

Smallcap-power interview from VRIC - Mentions that December-14 newsletter bought Kaminak, Premier Gold and Lakeshore Gold

Interview at CEOca

Additional interview discussing the usual subjects of lack of discoveries and the majors needing to buy good deposits, of which there are few, plus more discussion of selling discipline.

Smallcap-power interview from VRIC - Mentions that December-14 newsletter bought Kaminak, Premier Gold and Lakeshore Gold

Rick Rule Interview from VRIC-15

Another Resource Investing Interview from the Vancouver Show -

Best of the best on sale cheap, 20% of companies worthwhile.

The idea that there is no quality is idiotic.

Not in a capitulation market yet based on issuer behaviour.

Long term likes coal, uranium, gas - finding the best producers hanging on until market changes.

Additional interview at Smallcap power - discusses focus on buying "the best of the best" and the market recovery as a cracking whip.

Best of the best on sale cheap, 20% of companies worthwhile.

The idea that there is no quality is idiotic.

Not in a capitulation market yet based on issuer behaviour.

Long term likes coal, uranium, gas - finding the best producers hanging on until market changes.

Additional interview at Smallcap power - discusses focus on buying "the best of the best" and the market recovery as a cracking whip.

Doug Casey Gold Stock Picks - Louis James

At the Vancouver Conference - HERE

Include - Integra Gold, Continental Gold, Dalradian, Kaminak, Rubicon, Dynacor

Include - Integra Gold, Continental Gold, Dalradian, Kaminak, Rubicon, Dynacor

Subscribe to:

Comments (Atom)