Seeking Junior Gold Miners and Silver Miners for Investment. Manage Your Hope & Fear. You really cannot just buy and hold - sell some to greed - buy into fear was never more true but hard to do.

Pages

- Home

- Site Map - Guide

- Good People In Good Projects

- Junior Gold with a Major Mining Shareholder

- Gold Merger and Acquisition Targets - Denver Gold Companies

- Emerging Multi-Project Consolidators - Growth - Mergers & Acquisitions plus

- Project Generators

- Emerging Gold Producers

- Old Gold Mines - New Exploration

- Regional Exploration

- Gold & Silver Discovery Stocks

- Large Low Grade Gold Deposits

- Silver Miners . . . . . .

- Junior Gold Stock Newsletter Picks

- Junior Gold Miners Stock Selection & Trading . . . . . . .

- Due Diligence - Gold Deposits, Production & $/oz

- Gold PEA / PFS / DFS / BFS Company Updates - NI 43-101 / JORC

- PDAC 2012 - Core Shack

- News - Stock Movers - Insiders - Broker Upgrades - Earnings - Warrants

- Why Gold ?

Wednesday, 31 December 2014

Gold Juniors that Gained Traction in 2014

Northern Miner article discuss

Detour Gold, Guyana Gold, Lakeshore Gold, Rio Alto, Probe Mines

Detour Gold, Guyana Gold, Lakeshore Gold, Rio Alto, Probe Mines

Tuesday, 30 December 2014

Consolidated Gold Fund & ETF Holdings

Consolidated precious metal fund and ETF holdings (top 25 holdings).

Reviewing

Also company names need cleaning so there are some duplicates

- see tables below - 184 companies across 24 Funds & ETFs

Reviewing

- Total Market Cap of holdings - Total holdings approx $15bn

- Maximum % weighting in portfolios

- Greatest % increase / decrease in holdings. (= fund size + weighting)

Also company names need cleaning so there are some duplicates

- see tables below - 184 companies across 24 Funds & ETFs

Sunday, 28 December 2014

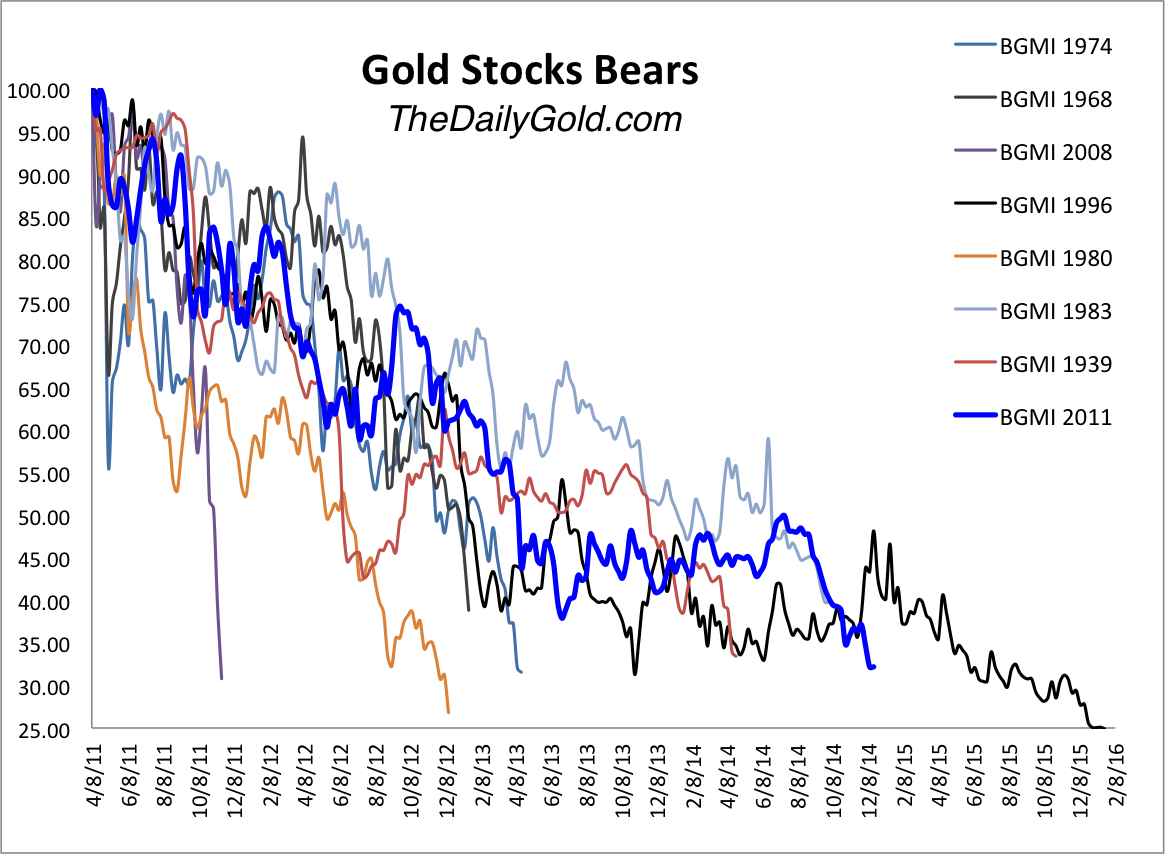

Gold Mining Stock Bear Market Comparisons

Update from Jordan Roy-Byrne comparing Barron's Gold Mining Index Bear Markets. Only the 1996 bear was longer in duration. The 1996 timing analogue might point to a bounce but that came after a base not the recent plunge we have seen.

Friday, 26 December 2014

Gold, Silver and Mining Stock Picks for 2015

Following on from 2014 Picks and 2013 Picks

Published stock picks for 2015 - Harder to find mining rec's this year. I shall update with more identified

Published stock picks for 2015 - Harder to find mining rec's this year. I shall update with more identified

- Raymond James - Denison Mines, Lundin Mining, Detour Gold

- Morgan Stanley International Mining Tips - New Boliden, Alrosa, Fresnillo, RioTinto, BHP Billiton, Nori'lskiy

- Zack's via Barchart - Allied Nevada, Banro

- The Australian - Tim Blue - (&write ups) - Berkeley Resources ( Uranium), Paringa Resources (Coal), Gold Road, Independence Group, Doray Minerals, Rox Resources, Crusader Rescurces, Duketon Mining, Western Areas, Cassini Resources, Sirius Resources, BHP

- Hard Asset Investments - (plus part 2 top 5) on Seeking Alpha - True Gold Mining, Alacer, B2 Gold, Klondex, Dynacor Gold, Callinan Royalties, Iamgold, Sandstorm, Rubicon, Richmont Silvers - Fortuna Silver, Silver Wheaton, Avino Silver, Silvercrest, First Majestic,

- Nick Hodge - Outsider Club - Fission Uranium

- Outsider Club - Part 1 - Bear Creek, Atac, Pilot Gold, Columbus Gold - Part 2 Lydian, B2 Gold, Elorado, Agnico Eagle

- Radomski - Top5 short / long term

- Ledbed - Wildcat Silver, Calibre, Pershing Gold

Stock Picking Contests

- Silicon Investor - Discussion - Spreadsheet 2015 - Spreadsheet 2014

Value Investing Links

Value Walk's "Timeless Reading" long list of reading

The Gold Miners' question is timing to find value - by value money managers - or value traps

The Gold Miners' question is timing to find value - by value money managers - or value traps

London Mines & Money Presentations

Various Presentations - HERE Including

Evy Hambro (Blakrock) and Mark Bristow of Randgold (embedded below)

Wednesday, 24 December 2014

Wednesday, 17 December 2014

Commodities Outlook 2015 - Deutsche Bank

HT IKN - Deutsche Bank's 140pp report across commodity sectors. Including many cost curves

Friday, 12 December 2014

Scotiabank Mining Conference 2014 - Webcasts

Scotiabank's mining conference was held on 2/3rd December.

Various discussions of gold price direction Mineweb ( what's in store for gold webcast below)

Webcasts Here - (change index numbers)

Various discussions of gold price direction Mineweb ( what's in store for gold webcast below)

Webcasts Here - (change index numbers)

- Precious Metal Miners - at an Inflection Point - Golden Star, Kirkland Lake, Teranga, Timmins Gold

- Thrill of the Hunt active in M&A - Primero, Goldfields, US Silver & Gold, B2 Gold

- Finding Hidden Value in Canadian Gold - Iamgold, Aurico, New Gold

- Mine builders - done it before doing it again - Rio Alto, Argonaut , Ivanhoe, TMac

- Leveraging Flagship Assets into Growth - Mandalay, Centerra, Dundee PM

- What's in Store for Gold in 2015 - Rob McEwen, WGC

- First Gold in 2015 - Emerging Gold Producers in 2015 - Rubicon, Guyana Gold, Asanko, True Gold, Mark O'Dea, Torex Gold

- Promising Metals Projects in a Capital Constrained Environment - Premier Gold, MAG Silver, Lydian, Pretium, Reservoir Minerals

- Gold Projects in the Pipeline - Alacer, Dalradian, plus

- Advancing New Discoveries - Orca, Pilot Gold, Probe Mines, Newstrike, Roxgold

- Star Projects - The next Royalty Generators - Virginia, Osisko, Altius

- Growing off a Silver Base - Endeavour Silver, Silver Standard, Tahoe, Silvercrest

- Comeback of the Diamond Miners

- Uranium

- Zincs Time to Shine

- What's next for Nickel

- The next generation of BC Copper Mines

- Singing Peru's Praises - BVN, Bear Creek, Pan American Silver

- Manageable Mega Projects in the Americas - Novagold, Nevada Copper, Alderon

- Franco Nevada

- Silver Wheaton - Randy Smallwood

- Agnico Eagle

- Eldorado

- New Gold - Randall Oliphant

- Yamana

- Detour Gold

Notes from London Mines & Money Conference

At CEOca

The mood was much more upbeat than I expected. However, the prevailing sentiment in the conference was that there’s more pain to come. The good news is that the cream should start to rise to the top allowing for the best management teams to get funded.

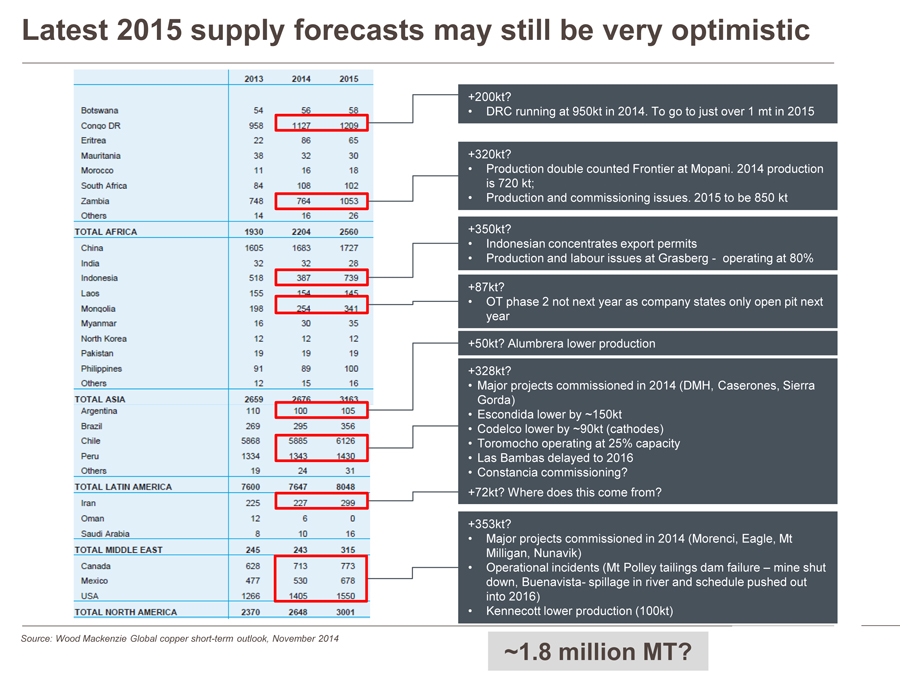

Copper Surplus or Deficit

Glencore depend on copper for almost 40% of earnings.

Ivan Glasenberg has been extremely critical of miners raising production levels - although bidding for Rio.

Here Glencore challenge coper supply growth assumptions.

Ivan Glasenberg has been extremely critical of miners raising production levels - although bidding for Rio.

Here Glencore challenge coper supply growth assumptions.

Thursday, 11 December 2014

Mining Investment Risk - Trust of NI 43-101

Another HT IKN

Discussion of reporting standards and mining management behaviour HERE

Discussion of reporting standards and mining management behaviour HERE

Wednesday, 10 December 2014

Peter Brandt - Six Chart Reasons Silver has probably bottomed - Technical Target $26

Peter Brandt discusses

Imagine, good miners operating with silver heading to $26 and hope for more instead of $15 expecting less. With energy costs heading to half 2011 levels, local currencies and labour costs 20% down. Capital costs in a market where most metals and energy markets are giving consultants cause to worry about their next paycheck. And everyone has their stink bids in for tax loss selling.

Imagine, good miners operating with silver heading to $26 and hope for more instead of $15 expecting less. With energy costs heading to half 2011 levels, local currencies and labour costs 20% down. Capital costs in a market where most metals and energy markets are giving consultants cause to worry about their next paycheck. And everyone has their stink bids in for tax loss selling.

Larger Players account for 40% of Exploration Expenditure - SNL

Report from SNL

IKN's take on the positive implications for selected juniorsThe top three explorers in 2014 include one copper producer (Antofagasta), a diversified major (Vale), and a major preciousmetal producer (Fresnillo)

Long story short what I'm pointing to is nothing more nor less than the revaluation of mineral assets. Now we're at near-zero, up has more chances than down, right? Well, I don't know if I'm right, but a big fat clue would be if some major or even Tier 2 goldie started running with that plan (AEM, perhaps?). If so, it'd be the time to position again into what you believed to be great rocks at low prices before the real money gets there.

Mining M&A to Double as Market Elements Align - Grant Thornton

Summary Full PDF

Gathering Momentum, the new report, attributes the resurgence of M&A to the confluence of four main factors, identified through feedback from over 250 senior mining executives globally. The first is that with one-in-ten junior miners likely to enter administration and a quarter of major mining companies anticipating challenges with financial covenants, the market can expect significant quantities of distressed assets and low valuations. There is also a ripe environment for matchmaking, with a third of executives at mining companies stating that they are likely to make an acquisition (35% junior and 32% major) and approximately the same amount showing an appetite for selling - believing that their company will either be sold or undergo a partial sale (36% junior and 27% major/other). Furthermore, lower commodity prices are identified by the report as a driver for M&A; pushing companies to band together to generate scale and lower productions costs in order to remain competitive.

Sunday, 7 December 2014

The US Dollar - Reserve Currency Burden / Debt Risks

The rise of the US Dollar is clear to any commodity investor as prices fall. The "goldbug narrative" of a collapse in the Dollar looks increasingly unlikely..... more ......

Sprott's Rick Rule interview with Tekoa Da Silva - On Speculative Profits

Widely linked around the blogs already this is an excellent interview with Rick Rule picking up on many repeated themes and more. The transcript (on the link above) is pretty complete but listening to the interview is worthwhile and probably more worthwhile in a few years time in any improved market. Some more notes below......

Gold Miners' Production Costs - Dundee - Plus cost build ups and drivers.

Dundee research at CEO - comparing costs across their covered miners.

I have appended a chart from Goldcorp's presentations showing fuel/power and labour/contractor costs across their various operations.

These costs make up ~50% of operating costs and impact both operating costs and sustaining capex. If gold can stabilise in US$ terms then the "real price" of gold against operating costs can increase which should be a key driver for the miners .....more....

I have appended a chart from Goldcorp's presentations showing fuel/power and labour/contractor costs across their various operations.

These costs make up ~50% of operating costs and impact both operating costs and sustaining capex. If gold can stabilise in US$ terms then the "real price" of gold against operating costs can increase which should be a key driver for the miners .....more....

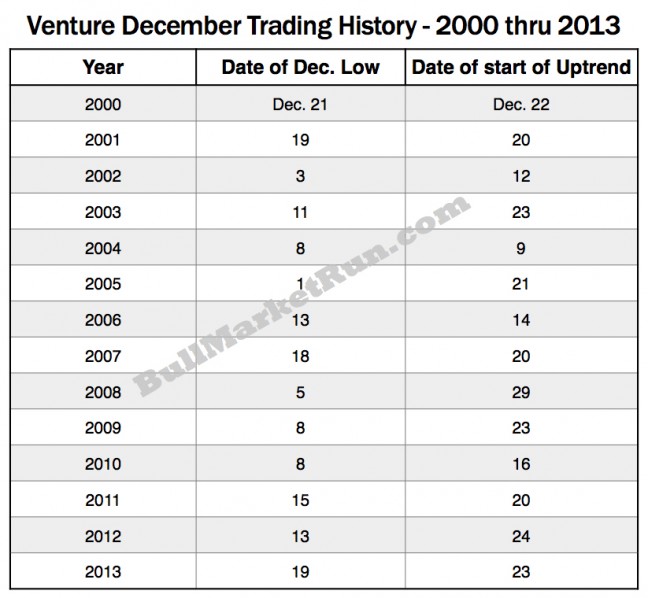

Canadian Venture Seasonality - December Lows and Uptrends

Bullmarketrun have a focus on the Canadian Venture market and speculative issues, here they review historical December lows and uptrends during the final throes of tax loss selling.

Friday, 5 December 2014

Why Central Banks buy Equities - Armstrong

Martin Armstrong continues to anticipate a Euro crisis driving funds towards the dollar, and the dollar assets of preference may be equities.

Wednesday, 3 December 2014

Tuesday, 2 December 2014

Junior Gold & Silver M&A - Coeur D'Alene in talks with Paramount Silver & Gold

(Update 17th Dec - Official Bid Confirmed at $146m )

Initial reporting from 'sources' at Reuters.

Initial reporting from 'sources' at Reuters.

Silver/gold producer Coeur with operations in Mexico, the US & Bolivia in talks with Paramount who have Silver projects in Mexico including San Miguel's 350,000 acres around Coeur's operations which may extend Palmajero's life by 7 years. Paramount's other assets including the Sleeper gold project in Nevada could be spun out.

Black Friday & Manic Monday in Gold & Commodities

Very unusual action between the OPEC meeting and Swiss gold vote.

From Mike Shedlock

Commentary at Acting Man

From Mike Shedlock

Commentary at Acting Man

we also mention last week’s capitulation in the crude oil market as an influencing factor. In fact, it is hard to tell what had more of an effect on the gold price, in spite of the fact that crude oil has very little to do with gold. These are after all two completely different markets, but there are a few ways in which they are linked. The first link is monetary inflation and its effects on prices and currency exchange rates. Rising US inflation expectations, which usually coincide with expectations of looser monetary policy........The second link between oil and gold prices is through investment funds that are focused on commodities. If they are forced to sell one major commodity (due to redemptions or margin calls), they often have to sell other commodities as well.......In fact, the sharp decline in crude oil prices mainly affects the profit margins of gold mining companies, since energy is one of their major input costs (crude oil has declined rather noticeably against gold in recent weeks). Gold mining margins should continue to improveShort Side of Long....on the Gold:Silver ratio

Sunday, 30 November 2014

Randgold & Acacia (African Barrick) Look to African Gold Aquisitions

Article at Bloomberg

“If you’re looking for producing assets, they’ve never been cheaper,” said Brad Gordon, head of African Barrick Gold Plc, just renamed Acacia Mining Plc. “Now is the time to be contrarian and pick up some of the best ground in Africa.”.........Acacia’s chief executive officer isn’t the only one on the prowl. Randgold CEO Mark Bristow said last week his company had a war chest of more than $500 million to spend on deals, a figure Gordon said Acacia could match for the right asset.

Diamond Miners & Exploration

The diamond market is notoriously opaque with very specialised skills and knowledge to provide valuations of non-standard stones and the DeBeers cartel controlling pricing until 2000.....more

Gold: a 6000 year old bubble revisited - Willem Buiter of Citigroup in full

Citigroup economist, former Bank of England, Willem Buiter's provocative Gold article just ahead of the Swiss Gold referendum.

Discussed here by Ambrose Evans Pritchard with link to Buiter's Full Paper

Further discussion by Izabella Kaminska at the FT

Discussed here by Ambrose Evans Pritchard with link to Buiter's Full Paper

Further discussion by Izabella Kaminska at the FT

Tuesday, 25 November 2014

Sunday, 23 November 2014

Gold Mining Hedge Book

Dominic Frisby considers gold miners' production hedging at Moneyweek.

If the global hedge-book is rebuilt that hedging will see sales into the futures market.

If producers are un-hedged collapsing prices would see very large losses in the industry which could reduce mine supply, though with such large above ground stock many would suggest that mine supply is not significant for gold pricing.

If the global hedge-book is rebuilt that hedging will see sales into the futures market.

If producers are un-hedged collapsing prices would see very large losses in the industry which could reduce mine supply, though with such large above ground stock many would suggest that mine supply is not significant for gold pricing.

Saturday, 22 November 2014

Comparing Canadian Venture Market Corrections - Canaccord

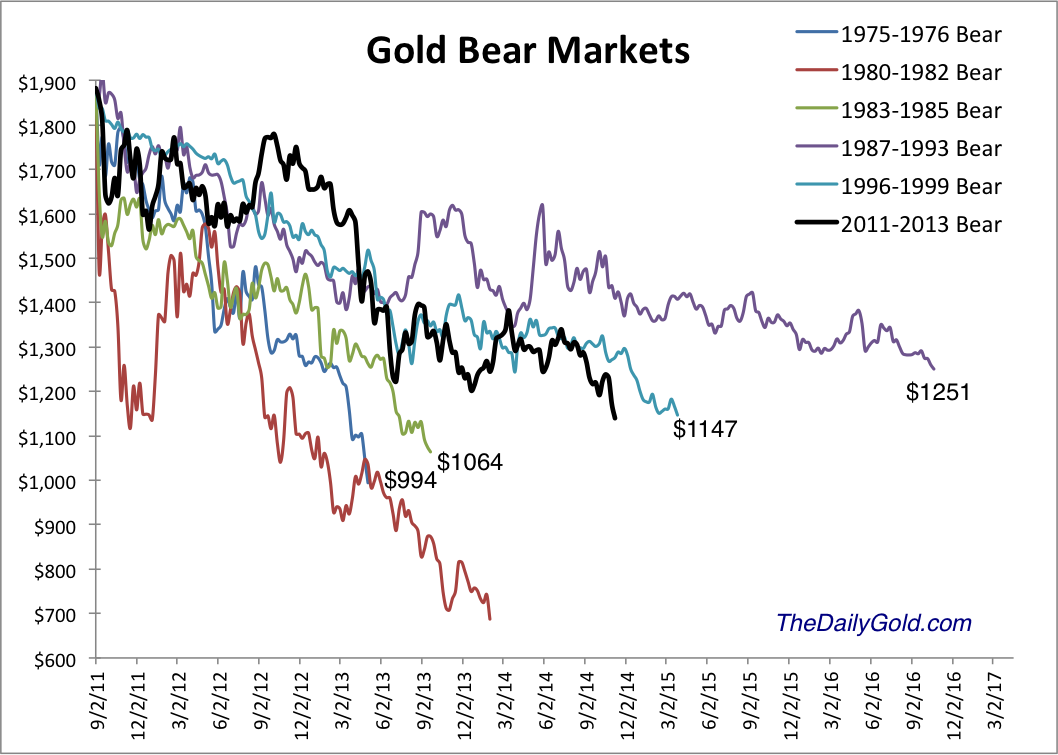

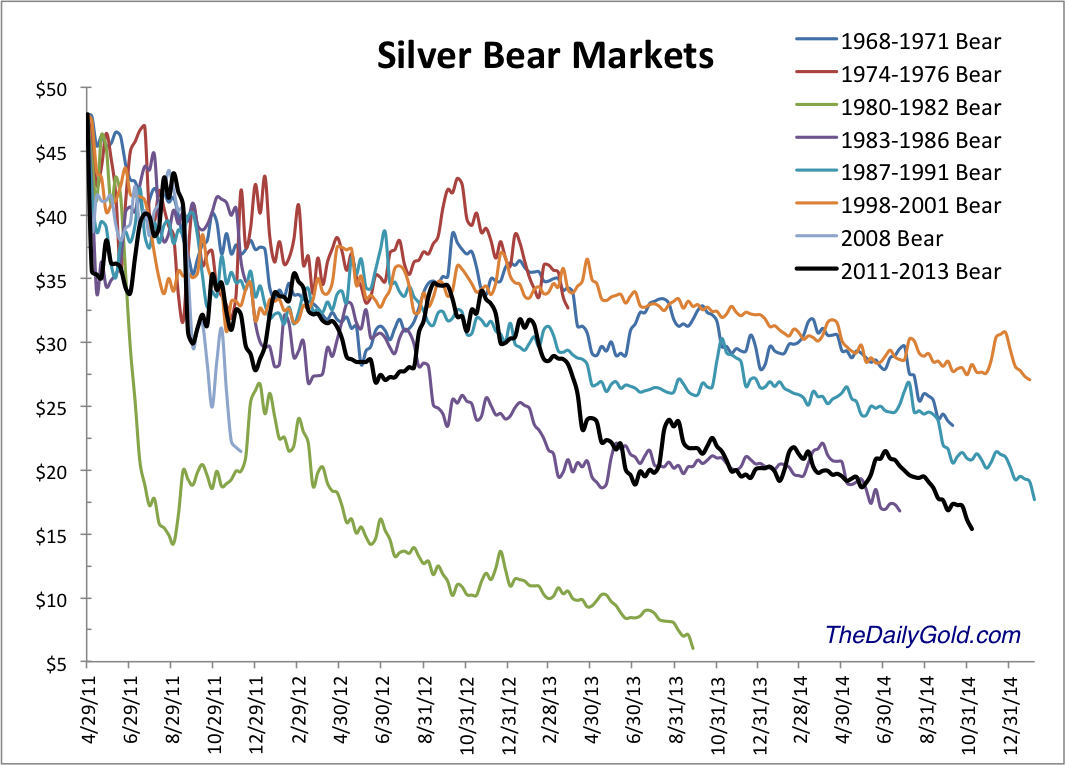

US Global Investors Weekly Report notes Canaccord's comparisons of Canadian Venture crashes over the years. The current bear is near the longest in time, though actually down less than many in %. This compares with Jordan Roy Byrne's tracking of the gold and silver bears.

And the long term charts from stockwatch

And the long term charts from stockwatch

Thursday, 20 November 2014

Hugh Hendry - Learning to Love the Central Banks

Well known bear turns believer in the power of Central Banks Interview at Moneyweek

... and part 2 and part 3

... and part 2 and part 3

Today, I question the relevancy of that disaster insurance. In a world where the central banks seem to have your back, seem to be underwriting risks and global asset prices, do you require that intense scrutiny of risk?........I was at a conference with some of the great and the good global macro managers in September in New York and I asked them all the question, “If the S&P is down 12% what do you do? Are you selling more or are you buying?” Guess what? They’re all buying. So the central banks have created a behavioural tic which is becoming self-reinforcing and I believe we saw another manifestation of that behaviour in October.

Wednesday, 19 November 2014

Monday, 17 November 2014

Junior Gold M&A - Carlisle Goldfields - Interest from Aurico and Nordgold

The last I read of Carlisle Goldfields was in this report from Paradigm Capital and the stock proceeded to halve shortly afterwards. Last week Carlisle rebounded on two corporate moves with Aurico looking to take a near 20% stake and a subsequent offer for the company from Russian backed Nordgold.

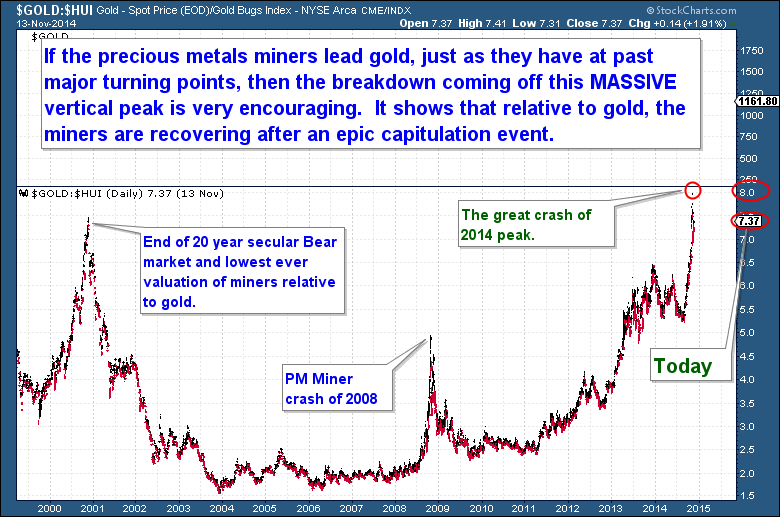

Extreme Gold:Hui Ratio

Bob Loukas at the Financial Tap discusses the current position of the miners and includes a long term chart of the gold price:gold miners ratio, reminding us of the extremes reached during the recent sell off. Of course the ratio may mean revert two ways, with a recovery in the miners or as the gold price breaks lower whilst the miners fall less or stabilise. Indeed a recovery for the precious metals sector "should" expect the miners to lead the metal.

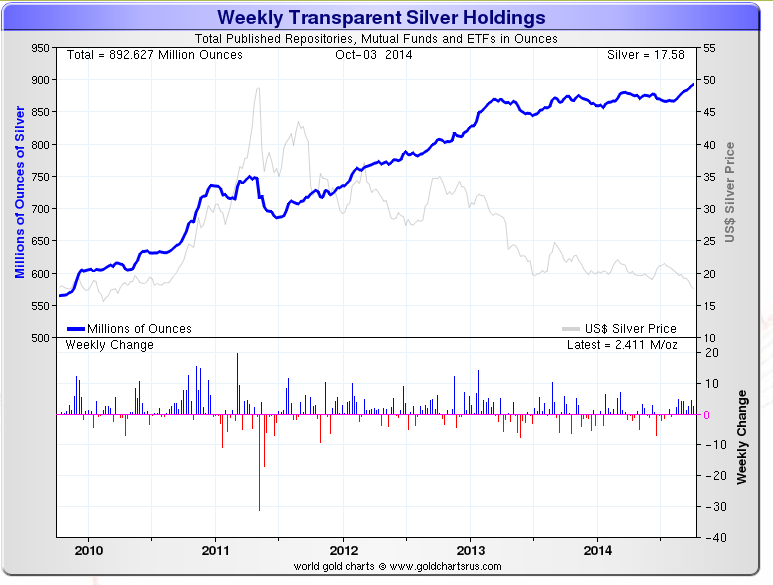

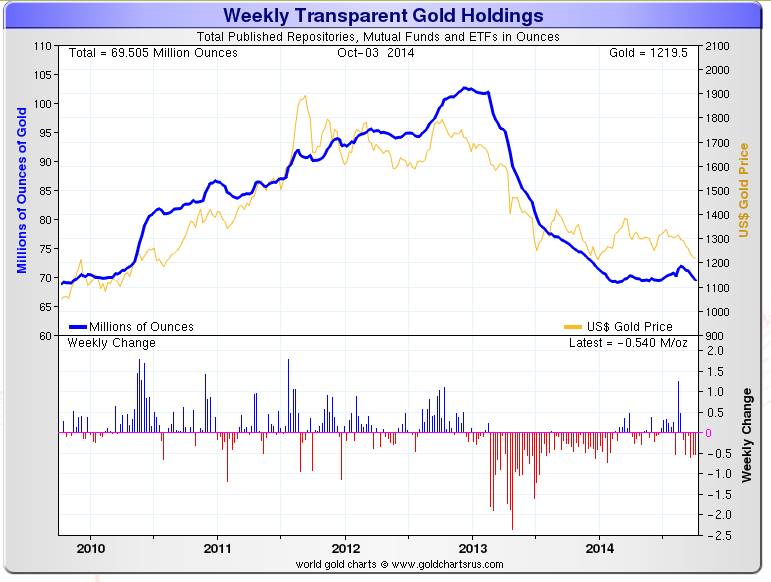

Gold & Silver ETF Holdings vs Price

Trader Dan Norcini has often pointed to the holdings of the Gold ETF being a clear indicator for Western investor sentiment towards the metal as holdings rose and fell with price.

Yet we see the opposite in silver, which is either yet to see an enormous unwinding or remains a relatively low value market holding, perhaps seen as an effective "leveraged" hedge?

892m oz of silver is worth approx $14bn - over 1 year mine supply ~ 800m oz

69m oz of gold is worth approx $80bn - below 1 year mine supply ~ 90m oz

Silver is seen as the more speculative metal and yet has seen increased holdings during this bear phase in the precious metals.

Saturday, 15 November 2014

Peter Brandt - Gold Blow off Bottom ?

Brandt suggesting possible end to the 3 year bear market in precious metals with a blow off bottom...........more

Wednesday, 12 November 2014

Gold Stock Rankings

Early September saw the Denver Gold Show and Precious Metals Summit, and the beginning of a sustained period of weakness in the mining stocks.

At the time I published a watchlist of all the stocks presenting (this and a number of other watchlists and stocklists are under the "companies" heading on the left sidebar of the blog)

There were just over 200 companies making it to one or both shows.

The far right of the listing tracked long term performance against a 10th September base date.

Here is a ranking of performances since then also showing daily performance last Friday 7th November on the day the GDX reported the highest ever volume.

Also showing relative positioning to 52 week highs and lows.

Click the arrow to expand or right click to open a new tab and zoom in.

Please note that Market Caps are in quote currencies, so it is not quite right to add up as I have done and as ever always double check the data as sometimes google finance returns some odd data.

At the time I published a watchlist of all the stocks presenting (this and a number of other watchlists and stocklists are under the "companies" heading on the left sidebar of the blog)

There were just over 200 companies making it to one or both shows.

The far right of the listing tracked long term performance against a 10th September base date.

Here is a ranking of performances since then also showing daily performance last Friday 7th November on the day the GDX reported the highest ever volume.

Also showing relative positioning to 52 week highs and lows.

Click the arrow to expand or right click to open a new tab and zoom in.

Please note that Market Caps are in quote currencies, so it is not quite right to add up as I have done and as ever always double check the data as sometimes google finance returns some odd data.

Junior Gold M&A : Central Rand Gold $150m offer from Hiria Group / Marsa

Central Rand shares soared over 400% as a bid came from an unlikely buyer, financial leasing and iron/nickel mining group Marsa.

Central Rand moved back into production, and continued losses in 2013 (FT)

The company would claim over 36 million oz of JORC inferred / indicated gold in old South African mining leases.

I can only imagine that this is not expected to be economic near term, but perhaps a bet on optionality over long term gold prices and mining technology / robotics moving deeper underground?

Central Rand moved back into production, and continued losses in 2013 (FT)

The company would claim over 36 million oz of JORC inferred / indicated gold in old South African mining leases.

I can only imagine that this is not expected to be economic near term, but perhaps a bet on optionality over long term gold prices and mining technology / robotics moving deeper underground?

Tuesday, 11 November 2014

Martin Armstrong on Gold Suppression - Bond Bear Market - Stock Bull

Discussion of Metal price suppression -

I remain bullish long-term BECAUSE there is no such suppression. If there was, it cannot be a free market so write it off. (JGMS - Armstrong has been bearish on gold - until time/price ?anyone?)Discussing potential for very high US Stocks in a private wave moving away from Bonds

This is a question of TIME more so than price. Keep in mind that the amount of capital contained in the bond markets is at least 3 times that in equities. If we see the Bond Bubble in 2015.75, then the capital pouring out of bonds will be like the 1929 Stock Market Crash. That money will then flow outward. This is when we will see the greatest potential for a rise in equity and YES we should see the turn in all tangibles including gold..............The worst for the Sovereign Debt Crisis seems to be first shaping up in Europe. Here we have new highs but with declining energy. The divergence warns that we are in a MAJOR topping pattern.......Everything is correlating so far on time. We have the metals crashing shaking the tree to get rid of all the perpetual bulls. They just have to be devastated before you can move in the opposite direction. This is just how markets move. The stock market advance has been with historic lows in retail participation. This sets the stage for the skeptics to rush back and buy the highs. The average person

Peter Brandt on Gold - Dollar - Copper and Silver

Brandt Updates his masterly overview of gold from the 1970's to present - HERE

And discusses gold breaking down - HERE (JGMS-Miners 'should' be ahead of the metal ?)

Patterns indicating Copper collapse to $2.22 - HERE

And discusses gold breaking down - HERE (JGMS-Miners 'should' be ahead of the metal ?)

Also discussing potentially extremely bearish patterns for the Euro, and hence extremely bullish US Dollar - HEREThis pattern has a target near $970. I believe that the last of the Gold-bugs will finally throw in the towel if the market has a wash out of $1,000. While as a trader I am interested in the short side of Gold futures, as an investor I want to accumulate physical Gold on this final leg of the bear trend that started at the September 2011 high. A decisive close above 1210 on the daily chart would place the descending triangle interpretation into doubt. A decisive close above 1260 would indicate that Gold has bottomed.

Yet, history tells a far different story than a range-bound Euro. The chart below shows the Euro dating back to the early 1970s (note – the chart is adjusted to use the D-Mark as a proxy for the Euro prior to 1999.) As this chart shows, the Euro is far from oversold. The decline from 1.4000 since May is not particularly spectacular from historic measures. However, a decline to 90 cents would be something special........ Remember, charts represent possibilities, not probabilities and definitely not predictions

Patterns indicating Copper collapse to $2.22 - HERE

Support has been uncovered at and just below the $3.00 level repeatedly since 2011. However, each successive price recovery has been weaker and weaker. A decisive close below 2.92 and then 2.87 would complete this chart pattern and establish a price target of 2.22. Only well funded traders should engage this market. The Copper market is known for high volatility.

Greenspan Opines on Gold - Council on Foreign Relations with FT's Gillian Tett

As central banks look to up the battle against deflation will gold be used to signal inflation?

Greenspan: Is gold currently a good investment - yes, in this case I didn't equivocate........"Gold is a Currency" it is still the premier currency, no currency including the dollar can match it.......it is half commodity, when an economy is weakening it goes down like copper, gold is an intrinsic currency.......Why do central banks put reserves into an asset with no rate of return and a cost of storage?

Comparing Gold & Silver Bear Markets

Jordan Roy Byrne continues to track comparable bears as a function of time and price.

Silver’s bear began five months before Gold’s and the bear analog below makes a strong case that the current bear will end very soon. Other than the epic collapse from 1980-1982, the current bear is the worst ever for Silver in terms of price and is the third worst in terms of time.

Sunday, 2 November 2014

Saturday, 1 November 2014

PWC - Junior Mine 2014

Junior Mining Report 2014 from PWC In Full

Analysis of the top 100 venture miners as of 30th June - Capitalisations have changed some since! Moreover the overall venture has collapsed with Oil and energy companies which had become a large part of the venture index.

Summary balance sheets and P&L for the Top 100 Companies.

Analysis of the top 100 venture miners as of 30th June - Capitalisations have changed some since! Moreover the overall venture has collapsed with Oil and energy companies which had become a large part of the venture index.

Summary balance sheets and P&L for the Top 100 Companies.

Wednesday, 22 October 2014

Gold M&A - Lundin Gold - Fortress to acquire Fruta Del Norte Gold project from Kinross

The Lundin family are buying .

Having paid $1.8bn to take control of the Candelaria Copper mining complex in Chile from Freeport McMoran, subsequently streaming the precious metals for financing, the Lundins are now buying what some consider the best Gold discovery of the last decade from Kinross (who bought out the Fruta Del Norte project from Aurelian) for only $240m.

(Longer release)

The mark down from Kinross' price of $1.2bn reflects the inability to agree a commercial mining regime with Ecuador, in particular a 70% windfall tax.

Ross Beaty also recently invested in Ecuador, in Odin mining.

Can Ecuador work with the new miners?

As pointed out by IKN why explore and develop when productive and advanced assets are for sale.

Having paid $1.8bn to take control of the Candelaria Copper mining complex in Chile from Freeport McMoran, subsequently streaming the precious metals for financing, the Lundins are now buying what some consider the best Gold discovery of the last decade from Kinross (who bought out the Fruta Del Norte project from Aurelian) for only $240m.

(Longer release)

The mark down from Kinross' price of $1.2bn reflects the inability to agree a commercial mining regime with Ecuador, in particular a 70% windfall tax.

Ross Beaty also recently invested in Ecuador, in Odin mining.

Can Ecuador work with the new miners?

As pointed out by IKN why explore and develop when productive and advanced assets are for sale.

Sunday, 12 October 2014

Junior Gold Mining M&A - Semafo Propose Acquisition of Orbis Gold

Semafo are bidding around AU$150m for Aussie Listed Orbis and their Natougou high grade gold project in Burkina Faso.

Orbis had recently seen a $20m partnership proposal with Greenstone Resources LP Private Equity run by Michael Haworth ex JP Morgan and Mark Sawyer ex Xstrata and Rio Tinto.

Orbis had recently seen a $20m partnership proposal with Greenstone Resources LP Private Equity run by Michael Haworth ex JP Morgan and Mark Sawyer ex Xstrata and Rio Tinto.

Tuesday, 7 October 2014

Brent Cook - Insight on Junior Gold Market

Podcast at The Northern Miner - (free month subscriptions at Northern Miner)

Monday, 6 October 2014

Wednesday, 1 October 2014

Golden Rule - Alan Greenspan on Chinese Gold Buying - Foreign Affairs

Not the usual goldbug crowd, but former Fed Chairman Alan Greenspan writing in the influential Foreign Affairs.

Whilst the gold price is currently weak, the facts of continued central bank ownership of gold and recent accumulation, in particular by China, continue to intrigue

Whilst the gold price is currently weak, the facts of continued central bank ownership of gold and recent accumulation, in particular by China, continue to intrigue

If China were to convert a relatively modest part of its $4 trillion foreign exchange reserves into gold, the country’s currency could take on unexpected strength in today’s international financial system.

If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to hold any gold. The fact that they do indicates that such currencies are not a universal substitute.What is not really discussed is why China would seek a stronger currency at a time we are seeing competitive global currency devaluations, with Japan and the Eurozone following the US to QE and

Wednesday, 24 September 2014

Carl Swenlin - Watch Gold

Decision Point founder and technical analyst Carl Swenlin notes key weekly chart for Gold.

Commodity Bust in Slow Motion - (Including Copper and Iron Cost Curves 2013-2018) - Handelsbanken

Handelsbanken Report - Dating from May 2014.

They appear to have been spot on regarding Iron Ore so far to $80/T.

Project copper to $5500/T or $2.50/lb......much more.....

They appear to have been spot on regarding Iron Ore so far to $80/T.

Project copper to $5500/T or $2.50/lb......much more.....

Monday, 22 September 2014

Sunday, 21 September 2014

Richard Schodde - Minex Consulting - Junior Exploration Reports

New presentations from Richard Schodde at Minex Consulting reviewing junior discovery performances. Well worth a full read, a few highlights below.

Optimisation of Mining NPV - Whittle Consulting at Denver Gold Show

The gold mining industry has come through a period of rising prices, until 2011, where the focus has been to identify the greatest ounces in the ground resources and see leverage to the gold price by developing marginal projects. Production ounces, resource ounces and growth prospects were highly valued by the market. Much work has gone into taking old uneconomic deposits and redeveloping them as they appear to work at higher prices.

As Rick Rule recently discussed this has left a marginal industry.......more ......

As Rick Rule recently discussed this has left a marginal industry.......more ......

Thursday, 18 September 2014

Martin Armstrong Interview

Armstrong blogs prolifically offering cycles and inter-market perspectives.

Long Interview and discussion of markets including the US Dollar and Gold

Armstrong has targets below $1000 for gold as capital flows continue to US$ assets.

New precious metals report is due to identify timing and more.

The miners and the juniors often move ahead of the metal, but gold below $1000 would likely kill much of the sector.

Long Interview and discussion of markets including the US Dollar and Gold

Armstrong has targets below $1000 for gold as capital flows continue to US$ assets.

New precious metals report is due to identify timing and more.

The miners and the juniors often move ahead of the metal, but gold below $1000 would likely kill much of the sector.

Junior Gold M&A - Mariana Resources bid for Aegean Metals

Very junior bid from S.American explorer Mariana for Aegean focussed on the Tethyan belt in Turkey near Alamos and Pilot Gold.

Smallcap £11m London Aim listed Mariana was recently able to raise up to $6m from New York based Bergen Global Opportunity fund.

Anglogold have an 11% holding in Mariana while Teck are backing into 51% of Aegean's Ergama project in Turkey and a Turkish producer Lidya Mining (Alacer partner in Turkey) earning into a second project Hot Maden. (Lidya Mining)

Smallcap £11m London Aim listed Mariana was recently able to raise up to $6m from New York based Bergen Global Opportunity fund.

Anglogold have an 11% holding in Mariana while Teck are backing into 51% of Aegean's Ergama project in Turkey and a Turkish producer Lidya Mining (Alacer partner in Turkey) earning into a second project Hot Maden. (Lidya Mining)

Sunday, 14 September 2014

Saturday, 13 September 2014

Gold M&A - Fresnillo Buyout Newmont's Penmont Stake in Mexico

Fresnillo will move closer towards being a balanced Silver and Gold producer with their $450m buyout of Newmont from their Penmont business in Mexico.

Once its gets full control of the joint venture Fresnillo will have an annualised production capacity of around 600,000-620,000 ounces of gold before ramping up to 750,000 ounces by 2018. The latter target could be raised further once the board approves development of the Mega Centauro and Centauro Deep projects, a spokesman said. Fresnillo operates three other mines in Mexico and expects to produce 43 million ounces of silver this year. Fresnillo is considering hedging part of the extra gold production it will get through the acquisition.

The End of the Iron Age - Goldman Sachs

Goldman has a well reported note out on Iron ore where prices have been tumbling.

Rio Tinto and BHP are aggressively expanding capacity while demand has cooled. The steep cost

Rio Tinto and BHP are aggressively expanding capacity while demand has cooled. The steep cost

OT - Ramsbottom Bury Black Pudding Throwing World Championships

The second Sunday in September, of course, sees Ramsbottom, Lancashire, (currently still part of the United Kingdom) host the Black Pudding Throwing World Championships.

Thursday, 11 September 2014

Denver Gold and Precious Metal Summit Companies Watchlist 2014

Stock watchlists for all the exhibitors at the Denver Gold Show and Precious Metals Summit are below the break.

Flagged D / P / D+P for shows attended.

Scrolling to the right should show performance fixed against base 10th September 2014

Flagged D / P / D+P for shows attended.

Scrolling to the right should show performance fixed against base 10th September 2014

Tuesday, 9 September 2014

Global Gold Development Projects - IRR vs Cash Costs

Comparison of non-fully financed gold projects owned by non-cash flowing companies, from Red Eagle presentation basis National Bank Financial.

IRRs are recalculated to a common $1300 gold price. Clearly cash cost estimates will be dependent on levels of accuracy / conservatism in economic studies with differing levels of confidence through scoping to feasibility.

List of projects and study levels, including most of those below and others, HERE on the blog

IRRs are recalculated to a common $1300 gold price. Clearly cash cost estimates will be dependent on levels of accuracy / conservatism in economic studies with differing levels of confidence through scoping to feasibility.

List of projects and study levels, including most of those below and others, HERE on the blog

Denver Gold Show & Precious Metals Summit

Two of the biggest precious metals conferences are in Colarado, over the next two weeks, this week at the Precious Metal Summit and next week at the more institutional Denver Gold Show.

Company attendances look high - see companies links below.

Webcasts will be available following the conferences. many companies have their presentations up on websites before the conferences.

Denver Gold Companies

Webcasts

Precious Metals Summit Companies

Webcasts

Company attendances look high - see companies links below.

Webcasts will be available following the conferences. many companies have their presentations up on websites before the conferences.

Denver Gold Companies

Webcasts

Precious Metals Summit Companies

Webcasts

Monday, 8 September 2014

Junior Gold M&A - Agnico Eagle bid for Cayden Resources

Having recently teamed up with Yamana to buy out producer Osisko, Agnico are bidding for relatively early stage explorer Cayden Resources for $205m (approx $3.79/share - not on chart below).

Cayden's stock has been well supported for some time following high grade, near surface, discoveries at El Barqueno in Jaliso, Mexico, but the buyout is well ahead of defined mineral reserves and economic studies.

Management are large holders and support the bid so presumably have taken a view that this is not the environment to seek to add further value above $200m through continued financing for exploration success.

Morelos Sur in Guerrero is proximate to an increasingly active area with Goldcorp's Los Filos mine and developments, Torex's large advanced projects and Osisko Royalties large exploration package.

Cayden's stock has been well supported for some time following high grade, near surface, discoveries at El Barqueno in Jaliso, Mexico, but the buyout is well ahead of defined mineral reserves and economic studies.

Management are large holders and support the bid so presumably have taken a view that this is not the environment to seek to add further value above $200m through continued financing for exploration success.

Morelos Sur in Guerrero is proximate to an increasingly active area with Goldcorp's Los Filos mine and developments, Torex's large advanced projects and Osisko Royalties large exploration package.

Peter Brandt - Factor Update 7th Sept 14

Full Trading Report - noting Gold and Silver risks and many other markets.

Saturday, 6 September 2014

Bank of America / Merrill Lynch - 20th Annual Canada Mining Conference 2014 - & Gold Cost Curves / Breakdowns

Major mining conference in Toronto last week.

Register once to watch - not found a list of all presenters ?

- no doubt many more companies linking presentations and webcasts from their websites.

Register once to watch - not found a list of all presenters ?

- no doubt many more companies linking presentations and webcasts from their websites.

- Goldcorp - showing the strong growth profile and cost control that has supported their stock - also note nil capex after this year, although have Camino PFS due, and low debt. Having missed out on Osisko surely in the market for some big M&A. Torex proximate to Los Filos and Rubicon in Red Lake?

- Barrick

- Royal Gold / Silver Wheaton / Franco Nevada

- Agnico Eagle

- McEwen

Gold Industry AISC - All in Sustaining Cost Curves - From Goldcorp's presentation...

Goldcorp's Cost breakdowns by region

Presumably the big differences in labour, fuel and power costs relate to open pit and underground operations aswell as pay rates in Canada vs Mexico

International Copper Study Group - World Copper Factbook 2013

World Copper Factbook 2013

Home & Monthly Updates

(Sell forecast mines and supply capacity data)

Many "large low grade" gold deposits come with considerable copper. Seabridge's KSM deposit for example has seen recent exploration highlighting more copper than gold. Potentially major base metals miners and PM streamers become involved in these projects as for example Thompson Creek and Royal Gold at Mt Milligan.

John Kaiser reviews various issues including Copper project pipeline and cost curve

Home & Monthly Updates

(Sell forecast mines and supply capacity data)

Many "large low grade" gold deposits come with considerable copper. Seabridge's KSM deposit for example has seen recent exploration highlighting more copper than gold. Potentially major base metals miners and PM streamers become involved in these projects as for example Thompson Creek and Royal Gold at Mt Milligan.

John Kaiser reviews various issues including Copper project pipeline and cost curve

Thursday, 4 September 2014

Africa Down Under Conference - Sept 2014

The African continent is endowed with enormous mineral wealth but many countries continue to be seen as high risk regimes. During the last run for gold mining stocks, into 2011, many Aussie companies targeted West Africa and have now collapsed from bubble valuations while quality deposits were discovered and developed.

B2 Gold has made 2 recent African acquisitions, Volta in Burkina Faso and Papillon in Mali.

Africa Down Under Conference

Recent discussion of African Mining and discovery potential with Sprott's Chief Geologist, Andy Jackson

B2 Gold has made 2 recent African acquisitions, Volta in Burkina Faso and Papillon in Mali.

Africa Down Under Conference

Recent discussion of African Mining and discovery potential with Sprott's Chief Geologist, Andy Jackson

Tuesday, 2 September 2014

Junior Gold M&A - Atlantic Gold acquires Acadian from Liongold

Spur Ventures had a phosphate project in China and sat on cash and short term investments over $20m for the past 5 years as their project didn't progress.

Clearly cash is a rarity on junior balance sheets so Spur recently merged with Aussie listed Atlantic Gold who in turn have very slowly progressed a gold project in Nova Scotia. Today Atlantic announced a further acquisition of neighbouring properties, buying Acadian Mining from Singapore listed Liongold who in turn only purchased in October 2013 just after suffering a huge flash-crash in their stock from $1.56 to 20c, now trading at 6c. Atlantic's presentation declares further acquisitive intent.

Clearly cash is a rarity on junior balance sheets so Spur recently merged with Aussie listed Atlantic Gold who in turn have very slowly progressed a gold project in Nova Scotia. Today Atlantic announced a further acquisition of neighbouring properties, buying Acadian Mining from Singapore listed Liongold who in turn only purchased in October 2013 just after suffering a huge flash-crash in their stock from $1.56 to 20c, now trading at 6c. Atlantic's presentation declares further acquisitive intent.

Sunday, 31 August 2014

Chinese Miners Seeking $1.3bn Acquisitions

Dave Forest at Pierce Points highlights recent plans by Chinese miner Zijin to spend $1.3bn this year alone on Gold and Copper projects over 3m oz and 2bn lbs, particularly gold in Africa.

Meanwhile China Molybdenum also expressed interest in copper projects in developed countries, and countries with stable political conditions, following the example of their $820m purchase of the Australian Northparkes Copper Mine from Rio Tinto.

Meanwhile China Molybdenum also expressed interest in copper projects in developed countries, and countries with stable political conditions, following the example of their $820m purchase of the Australian Northparkes Copper Mine from Rio Tinto.

China Molybdenum’s chairman Li Chaochun was quoted by the South China Morning Post as saying, “We are bullish on copper over the long run. It is one of our investment priorities.”

Forest - Both announcements suggest that demand for quality mining projects from China is going to remain high. Both in established jurisdictions–and frontier economies such as in Africa.It will be interesting to note whether specific African jurisdictions see favour or whether good projects in more difficult regimes can be taken on with the weight of the Chinese state support where Western investors fear to tread.

Thursday, 28 August 2014

Eric Coffin Interview

Including stock discussions of Rockhaven, Constantine, Precipitate

Strategic Metals has significant holdings in these and others.(NBV focus)

Strategic Metals has significant holdings in these and others.(NBV focus)

Why Central Banks Should Give Money Directly to the People - Foreign Affairs

The influential journal Foreign Affairs floats this balloon.... or helicopter.

Governments must do better. Rather than trying to spur private-sector spending through asset purchases or interest-rate changes, central banks, such as the Fed, should hand consumers cash directly. In practice, this policy could take the form of giving central banks the ability to hand their countries’ tax-paying households a certain amount of money. The government could distribute cash equally to all households or, even better, aim for the bottom 80 percent of households in terms of income.But

Because they are more efficient, helicopter drops would require the banks to print much less money. By depositing the funds directly into millions of individual accounts -- spurring spending immediately -- central bankers wouldn’t need to print quantities of money equivalent to 20 percent of GDP. The transfers’ overall impact would depend on their so-called fiscal multiplierand fortunately

it makes no sense to worry about the solvency of central banks: after all, they can always print more money.

Wednesday, 27 August 2014

Brien Lundin Interview and Junior Stock Picks

Interview - HERE from 13:00 on download.......notes below

Tuesday, 26 August 2014

Gold Mining M&A Targets - Project Comparisons

A number of analysts are pointing to a Merger and Acquisition spree as likely to follow a gold price break out. ........more......

The State of African Mining -SNL

Presentation HERE including recent feasibility studies summary of Capex & NPV

Appears to be from recent Mining on Top -Africa conference

More Conference Presentations HERE and HERE

Appears to be from recent Mining on Top -Africa conference

More Conference Presentations HERE and HERE

Monday, 25 August 2014

Nolan Watson on Gold Streaming & Royalty Companies

Interview HERE. No mention of Brazilian mis-adventures at Colossus and Luna Gold

- With the assets, what we are looking for is robust economics. You want to ensure that the ratio of the value of the mine to CAPEX is high so that you’re not putting up a tremendous amount of capital for a small return when you do build that mine.

- We are also looking for low-cost operations, so once they do build it, the question is whether the company is going to be able to produce at below the industry average all-in cost of production.

- The third thing that we are looking for with a mine is exploration upside. We want to find situations where the mine life can double or triple.

- On the company side, what we are looking for is obviously good management teams, but other things we are looking for are capital structure and balance sheets.

- We are very sensitive to not over-stream a mine. Our goal is to ensure that their shareholders are the primary beneficiary of the cashflow of the asset. We have run into it in the past where things have been over-streamed and mining companies started losing incentive to actually extract value from the asset.

Friday, 22 August 2014

Wednesday, 20 August 2014

Pierre Lassonde on Royalties and Exploration - Interview with Sprott

Interview with Pierre Lassonde at Sprott - in full

......when we create a royalty. I’m not talking about a stream; I’m talking about a royalty -- like the GoldStrike royalty or the Detour royalty. We get a free perpetual option on the discoveries made on the land by the operators, and we get a free perpetual option on the price of gold.

we need the exploration companies to get back to making discoveries. Otherwise the whole industry, particularly the gold mining industry, is going to go very flat production-wise. Even if the gold price starts to go up, it could take five or six years before production increases in response. So there’s a real need for venture capital

So do you avoid early-stage exploration stocks? Mostly, yes – though I do have people looking for the next Hemlo, or the next Voisey’s Bay. Whoever finds one of those, the premium they get to their share price will be beyond belief, because it’s been way too long since we’ve had a really significant new discovery – a Hemlo, at like 20 million ounces of gold, or a GoldStrike, with around 40 million ounces, a Voisey’s Bay or a Diamond Fields. It’s been over 20 or 25 years since we’ve had one of those discoveries. The world is just panting for one and I think it would be helpful to bring back the risk-taking attitude that’s completely gone from that sector. But those companies I look at are 1 in a 1,000. You can look at 999 dogs before you find one. It’s very difficult.

Friday, 15 August 2014

Brent Cook - Telling Right from Wrong in Exploration

Identifying Exploration Companies

Exploration is a tough business, making a discovery is much tougher, and advancing a real deposit through the hurdles of geology, politics, and the stock market is the hardest test and is rarely successful.......We should move ‘down the food chain’ into companies with stellar, early-stage projects that have yet to be tested—a process also much easier said than done. You can always find a reason not to buy.

Friday, 8 August 2014

Thursday, 7 August 2014

Rick Rule Interview

at SmallCapPower site

- Saucer shaped recovery,no spike sell off, so no hockey stick rebound.

- Feasibility / PFS stage M&A will be first movers 50-70% gains

- Entering beginnings of discovery cycle.

- Tiny-caps with good teams will be 10-baggers later as market develops

- Risks muted. Those who survived fairly decent. Top quartile. Past success. Current endeavour in similar circumstance.

- Capital / access to capital to stay alive until tide lifts all ships

- Nobody dreams about small deposits. Rewards commensurate with risk - size.

- Gold & silver M&A this year.

- 2-3 year horizon industries in liquidation with prices below cost of production. Plat/Palladium. Uranium, Zinc, Nickel, Lead, Potash / Ag minerals. Longer horizon coal sector. First time since 2001 gold & silver reasonably priced.

- Prospect generators

- Optionality stocks - big deposits , price sensitive, very large capital. See much more upside. $40-50m caps vs $400m 3 years ago.

British Columbia Mining - Mt Polley Disaster

The catastrophic breach of the tailings dam has seen huge concern in Canada - reported with videos at IKN

Jack Caldwell at I Think Mining (see blogroll) has this from correspondents.

Jack Caldwell at I Think Mining (see blogroll) has this from correspondents.

The cost to other mining aspirants of delayed projects, additional tailings facility features, and so on is, in a sense, incalculable. As one private correspondent said to me today: “This sets mining in Canada back for at least ten years.” Another private correspondent said: “Nobody will permit a new mine in BC for at least ten years.”

Very Junior Gold M&A

Some of the smaller juniors becoming extinct through M&A in the very junior gold space over recent months. List Below

Monday, 4 August 2014

Diggers & Dealers - Australia 2014

The premier Aussie Mining event kicked off in Kalgoorlie today

Presenting Companies and Exhibitors

Review at Mining Australia

Mervyn King former governor of the Bank of England gave the opening address.

Presenting Companies and Exhibitors

Review at Mining Australia

Mervyn King former governor of the Bank of England gave the opening address.

"We need to have these changes in the world economy, supply side reforms and changes to real exchange rates in order to boost the real incomes of countries that previously had large trade surpluses, and they will need to spend that on consumption and reduce their trade surpluses."

Sunday, 3 August 2014

Marginal Producers

The marginal producers clearly offer great risks to investors during periods of metal price weakness, a number of business failures have occurred during this down-cycle. If we are entering a period of increasing prices the marginal producers who survived may offer great leverage, and sooner than the explorers or developers as they will control increasing cashflow.

Here Ravi Sood, the CEO of such a marginal producer is interviewed on Palisade Radio.

Wednesday, 30 July 2014

Brent Cook Interviewed by Daniella Cambone

Interview on Kitco

On the junior side, he thinks that it is an interesting area to look at but at the same time it is getting ‘tough.’ “There are very few [junior] companies out there now with the technical competence and cash to really advance exploration plays.” However, Cook says well-standing junior companies are the place to be because over the next two years, the majors are going to have to buy something and this is where they will be looking

Tuesday, 29 July 2014

Productivity in Mining - Ernst & Young

Report from Ernst & Young putting the case for "broad transformation" by the miners to increase productivity.

A long term re-focus is required

Monday, 28 July 2014

Eric Coffin & Rick Rule Discussion at Sprott Vancouver Resource Symposium

Discussions from Sprott Conference on Korelin.

Sprott Symposium - Includes list of Sponsor Companies

Reports on Symposium discussions

Sprott Symposium - Includes list of Sponsor Companies

Reports on Symposium discussions

- Northern Miner (free subscriptions offer)

- Sprott

Liam Halligan - UK Telegraph Questioning the Dollar

Goldbug narrative in the mainstream / establishment UK Telegraph newspaper questioning the Dollar's role as reserve currency, the rise of the Brics at purchasing power parity and non-dollar trade settlement.

Martin Armstrong also discusses the politicisation of the dollar in trade and reserves.

Martin Armstrong also discusses the politicisation of the dollar in trade and reserves.

Subscribe to:

Comments (Atom)